Evgeny Sorokin for e-Forex: Launch of the DXtrade SaaS Trading Platform

Devexperts was founded in 2002 and specializes in the development of highly sophisticated software solutions and services for the Financial Markets industry. In May the firm launched its all-new SaaS platform solution, DXtrade. E-Forex spoke with Evgeny Sorokin, SVP of Software Engineering at Devexperts, to discuss this new product, the state of the retail trading industry, and more.

Can you tell us more about your DXtrade platform?

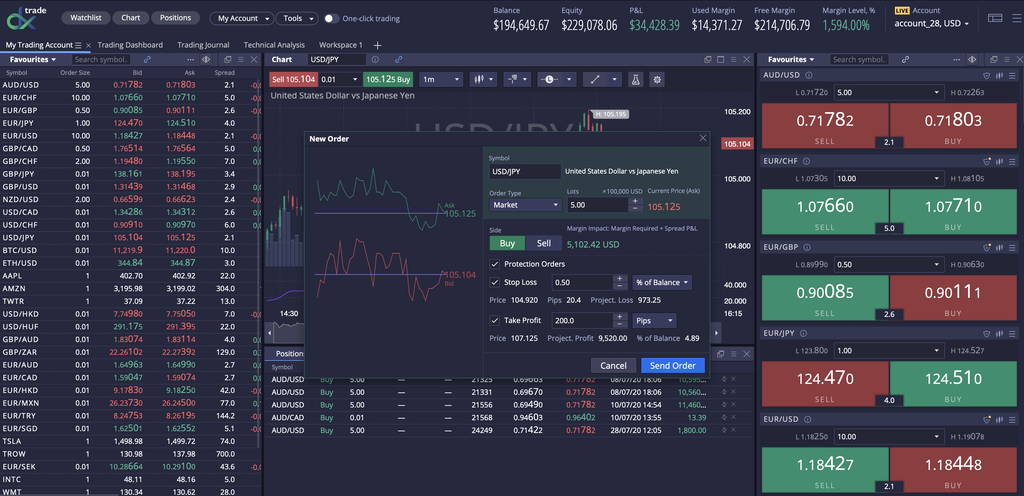

With pleasure. DXtrade by Devexperts is a software-as-a-service trading platform. It’s entirely web-based, so users get the same trading experience across all operating systems and devices. Brokers can leave the maintenance to our experienced team to handle The interface itself is based on widgets, which means it is highly customizable. Brokers can configure custom layouts for their clients, while users can tailor them to fit their trading workflow. Thanks to this modular approach, we can continue releasing new widgets that add functionality to the platform as well as a suite of exclusive trading tools and technical indicators.

How does DXtrade differ from other platforms on the market?

We at Devexperts are big believers in providing greater control and flexibility to brokers; our technology has always reflected this. We’re very experienced when it comes to building platforms from the ground up and tailoring them to function precisely as institutions require. DXtrade is no exception. It’s software-as-a-service, but with it, we aimed to bring our bespoke sensibilities to the retail FX/CFD market.

Brokers find it difficult to shine in this market and DXtrade can help them. It can be tailored specifically to groups of users. For example, European traders can get a unique look and feel, with different symbols and marketing campaigns from Asian ones.

Brokers get the freedom of control on the back end side of the platform, without patching together messy arrays of third-party solutions. DXtrade has all the functionality they need straight out of the box. They can do it all – from applying margin, spread, and limit profiles on a per instrument, group, or even individual account basis to the ability to run a combination of risk management strategies and change them on the spot to fit their needs.

What made you launch a new platform?

For the past 20 years, we’ve built roughly 40 trading platforms for various brokerages and other financial institutions from scratch. This puts us in somewhat of a unique position: we know how the landscape has changed since the early days of the industry, but we’re also aware of the pain points of all kinds of financial services firms.

We know what works for them and what doesn’t in the established offerings, what they wish they could change but don’t have the option to, and why they stick with tried and tested solutions despite them starting to show their age. In addition, most of our employees are veterans of the online trading industry, which means we know in-depth how brokers are forced to work around the limitations of many of the existing offerings.

Who are you targeting with DXtrade?

