DXtrade Tutorials: Vertical Options Spreads Explained

The DXtrade platform from Devexperts is ideal for new and existing options brokers that want to offer their traders a professional trading experience in an easy-to-use web-based platform. DXtrade comes bundled with all the advanced features that are required by options traders.

Aside from access to option chains, Greeks, a stock screener, trading journal, economic calendar and a variety of indicators and visualizations, DXtrade also features the following present options strategies: vertical, straddle, strangle, ratio/back, combination, synthetic, covered, calendar, diagonal, butterfly, condor, and iron condor.

This allows options traders to easily create complex trades by selecting the relevant options strategy from a list. In this article, we’ll focus on vertical spreads, explaining what they are, how one varies from the other, and how they work.

4 types of vertical spread options

Vertical options spreads are the most basic of options spreads. Like the other options strategies presented in this series, it involves combining different options in order to create the desired risk protection and profit potential. In the case of vertical options spreads, the strategy involves buying and selling either a pair of call options, or a pair of put options with the same expiration date but at different strike prices.

This strategy takes its name from the fact that one strike price is higher than the other. This allows options traders to take a directional position but define from the outset precisely how much the trade stands to gain and lose in the best- and worst-case scenarios.

There are four vertical option spreads. Long call spreads, which are bullish, short call spreads, which are bearish, long put spreads, which are bearish, and short put spreads, which are bullish.

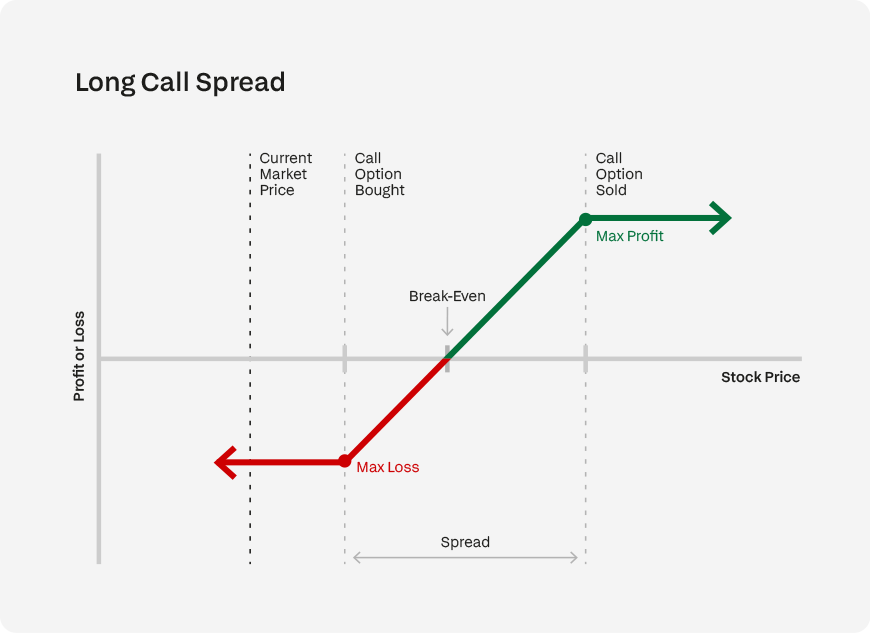

Long call spreads

A long call spread (also known as a bull call spread) profits when the price of the underlying asset increases. It’s a bullish options strategy that involves buying a call option (long) and simultaneously selling a call option (short) at different strike prices but with the same expiration.

In a long call spread, the call option that is sold (short) is at a higher strike price than the call option bought (long). This effectively limits the potential profit should the underlying asset’s price rise beyond both strike prices, however, it reduces both the risk of the trade and the cost of opening the position.

This is because the trader receives credit for selling the call option at the higher strike price. What’s effectively at risk is just the spread between the two respective strike prices.

The call option bought at the lower strike price is costlier (being closer to the current market price), but the credit received for selling the call at the higher strike price offsets some of this amount, thus lowering the cost of the overall position and reducing the breakeven price of the trade.

In options trading, when you pay more in premium than you collect (the option bought costs more than the options sold), the position is said to have a net debit. When you receive more in premium than you pay (the option sold was worth more than the option bought), then the position is said to have a net credit. Long call spreads have a net debit because the option bought is worth more than the option sold.

If, at expiration, the price has risen to a level above the long call option (bought) and at or above the short call option (sold), then the trade achieves its maximum profit potential. In this case, the trader collects the value of the spread between the two call options minus the value of the net debit.

The net debit is the cost of purchasing the more expensive call option with the lower strike price (closer to the current price), minus the credit received for selling the cheaper call option at the higher strike (further away from the current price).

If, at expiration, the price is at or below the strike price of the long call option (bought), the trade will incur its maximum loss, which is simply the value of the net debit.

