Wealth Management Software: What is Needed for High-Performance

Today digital financial advisors are still fine-tuning the best strategies to secure and increase fixed assets and investment portfolio performance. The functional requirements are advanced and vary greatly.

Investing in assets is demanding and involves risks. Decisions need to be made lightning fast, based on the latest financial analytics and most accurate analysis.

The only practical way to do this is using wealth management software.

Let’s explore exactly what that involves, from what software for wealth management is, to who uses it, what they use it for, and the mechanics behind the high-performance solutions.

What is wealth management software?

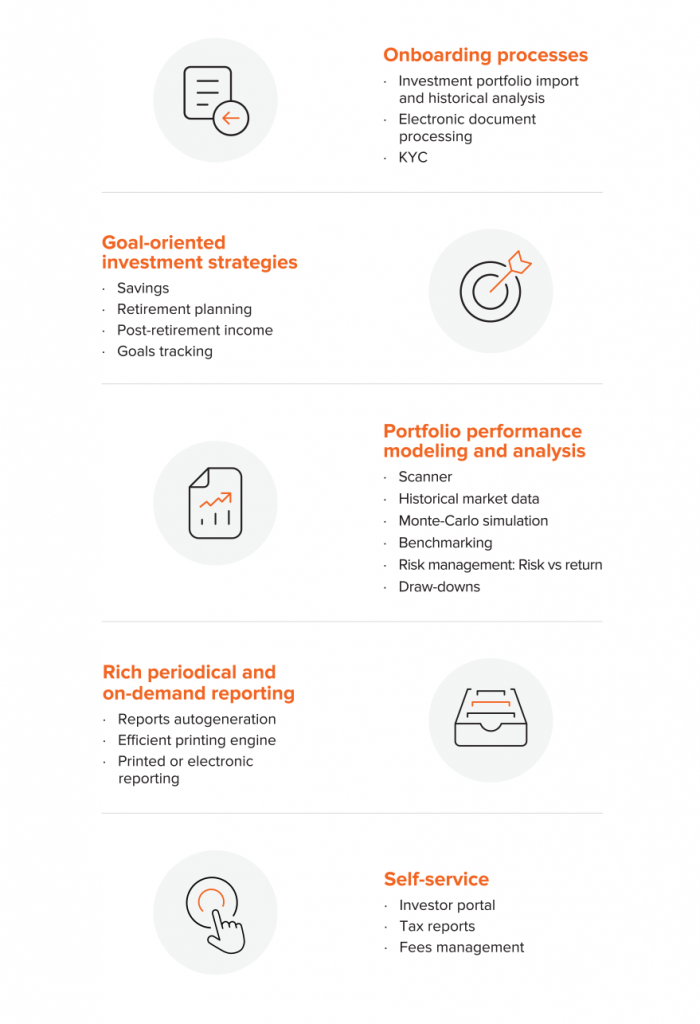

Powerful wealth management software provides an overview of investment assets, returns, terms, CRM, risk management, fractional order management systems, tax and financial planning, and many more tools and features.

Wealth management software solutions allow all parties involved with an investment portfolio to develop analyses and strategies based on real-time financial analytics data, so they can continually adapt to current market conditions, and make sure they are on the right track toward their pre-determined targets and objectives.

In the era of personalization, businesses using wealth management platforms don’t want to adapt their processes to fit an off-the-shelf solution. Rather, they expect a solution with tools tailored to their needs.

This means wealth management software providers need to put the user at the center, providing engaging digital experiences that offer convenience and personalization, and prioritize UX.

Who uses wealth management software?

The average investor wants to invest efficiently, but rarely do they have the time and expertise to tackle this task alone. As a result, they rely on service providers like asset management firms.

The individual investor retains an overview of their investments using a wealth management software solution, that is also used by the asset management firm.

If we were to use the analogy of grocery items and supermarkets; wealth management professionals (the asset managers) would play the role of supermarkets or shopping malls.

Without the supermarket framework, the selection of grocery items and brands would be so overwhelming, that it would be cumbersome for the customer (the investor) to assemble and monitor their investment portfolio.

