DXtrade XT is for

Create your optimal offering

Why DXtrade XT?

Brokers licensing DXtrade XT benefit from

Features

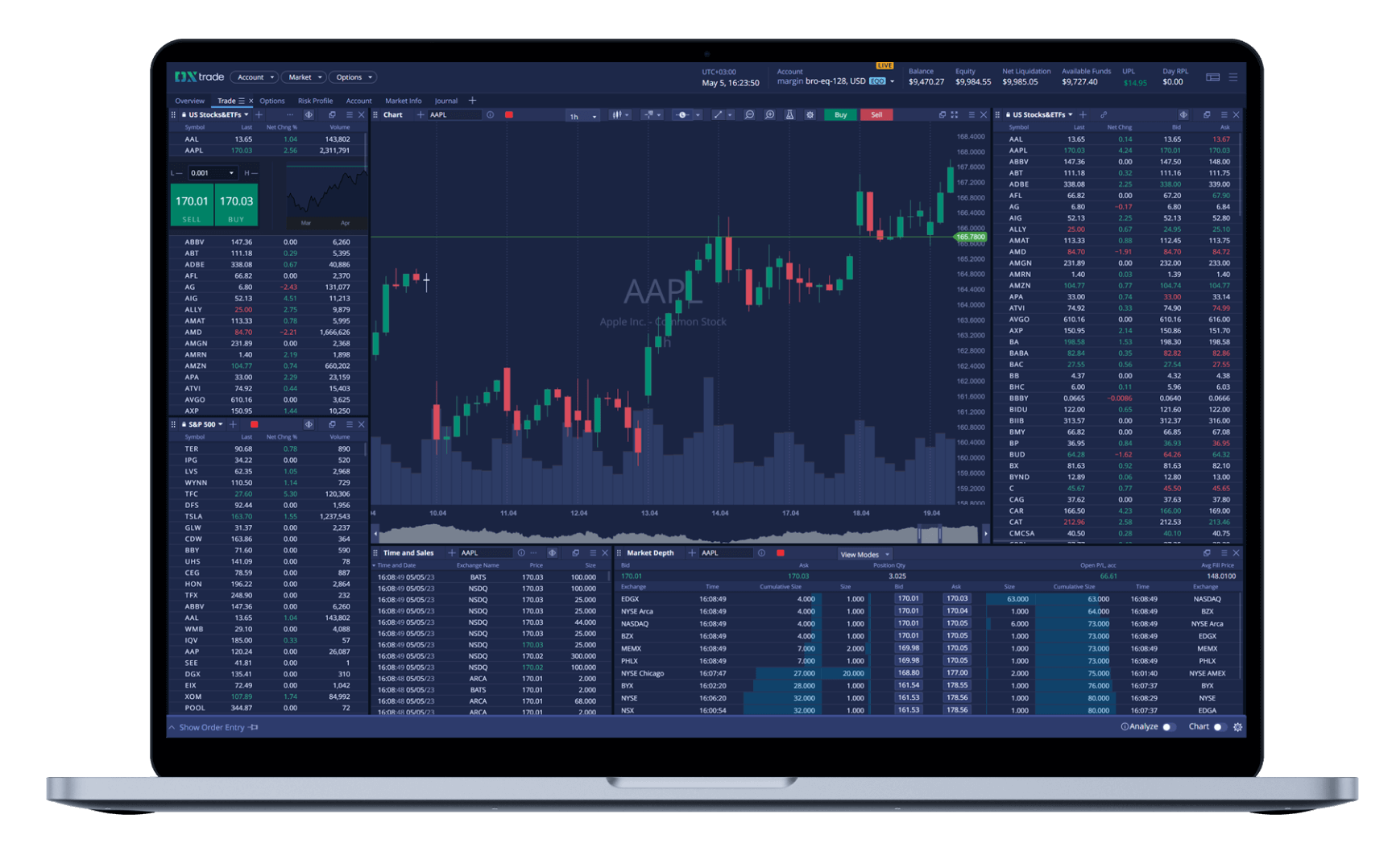

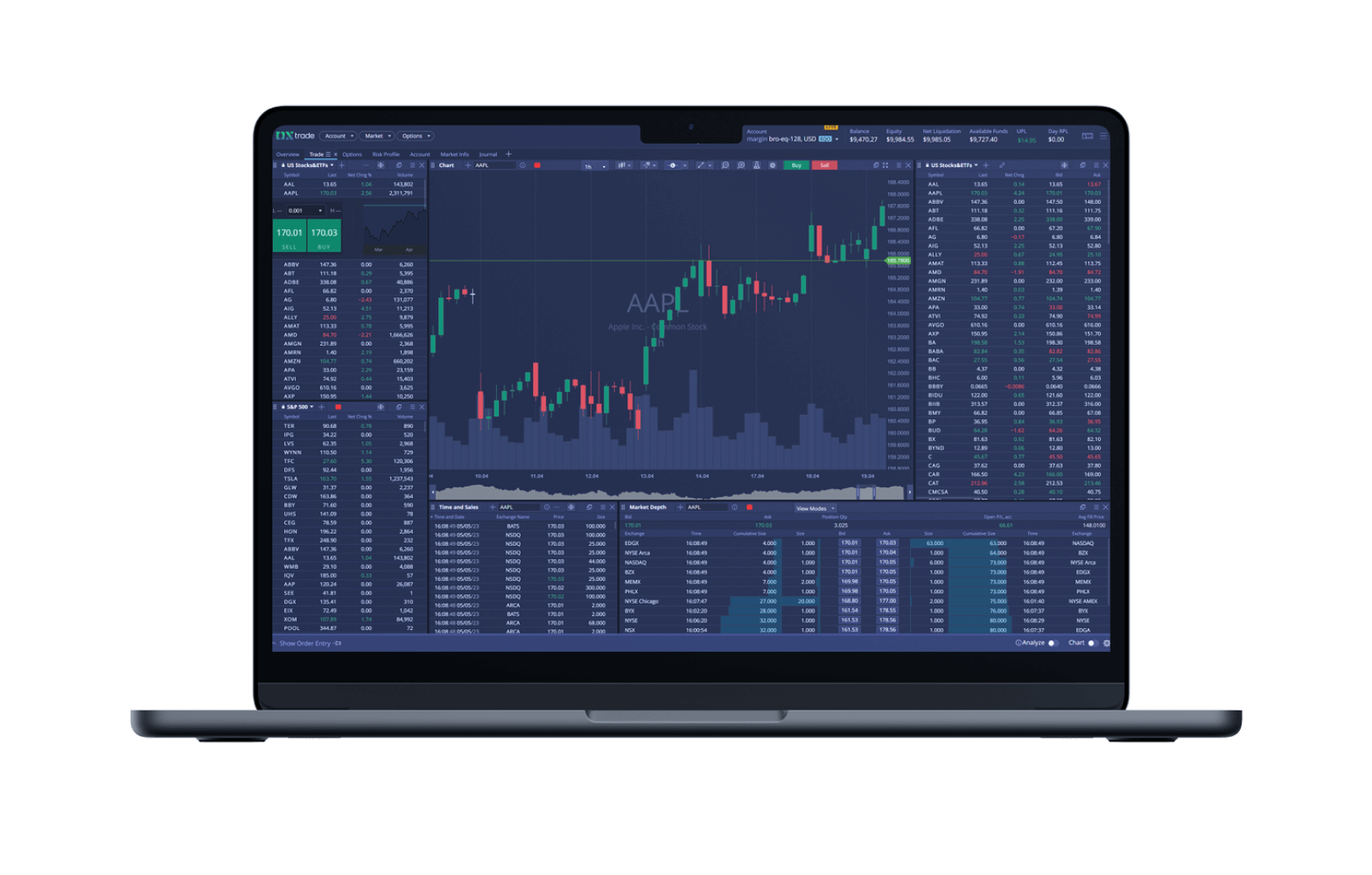

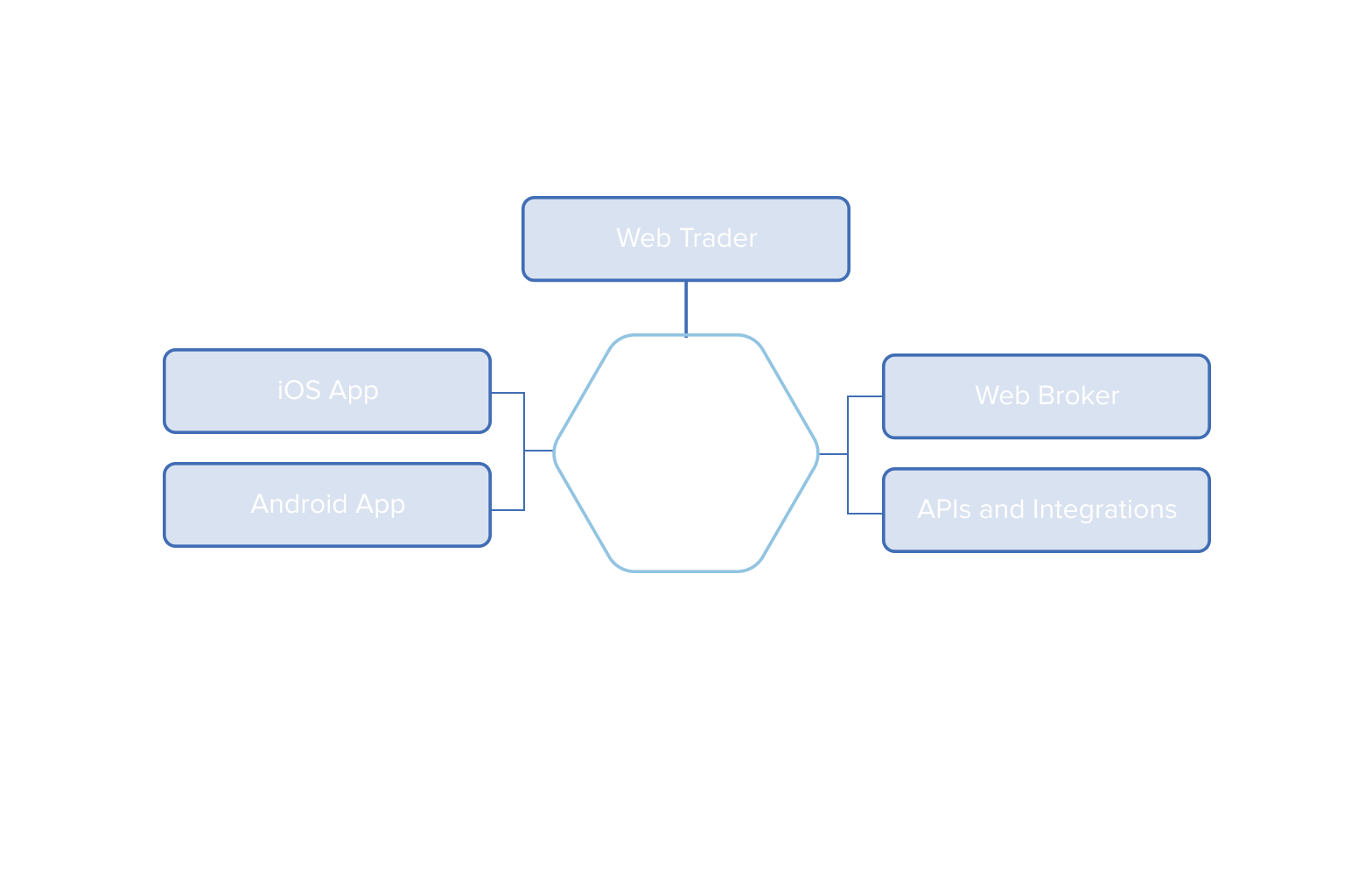