The breakeven price of this trade is the strike price of the call option bought plus the net debit paid. This will be somewhere between the strike prices of the two options traded.

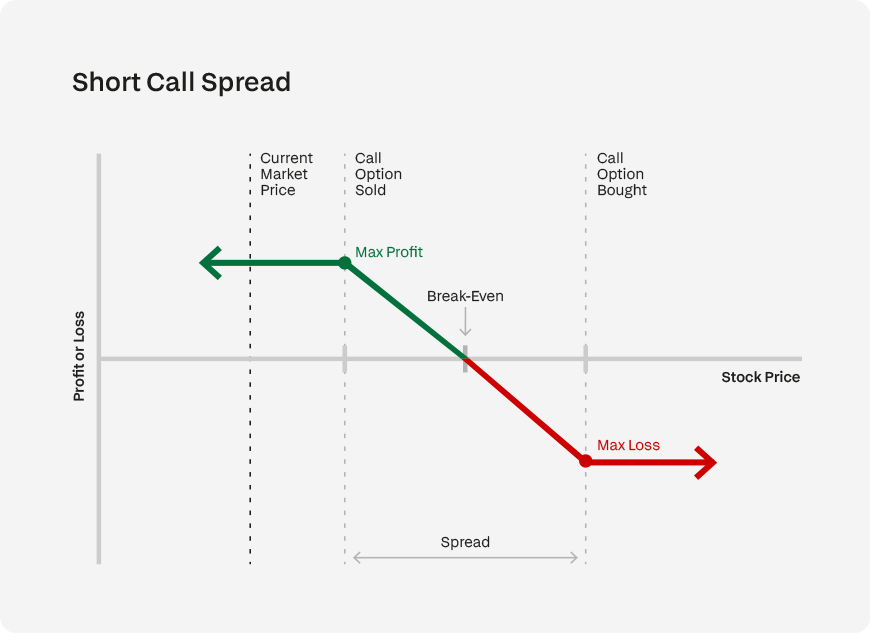

Short call spreads

A short call spread (also known as a bear call spread), just like the long call spread, involves both buying a call option and selling a call option. However, in this case, the strategy is bearish. The call option that is sold (short) is at a lower price (closer to the current market price) than the call option that was bought (long).

This position has a net credit because the option sold, being closer to the current market price, is worth more than the option bought further from the current price. The trader immediately receives a credit for selling a call option that’s more valuable than the call option that is bought. From the outset this trade is in profit due to the credit received.

In this setup, the trade profits if the price falls below the breakeven price (between the call sold and the call bought) and is in loss if it rises above that breakeven point.

Maximum profit is achieved if the price is at or below the strike price of the call option that was sold. In this case, both options will expire worthless, and the trader will get to keep the entire credit received for the call option sold.

Maximum loss is incurred if the price rises to or above the higher strike price of the call option bought. In this scenario, the spread between the call option sold and the call option bought, minus the net credit received for selling the call option, is the maximum the trader stands to lose. The loss is capped at the spread width, and the credit received for the call option sold offsets some of this loss.

The breakeven price in this trade is the strike price at which the call option was sold plus the credit received for selling the call option in question. If the price at expiration reaches this level, then the call option bought at the higher strike price expires worthless, and the call option sold is worth exactly the amount that was received, making it a breakeven trade.

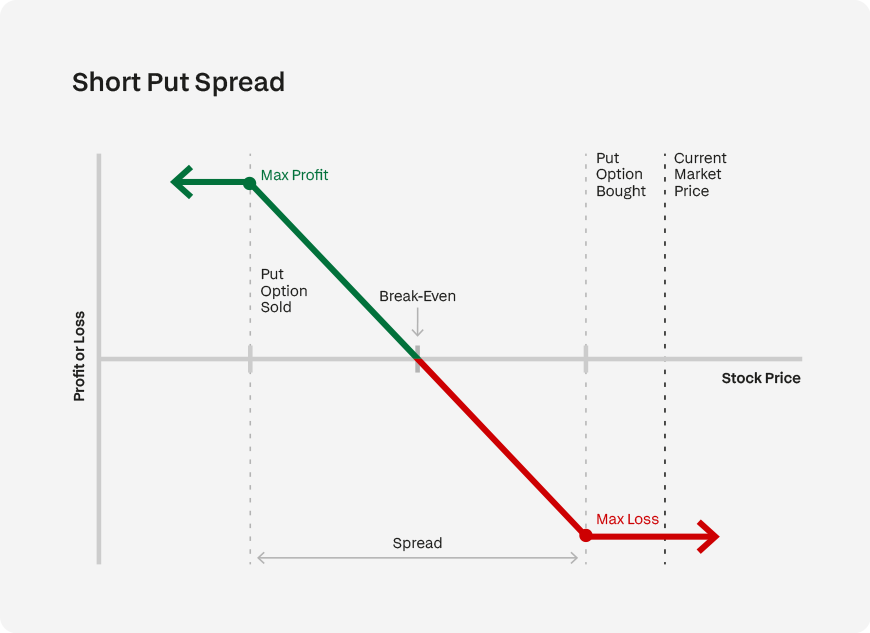

Short put spreads

Short put spreads (also known as bear put spreads) profit when the price of the underlying asset decreases. They are bearish options that involve buying put options (long) and selling put options (short) at different strike prices but with the same expiration.

