- DarkLight

Standard Deviation Volatility

- DarkLight

Standard Deviation Volatility is an indicator that measures volatility dispersion i.e. the difference between the actual price and the average price value. The indicator can be used to determine the strength of the market price movements. The stronger the price deviation from zero, the higher the volatility is.

StdDev = SQRT [SUM (Closen-1 - SMAn)^2)/N]

StdDevVlt = StdDev/SMAn * 100

where:

SMA – n-period Simple Moving Average for current bar

Close – close price for each of the past n periods

N – calculation period

Standard Deviation Volatility

Standard Deviation VolatilityINPUTS

| Input | Description |

|---|---|

| Length | The number of bars used to calculate the Standard Deviation Volatility |

| Price |

|---|

The following data sources are available for the price:

|

| Input | Description |

|---|---|

| Deviations | The number of standard deviations between the Linear Regression Trendline and support/resistance lines |

PLOTS

The plot renders the data you are working with on the chart. You can show/hide a plot by clicking the corresponding item in the settings. Every plot has a set of basic settings that you can change: color, weight, and type.

| Plot | Description |

|---|---|

| StdDevVlt | The Standard Deviation Volatility plot |

| Color |

|---|

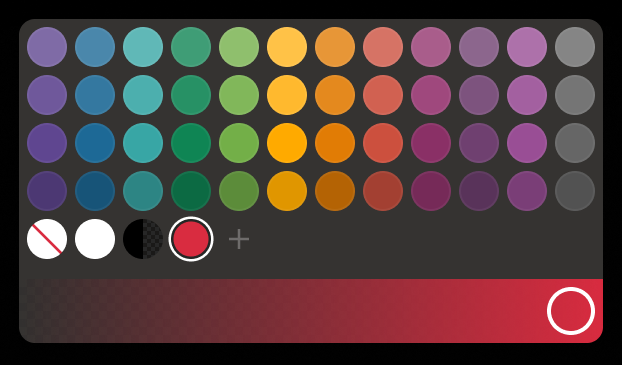

Click the color rectangle under the plot's name to open the palette. Use the slider at the bottom to set the opacity of the color.  Palette PaletteTo create a custom color:

The custom-created colors are added to your palette. To remove a custom color, drag it out of the palette. |

| Weight |

| Change the value (in px) to adjust the thickness of the plot. |

| Type |

The following plot types are available:

|

OVERLAYING

Check Overlaying to display the indicator on the chart. Otherwise, the indicator is shown in a study pane down below.