- DarkLight

Keltner Channels

- DarkLight

Keltner Channels are volatility-based lines (upper and lower bands) placed above and below either side of an asset's price with Exponential Moving Average (EMA) as the middle line. The distance between the bands and the moving average is equal to the Average True Range (ATR) indicator's value multiplied by 2 by default. The Keltner Channels are used to determine the direction of the trend: price that reaches the upper band gives the bullish signal, while price reaching the lower band gives the bearish one.

Keltner Channel Middle Line = EMA

Keltner Channel Upper Band = EMA + 2 * ATR

Keltner Channel Lower Band = EMA - 2 * ATR

where:

EMA – Exponential Moving Average

ATR – Average True Range

Keltner Channels

Keltner Channels

INPUTS

| Price |

|---|

The following data sources are available for calculation of the EMA:

|

| Input | Description |

|---|---|

| Length | The number of bars used to calculate EMA |

| Factor | The coefficient used to calculate ATR |

| Average |

|---|

The following Moving Average types are available for calculations:

|

PLOTS

The plot renders the data you are working with on the chart. You can show/hide a plot by clicking the corresponding item in the settings. Every plot has a set of basic settings that you can change: color, weight, and type.

| Plot | Description |

|---|---|

| LowerBand | The lower channel plot |

| MidLine | The average plot |

| UpperBand | The upper channel plot |

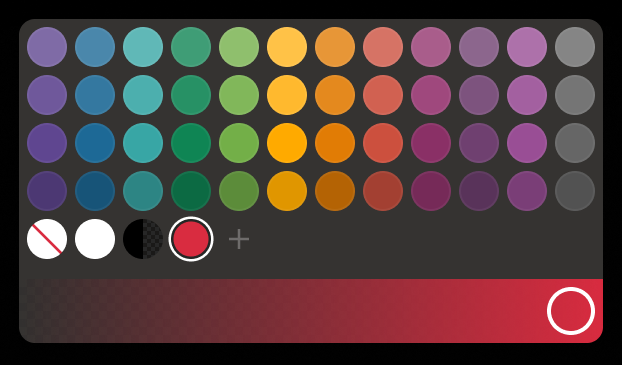

| Color |

|---|

Click the color rectangle under the plot's name to open the palette. Use the slider at the bottom to set the opacity of the color.  Palette PaletteTo create a custom color:

The custom-created colors are added to your palette. To remove a custom color, drag it out of the palette. |

| Weight |

| Change the value (in px) to adjust the thickness of the plot. |

| Type |

The following plot types are available:

|

OVERLAYING

Check Overlaying to display the indicator on the chart. Otherwise, the indicator is shown in a study pane down below.