The same applies to the asset managers, the wealth management software brings order to their own diverse investment portfolios, organizing the products available for the investor to buy.

And last but not least, sales professionals within the financial services industry, who offer wealth management services also benefit.

They may have curated attractive investment portfolios, but they need a way to present and visualize them to investors. Here, they also rely on the modern digital tools that are part of wealth management software’s functionality.

A wealth management platform is used by investors, asset managers, financial advisors, and the broad range of roles that fall within the wealth management industry, to execute the following areas of wealth management.

Areas of wealth management

What does high-performance wealth management software prioritize?

Wealth management software is used by both individual investors and professionals; and therefore needs to meet their different needs and objectives.

A good asset management and advisory platform must strike the balance between functionality, ease of use, and performance.

It must respond equally to the needs of both beginners and professional traders. This requires a number of key functionalities that are interwoven and serve all stakeholders.

Although, from the perspective of each of these user groups, other sub-functionalities arise in the foreground, but all actors focus on one key goal: to earn money.

Therefore, the basic requirements for wealth management software overlap.

User-friendliness and responsiveness

For the end user, an efficient system, short reaction times, and a seamless user experience are crucial.

Customers today expect fast information and integrated technology. The days when asset managers were able to send their clients a monthly report in PDF format are over.

Even though these reports contained summaries in the form of tables and small print, they could not give an overall picture of the financial situation, objectives, or risks.

Investors expect more nowadays. They no longer just ask “How are my investments going?” But also “What does that mean?”.

State-of-the-art online portals enable asset managers to show their customers all relevant information clearly and precisely – even on end devices like smartphones or tablets.

Predictive modeling capabilities allow investors to try the recommended actions; testing out how the performance changes depending on the investment mix or focus.

Real-time analysis and mobile availability

Sales staff in the financial services industry can get by with intuitive and responsive software, however, there are desirable features that increase their productivity, like the ability to generate offers on the fly and on the move.

For example, a consultant talks to a prospective customer about their plans for retirement, property purchase, and other investment goals. He asks him standardized questions about risk-taking and the desired investment mix. Now he has to submit a proposal to him, which takes these plans into account and uses the jointly defined goals to make investment recommendations.

A challenging task. Unfortunately, many of the available wealth management software solutions do not provide the near-real-time data required for these investment recommendations.

Systems are therefore in urgent demand, with which financial advisors can create customer profiles within a very short time and analyze how the recommended investments actively adapt to the defined goals. And not only on desktop PCs but also on mobile devices.

Consultants who can enrich their own insights with real-time data and analysis on the go are particularly powerful.

AI and automation

Being consulted by automated assistants or robots is convenient, as automated tools allow customers to experiment more with their investment mix.

The tools provide feedback as the investor plays through various investment portfolio options and tries different strategies.

The potential of AI is illustrated by the following relatively common example: a client has five to ten percent of their assets available to actively trade in the securities of your choice. Based on the information available to them, they decide to buy a particular security or to sell it outright.

If this step is unwise, the AI system will issue a warning message based on statistical analysis.

Perhaps the system even realizes that the investor always makes unfavorable decisions early in the morning, or they invest in specific sectors with consistently poor performance. AI can even leverage on knowledge of other investors with similar profiles and propose to the investor an investment mix with good performance.

Asset managers should be prepared for such AI scenarios and organize their data so that they can easily be processed by the appropriate systems.

Although AI systems are still unable to provide consistently high-quality investment advice, especially when it comes to complex tasks such as tax or wealth planning.

Also, the technology restricts personal contact and personal counseling and is currently far removed from a person’s intellectual capacity. But the development is advancing rapidly.

Ideally, artificial intelligence becomes a powerful asset management tool without replacing personal advice.

Conclusion

The goal of high-performing wealth management software should be to constantly evolve in line with both the end-users’ expectations, and by embracing and staying on top of the current tech trajectory, so that the most value can be provided.

This is the Devexperts approach. Innovating wherever it makes sense, and adds value to our clients.

Looking for wealth management software that has been recognized as a leading solution? Get in touch with our team to learn more about Devexperts wealth management software solutions.