Web Trader

A branded web trading platform with customizable layouts

- Whole share, fractional, and notional order entry

- Real-time quotes and alerts

- Built-in calendar with corporate and economic events

- Heatmap tool to visualize market movers

- Full-fledge trading simulator

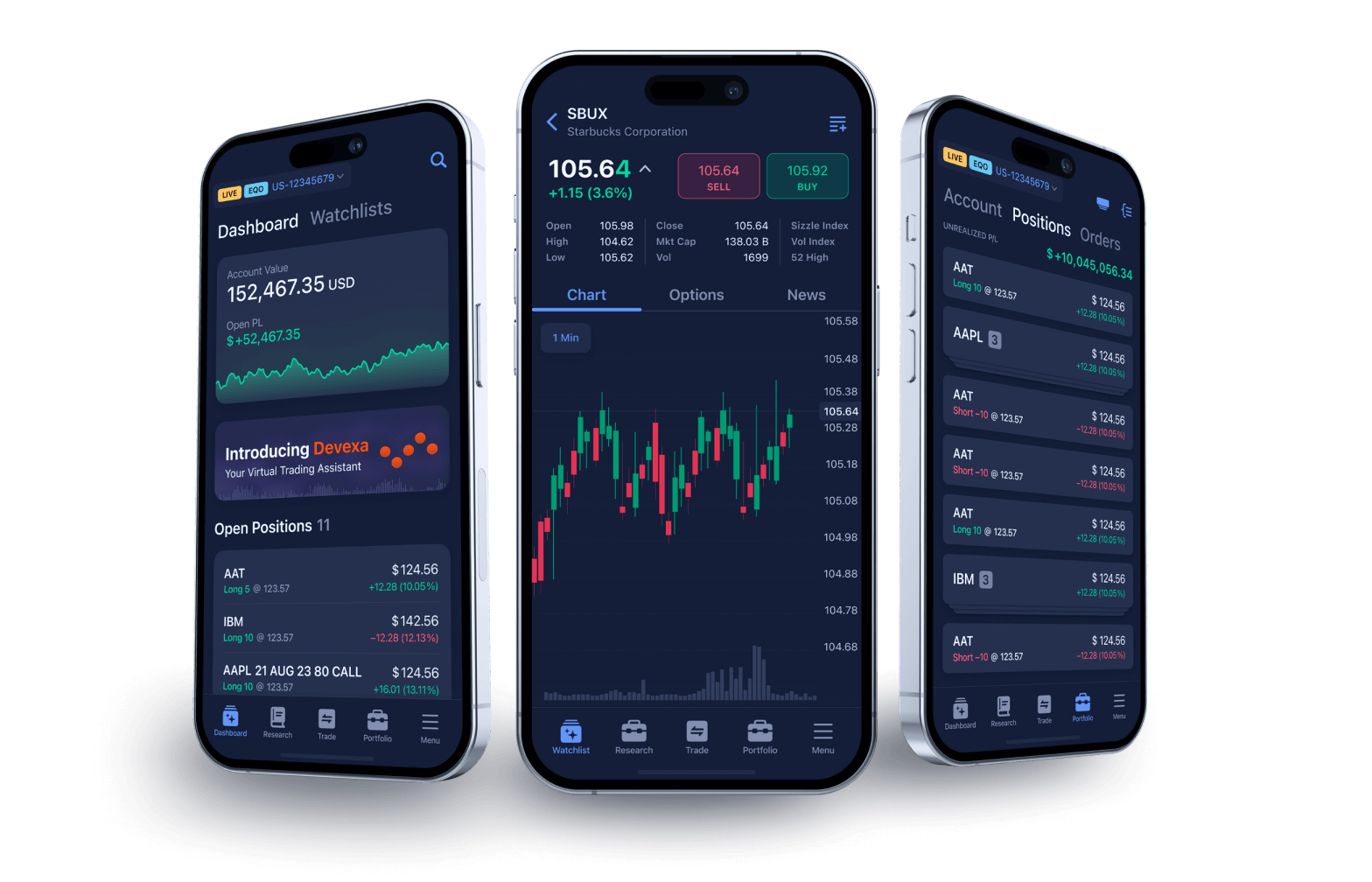

Mobile apps

Your own branded iOS and Android mobile trading

apps with dedicated pages in app stores

