- DarkLight

Stochastic RSI

- DarkLight

Stochastic Relative Strength Index, Stochastic RSI or StochRSI is a momentum oscillator that applies the stochastic formula to Relative Strength Index (RSI) values instead of price. It enhances sensitivity to short-term moves and ranges from 0 to 1, with values above 0.8 typically marking overbought conditions and below 0.2 marking oversold levels. Often used to anticipate momentum shifts, reversals, and divergences, it appears in a separate panel with two lines: %K (main value) and %D (smoothed signal). This value is calculated by positioning the RSI within its range over a user-defined period, typically 14.

where:

Lowest RSI – the lowest RSI over the selected period

Max RSI – the highest RSI over the selected period

Stochastic RSI

Stochastic RSIINPUTS

| Input | Description |

|---|---|

| RSI Length | The number of bars used to calculate RSI |

| Stochastic Length | The number of RSI values used to calculate StochRSI |

| %K | The smoothing factor for the %K line |

| %D | The smoothing factor for the %D signal line |

| Overbought | The upper reference level for overbought conditions |

| Oversold | The lower reference level for oversold conditions |

| Source | Price input used to calculate RSI |

| Price |

|---|

The following data sources are available for the price:

|

PLOTS

The plot renders the data you are working with on the chart. You can show/hide a plot by clicking the corresponding item in the settings. Every plot has a set of basic settings that you can change: color, weight, and type.

| Plot | Description |

|---|---|

| %K | The main line showing the StochRSI value |

| %D | The smoothed signal line based on %K |

| Overbought | The overbought level |

| Oversold | The oversold level |

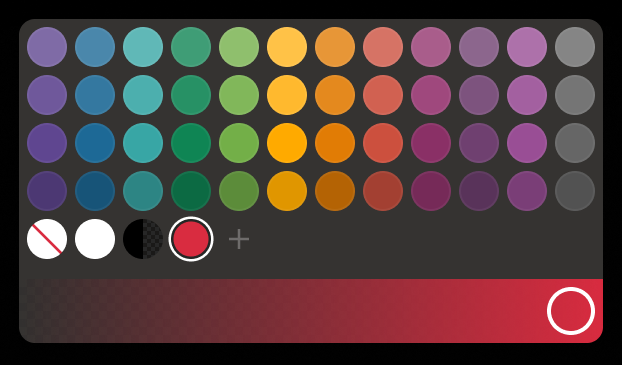

| Color |

|---|

Click the color rectangle under the plot's name to open the palette. Use the slider at the bottom to set the opacity of the color.  Palette PaletteTo create a custom color:

The custom-created colors are added to your palette. To remove a custom color, drag it out of the palette. |

| Weight |

| Change the value (in px) to adjust the thickness of the plot. |

| Type |

The following plot types are available:

|

OVERLAYING

Check Overlaying to display the indicator on the chart. Otherwise, the indicator is shown in a study pane down below.