We designed DXtrade for both new and existing FX/CFD and crypto brokers. Each group has an individual set of needs, requirements, and problems to solve.

Each contingent comes with its own unique sets of needs For example, startups who decide to make DXtrade the backbone of their businesses have the chance to build their entire offering around the platform. The advanced functionality can be integrated from the beginning to help the key departments communicate. These include dealing, back office, and marketing.

Established brokers can use the opportunity to revamp their existing offering to leverage all of DXtrade’s benefits. In addition, they can attract new clients, retain old ones, and generally create a buzz around a new product offering. We’re also working on the crypto market. In recent years, crypto brokers have been incredibly bold. They entered the trading scene with a new asset class, a new way of doing things, and didn’t follow the usual formulas of the online CFD industry. Platform quality, however, differs widely in terms of functionality and usability in this segment and DXtrade has a lot to offer there as well.

Is there anything that influenced you to launch a SaaS trading platform for retail brokers?

We observed that the retail trading platform segment has somehow stagnated for years. There is a gap between the development projects that are within the scope of retail brokerages and those suitable for larger financial institutions. In terms of lead time and budget, this gap is partly why there’s been such a scarcity of platform development in the space.

We aim to fill the gap by developing the platform ourselves rather than waiting for a prospective client to commission it. We hope that we can give the industry an innovative look and feel, and eliminate the brokerages’ reliance on third-party solutions.

Before this, we weren’t that invested in the OTC space. We were focusing on larger-scale development and implementations. In a way, we were sort of an incubator of new ideas: clients come to us with unique projects that we then attempt to turn into a reality. But this isn’t suitable for all businesses. We put our experience and knowledge to make DXtrade an affordable SaaS platform to solve actual problems in the industry and get more people acquainted with the Devexperts brand.

Why has it been so difficult for newer trading platforms to get ahead of the established players in retail FX?

The reasons are many, the most obvious being that when a recipe is working, there’s not much of an incentive to change it. As people say, “if it ain’t broke, don’t fix it”. The online FX industry has been incredibly successful and the platforms themselves have become an integral part of the formula. This is why over the years a brokerage template has emerged: the same website styles, copy, product offerings, and, of course, the same few trading platforms.

We saw many outfits try and conquer the market with something fresh only for them to die on the vine, so to speak. There are times when a new broker will enter the scene, enthusiastic to develop their own proprietary solution. They often have good ideas and an exciting vision of the future but lack the in-house technical know-how to see the products through, or the budget to outsource the job to experts.

Also, remember that online trading things tend to move at the speed of a brokerage’s marketing department. Newcomers sometimes have unrealistic expectations. They learn the hard way that web development, design, and content creation require a certain time frame and a certain cost, whereas creating an entirely new trading infrastructure is quite another undertaking, with an entirely different time horizon and orders of magnitude more in terms of resources. When the launch date comes close, many find themselves scaling down their expectations and going for the tried-and-tested solutions their competitors use.

Is it easier for new brokers to follow the crowd when so many others rely on the same platforms?

Absolutely. There’s a self-fulfilling element to the whole process; brokers have the same old platform pages advertising the same old trading platforms that traders have been using for many years.

Those platforms have been around since the mid-2000s. It’s when services like Facebook, YouTube, and Twitter emerged, as well as game-changing products like the first iPhone. Products and services have gone through so many iterations since their inception and the online world has evolved a lot since then. In a way, online FX has become stuck in a rut when it comes to trading platforms.

How are you handling acquisition and retention in the development of DXtrade?

Every brokerage does things slightly differently, so customizability is key as far as acquisition and retention are concerned. A trading infrastructure should offer the flexibility to conduct business, rather than tie them to a single approach due to their platform’s functionality.

This is where DXtrade’s power lies – it offers a customizable experience on both the client-facing side and the back-end. It can tailor marketing campaigns to the geographical location of a broker’s traders, account tiers, etc. Managing and applying rebates and commissions for affiliates and IBs is also extremely easy.

DXtrade sells itself in a lot of ways. We spend a huge amount of time and effort perfecting the UI and UX. Our main focus was updating online trading for the new generation of traders, which demands more user experience. Add our proprietary trading tools and indicators that are rolling out and you have a very enticing prospect for traders new and old.

