- DarkLight

Aroon Indicator

- DarkLight

Aroon Indicator is a study comprising two plots. The first one (Aroon Up) measures the number of periods between the highest prices reached in every specified time period. The other one (Aroon Down) measures the number of periods between the lowest prices reached in every specified time period. The plots help identify bullish (Aroon Up > Aroon Down) or bearish (Aroon Up < Aroon Down) price behavior on the charts.

Aroon Up = 100 * (n-periods since n-day High) / n

Aroon Down = 100 * (n-periods since n-day Low) / n

where:

n – the number of periods

n-day High – the n-days highest price

n-day Low – the n-days lowest price

.png) Aroon Indicator

Aroon IndicatorINPUTS

| Input | Description |

|---|---|

| Length | The number of periods the indicator uses to calculate the AroonUp and AroonDown plots |

| Overbought | The price value to fix the OverBought level at |

| Oversold | The price value to fix the OverSold level at |

PLOTS

The plot renders the data you are working with on the chart. You can show/hide a plot by clicking the corresponding item in the settings. Every plot has a set of basic settings that you can change: color, weight, and type.

| Plot | Description |

|---|---|

| AroonUp | The AroonUp plot |

| AroonDown | The AroonDown plot |

| OverBought | The overbought level |

| OverSold | The oversold level |

| Color |

|---|

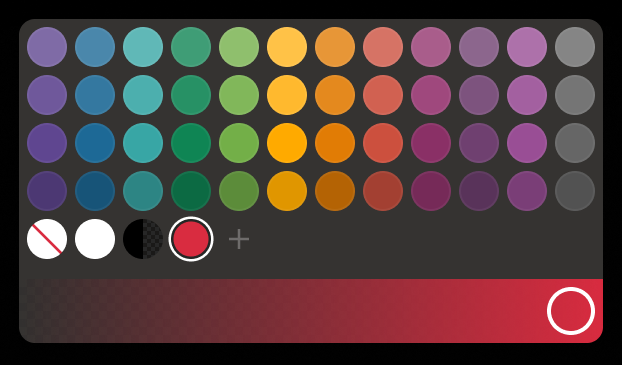

Click the color rectangle under the plot's name to open the palette. Use the slider at the bottom to set the opacity of the color.  Palette PaletteTo create a custom color:

The custom-created colors are added to your palette. To remove a custom color, drag it out of the palette. |

| Weight |

| Change the value (in px) to adjust the thickness of the plot. |

| Type |

The following plot types are available:

|

OVERLAYING

Check Overlaying to display the indicator on the chart. Otherwise, the indicator is shown in a study pane down below.