- DarkLight

Full Stochastic

- DarkLight

The Full Stochastic oscillator is a generalized version of the two other oscillators: Fast Stochastic and Slow Stochastic. Likewise Fast Stochastic and Slow Stochastic, the indicator identifies the market strength by comparing the closing price of a security with its price range over a period of time. The oscillator is bounded to the range from 0 to +100 and is consisted of two plots: FullK and its smoothed version FullD. Crossover of either lines with overbought/oversold levels generates sell (above 80) and buy (below 20) signals respectively.

Default settings of the Full Stochastic makes it neither Slow nor Fast but an average version in comparison with the Fast Stochastic and Slow Stochastic oscillators. Customize the number of periods of the FullK and FullD plots in settings to make it act closer either to the Slow or Fast version.

FullK = MA(%K), %K = [ (C - L) / (H - L) ] * 100

FullD = MA(FullK)

where:

%K – FastK, the plot from the Fast Stochastic oscillator

C – the most recent closing price

L – the Lowest price during period

H – the Highest price during period

MA – Moving Average

Full Stochastic

Full StochasticINPUTS

| Input | Description |

|---|---|

| KPeriod | The period the indicator uses to calculate FullK |

| KSlowing | The length of the moving average to be applied to FastK (%K) |

| DPeriod | The length of the moving average to calculate FullD |

| Overbought | The price value to fix the overbought level at |

| Oversold | The price value to fix the oversold level at |

| Average |

|---|

The following Moving Average types are available for calculations:

|

PLOTS

The plot renders the data you are working with on the chart. You can show/hide a plot by clicking the corresponding item in the settings. Every plot has a set of basic settings that you can change: color, weight, and type.

| Plot | Description |

|---|---|

| FullK | The FastK plot |

| FullD | The FastD plot |

| OverBought | The oversold level |

| OverSold | The overbought level |

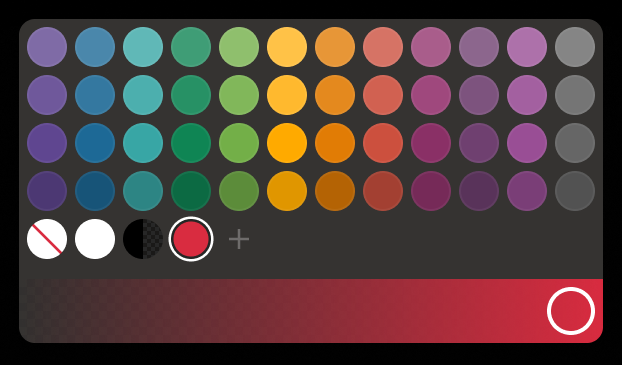

| Color |

|---|

Click the color rectangle under the plot's name to open the palette. Use the slider at the bottom to set the opacity of the color.  Palette PaletteTo create a custom color:

The custom-created colors are added to your palette. To remove a custom color, drag it out of the palette. |

| Weight |

| Change the value (in px) to adjust the thickness of the plot. |

| Type |

The following plot types are available:

|

OVERLAYING

Check Overlaying to display the indicator on the chart. Otherwise, the indicator is shown in a study pane down below.