- DarkLight

Inertia

- DarkLight

Inertia is an indicator that helps determine the prevailing price trend. The indicator uses the linear regression algorithm to plot a curve based on Relative Volatility Index (RVI). The curve's values are utilized on the scale from 0 to +100, where 50 is a neutral level. When the readings are greater than 50, the market is considered uptrend, and when the readings are lower than 50, it is considered downtrend.

Inertia = LinearRegressionn (RVIn )

where:

RVI – Relative Volatility Index

N – number of bars

Inertia

Inertia

INPUTS

| Input | Description |

|---|---|

| RviLength | The number of bars used to calculate the Relative Volatility Index |

| RegressionLength | The number of bars used to calculate the linear regression curve |

PLOTS

The plot renders the data you are working with on the chart. You can show/hide a plot by clicking the corresponding item in the settings. Every plot has a set of basic settings that you can change: color, weight, and type.

| Plot | Description |

|---|---|

| Inertia | The Inertia plot |

| Middle | The neutral volatility level |

| Color |

|---|

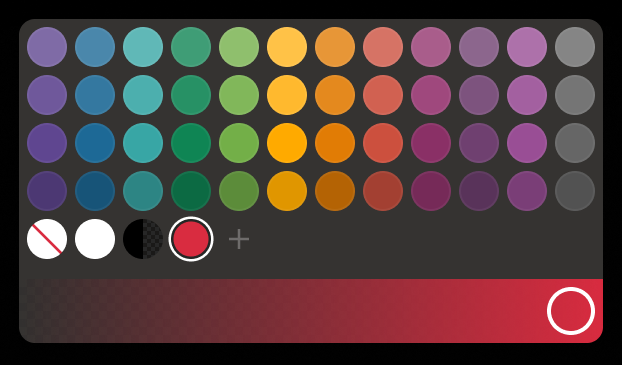

Click the color rectangle under the plot's name to open the palette. Use the slider at the bottom to set the opacity of the color.  Palette PaletteTo create a custom color:

The custom-created colors are added to your palette. To remove a custom color, drag it out of the palette. |

| Weight |

| Change the value (in px) to adjust the thickness of the plot. |

| Type |

The following plot types are available:

|

OVERLAYING

Check Overlaying to display the indicator on the chart. Otherwise, the indicator is shown in a study pane down below.