- DarkLight

Chaikin Volatility (CHV)

- DarkLight

The Chaikin Volatility (CHV) study is a technical indicator that measures volatility by comparing the spread between security's High and Low prices over a period (not including gaps in price movements). CHV is calculated as the difference between two EMAs of a volume-weighted Accumulation/Distribution (A/D) line.

CHV = (EMAn [H-L] - EMAi [H-L]) / EMAi [H-L] * 100

where:

EMAn [H-L] – the Exponential Moving Average of High and Low prices for n-period (Length)

EMAi [H-L] – the Exponential Moving Average of High and Low prices for i-period (ShiftLength)

.png) Chaikin Volatility

Chaikin VolatilityINPUTS

| Input | Description |

|---|---|

| Length | The number of periods the study uses to calculate the EMA |

| ShiftLength | The number of periods the study uses to calculate the EMA a few periods ago |

PLOTS

The plot renders the data you are working with on the chart. You can show/hide a plot by clicking the corresponding item in the settings. Every plot has a set of basic settings that you can change: color, weight, and type.

| Plot | Description |

|---|---|

| ChaikinVlt | The Chaikin Volatility plot |

| Zero | The zero level |

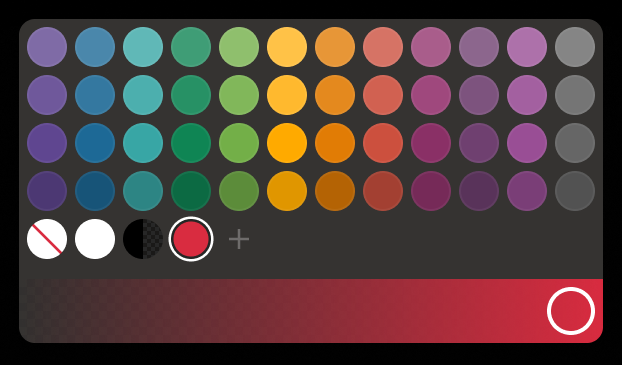

| Color |

|---|

Click the color rectangle under the plot's name to open the palette. Use the slider at the bottom to set the opacity of the color.  Palette PaletteTo create a custom color:

The custom-created colors are added to your palette. To remove a custom color, drag it out of the palette. |

| Weight |

| Change the value (in px) to adjust the thickness of the plot. |

| Type |

The following plot types are available:

|

OVERLAYING

Check Overlaying to display the study on the chart. Otherwise, the study is shown in a study pane down below.