In a short put spread, the put option that is sold (short) is at a lower strike price (i.e. further away from the current market price) than the put option that is bought (long). In contrast to the call options seen above, when we talk of put option strike prices being further away from the current market price we’re referring to strike prices below the current market price.

A short put spread trade limits the potential losses should the underlying asset’s price rise beyond both strike prices, as well as reducing the cost of opening the position since the trader receives a credit for selling the put option at the lower strike price, which offsets the higher cost of buying the other put option at the higher strike price. This position is said to have a net debit because the option bought costs more than the amount received for the option sold.

The maximum profit a short put spread can earn is the width of the spread of the two strike prices trades minus the cost of the trade (put option bought minus credit for put option sold, or net debit). This takes place when the price at expiration is at or below the lowest of the two strike prices traded (in this case the put option sold).

The maximum loss a short put spread can incur is the net debit cost of the put option bought at the higher strike price minus the credit received for the put option sold at the lower strike price. This scenario occurs when the price of the underlying asset at expiration is at or above the long put option (bought).

In such a case, both of the put options traded would expire worthless (since the price is higher than either of the strike prices), and the trader just loses the cost of the long put minus the credit for selling the short put.

The breakeven price for a short put spread is the strike price of the long put option (bought) minus the net cost of the position (long put option price minus short put option credit).

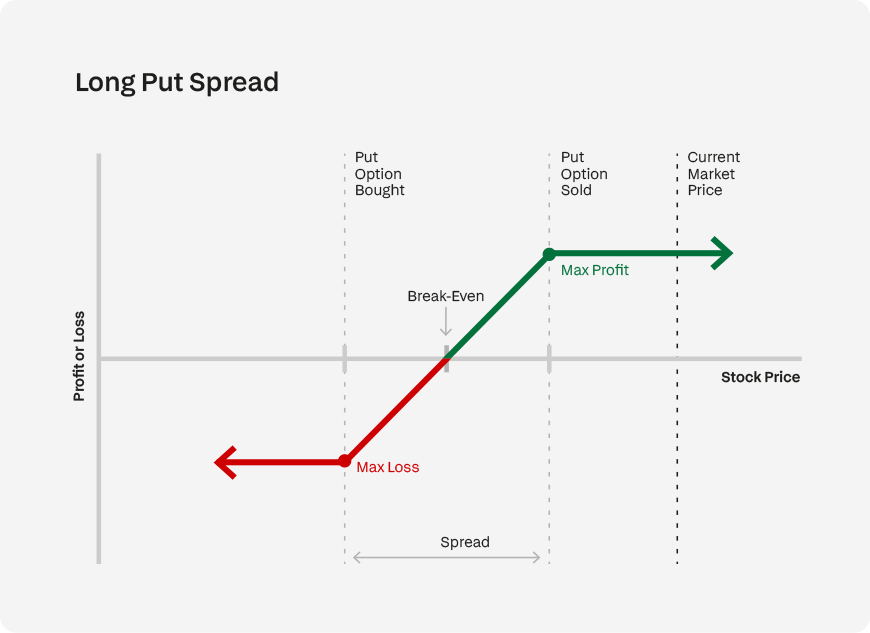

Long put spreads

Long put spreads (also known as bull put spreads), like short put spreads, involve both buying put options and selling put options at different strike prices and for the same expiration date. However, in the case of long put spreads, the put option that is sold is at a higher strike price (i.e. closer to the current market price) than the put option that it bought.

Long put spreads have a bullish bias because they make money when the price remains above the strike prices in question. Buying the put option at the lower strike price reduces the risk of the position.

This trade is said to have a net credit because the put option sold, being closer to the current market price, is worth more than the put option that is bought.

The maximum profit such a trade can potentially earn is the value of the credit earned for selling the put option at the higher strike price minus the cost of buying the put option at the lower strike price.

This occurs when both options expire worthless and the trader gets to keep the net credit earned for selling the more costly put option at the higher strike price. For this to happen, the price of the underlying asset at expiration has to be at or above both of the strike prices of the options traded.

The maximum such a position can potentially lose is the width of the spread between the two strike prices minus the net credit received.

The breakeven price for this trade is the strike price of the put option that was sold minus the net credit received.

Try DXtrade out for yourself

If you’re interested in offering DXtrade to your options traders, please get in touch with our team, and one of our representatives will be in touch to discuss your options.