How can your systems handle the increased pressure from unforeseen market events?

Our systems have the robustness and resilience that modern markets demand, thanks to a combination of front and back-end optimizations.

We employ transport protocols on the front end, to prioritize traffic so that business-critical functions such as position entry, exit, and management can be the focus. During times of peak load, we rely on a number of strategies that ease the strain on bandwidth and servers; using the latest snapshots, as well as quote conflation and removal, for example. Our sister company, dxFeed has been a vital part of this, thanks to their experience in providing price feed to such a variety of market participants.

When it comes to the back-end server modularity, arrays and lists in method calls, garbage-free libraries and read-only objects in the entity framework greatly improve the efficiency during market meltdowns.

Testing is fundamental in the development stage so that our systems can be routinely pushed beyond their maximum capacity and we can see how pressure affects performance and how long systems can maintain uptime before having to be restarted. The goal is to over-engineer our trading infrastructures and give them a significant margin compared to our rivals.

Speaking of dxFeed, did their teams experience any issues in their data storage and distribution services?

The recent bout of volatility has been like a case study for the anti-fragility of their systems. The loads, especially in certain asset classes and at a specific time, were amazing. Thankfully, the strategies I covered earlier, among others, allowed dxFeed to maintain the quality of service in spite of the enormous pressures placed upon them.

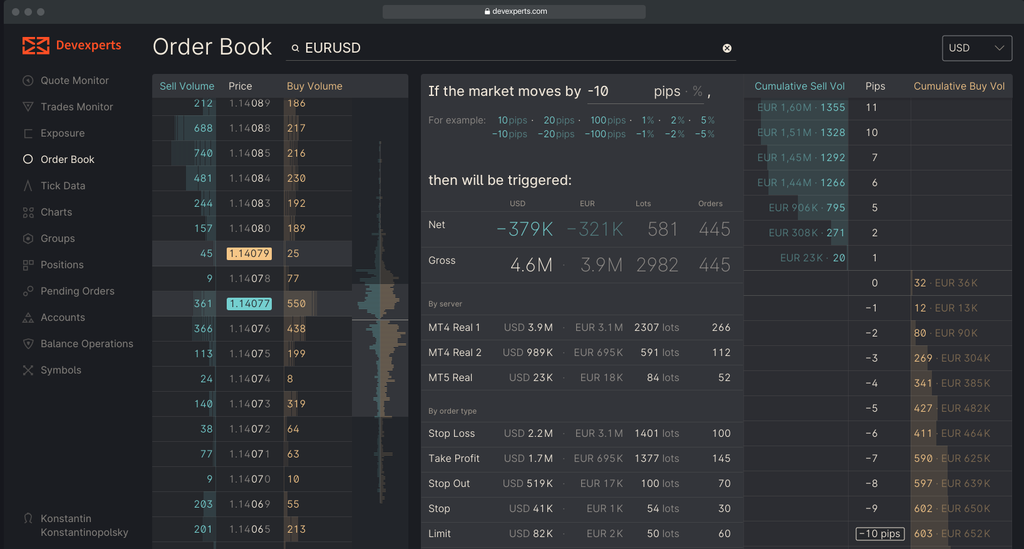

In addition, dxFeed was able to provide real-time feeds from US and European exchanges to brokers, without charging a per-user fee for every broker’s client. This highly popular development allows brokers to supply their traders with real Level 2 order books, which wasn’t an option before.

Any other developments that you’d like to mention?

An impressive one is our Gate45 system, which unites heterogeneous trading systems into a single unit. This lets brokers automate numerous resource and labor-intensive procedures, like risk management, anti-fraud, scalping detection, and ‘what if’ analysis, among others. This is at a time when resources have been at a premium and the influx of new traders has caused many brokers to operate over their peak capacity.

As with everything we’ve covered so far, this is a case of an unforeseen event pushing older technologies to breaking point and simultaneously demonstrating the importance of the various innovations our companies have been developing these past few years. We’re all working towards making the industry stronger, more efficient, resilient, and better able to meet the challenges of today’s markets.