AI Chatbots: Customer Service in Finance

Chief Product Officer, Evgeny Sorokin and Devexa Team Lead, Ivan Kunyankin share their insight and perspectives on AI chatbots in the finance customer service space.

How have AI chatbots transformed customer service operations in the financial sector, and what specific benefits have you observed, or anticipate?

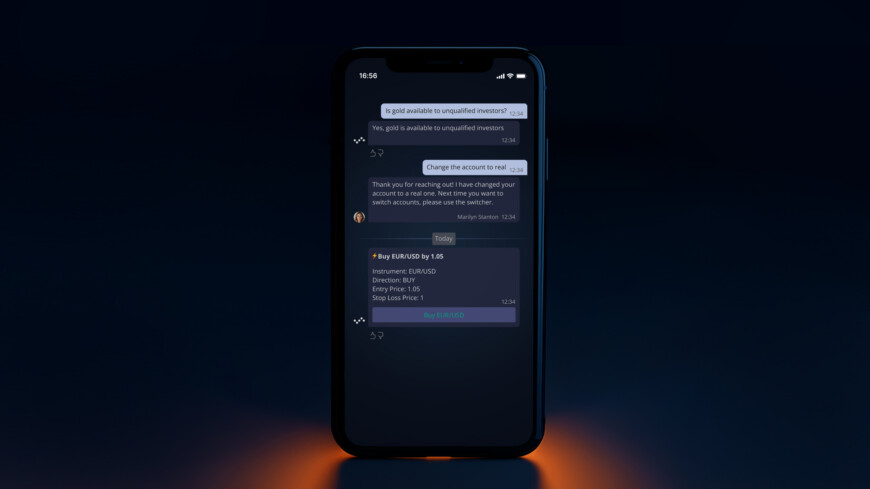

Natural language processing (NLP) technology has been around for a while. The implementation of NLP into chatbots has become ubiquitous in large customer care departments, including financial institutions. Today, nearly every bank app leverages chatbots to handle common customer inquiries and tasks, such as reporting lost credit cards, before directing users to a human representative.

The primary benefit of chatbots is their ability to provide instant utility, allowing customers to quickly and easily complete routine actions. This has led to substantial payroll savings for banks, which reported notable reductions in customer care expenses as early as five years ago.

At the same time, the quality of such services was usually perceived as mediocre at best. There have been lots of memes and jokes about the “stupidity” of the chatbots, and that included the bots of brokers and banks, too.

The recent advancements in AI have enabled chatbots to move beyond their rigid regular expressions, predefined dialogue trees, and other rigid rule-based logic. Now NLP works so much better with intent recognition.

Customers have also adapted, learning to better articulate their needs to resolve issues efficiently.

What are the main challenges and regulatory concerns associated with the adoption of AI chatbots in financial services, and how can these be effectively addressed?

Adopting AI chatbots in financial services comes with several challenges, primarily due to the sector’s conservative nature, rigorous compliance requirements, and the nascent stage of many advanced technologies.

Financial institutions often face restrictions on using third-party AI solutions within their cloud environments. Although major AI providers are gradually adapting their offerings to meet the specific needs of the financial industry, this process is not always prioritized amidst rapid technological growth.

The biggest concern is the unpredictability of AI chatbot outputs. In a heavily regulated industry chatbots must operate within strict compliance boundaries to avoid misleading customers or exposing them to undue risks. For example, without a certain license, one cannot give investment advice to customers.

Since Gen AI is very much like a black box to many companies, adoption within the remit of handling customer comms nearly stops here: who can guarantee that the bot’s answer would be compliant?

And so some companies stay away from using chatbots on the frontline because it is still a “gray zone”. Once “the dust has settled” and everyone understands the rules better, the adaptation will happen faster.

At the same time, it is clear how powerful AI could be. So to balance the risks and the benefits, one effective response to these challenges is to repurpose AI for internal use rather than direct customer interactions. AI can support financial institution employees by performing sentiment analysis, quality control, and data leak prevention.

The emerging trend is that — in response to the complications and obstacles of implementing GenAI in the financial institution to speak with the customers — GenAI is used in the form of prompters for the customer reps, assisting them in crafting responses. This approach maintains human oversight; meeting regulatory standards while enhancing employee efficiency. If you have recently been on Gmail, Outlook, Slack, or LinkedIn, you may have noticed their prompters helping you compose a message.

The next stage is to educate customers and manage their expectations. ChatGPT and its rivals certainly help people to remember that AI can make mistakes and lower the expectations. In some cases, people would favor instant utility and speed over accuracy. For instance, sometimes one just needs a general understanding of a topic.

Maybe we will see the introduction of toggles in the interface that allow users to prioritize speed or accuracy. Accurate answers will likely be skimpy, given they are bounded by the corp knowledge base they are trained on. There of course should be an escalation path to a human operator in all such cases.

What advancements or future developments in AI chatbot technology do you foresee, and how will these impact the financial services industry over the next few years?

The future of AI chatbot technology in the financial sector is poised to see widespread adoption of Retrieval-Augmented Generation (RAG) solutions. Enterprise ChatGPT-like solutions will be adopted and used in all companies, by both employees and customer service departments. We will most likely witness the heyday for self-managed knowledge bases for different teams (e.g., compliance, risk management, HR), systems that implement role-based access controls to the information and fine-tune assistants’ responses and capabilities.

GenAI however, can still become more autonomous. Now engineers are holding its hand because we’re afraid it will do something wrong. That’s why its applications are mainly directed inward. Further advancements will expand applications beyond increasing employee productivity; it will create more opportunities for the end customers.

There are many AI-based applications in the financial sector, and these models are capable of detecting suspicious behavior by looking at time series and many other data points. Solutions like this could be further empowered by intelligent GenAI assistants capable of reasoning and decision making. This way many downstream domain-specific tasks, like investment research and copiloting fraud detection teams, could be solved in a more dynamic manner, that is adaptive to the ever-changing realities of the AI and financial industries space.