- Quick order entry and position monitor

- Watchlists and alerts

- Full Option Chain

- Charting with 70+ studies out of the box

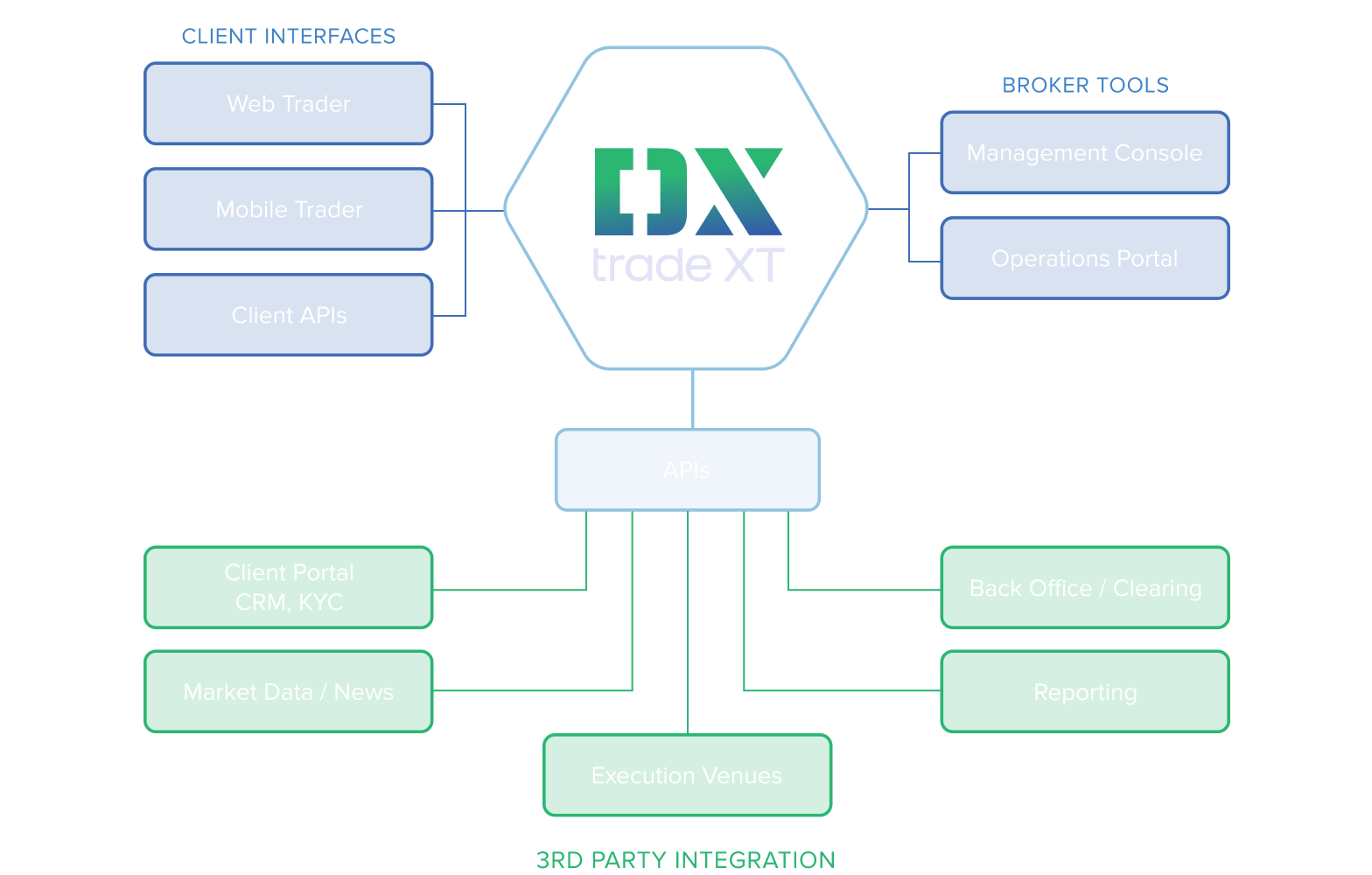

Broker tools

A web-based risk management and operations portal

- FIX connection monitor with real-time status updates

- Routing Wheel manages order flow to multiple destinations

- Broker to client push notifications

- Message monitor to review rejected messages sent to your clearing agent

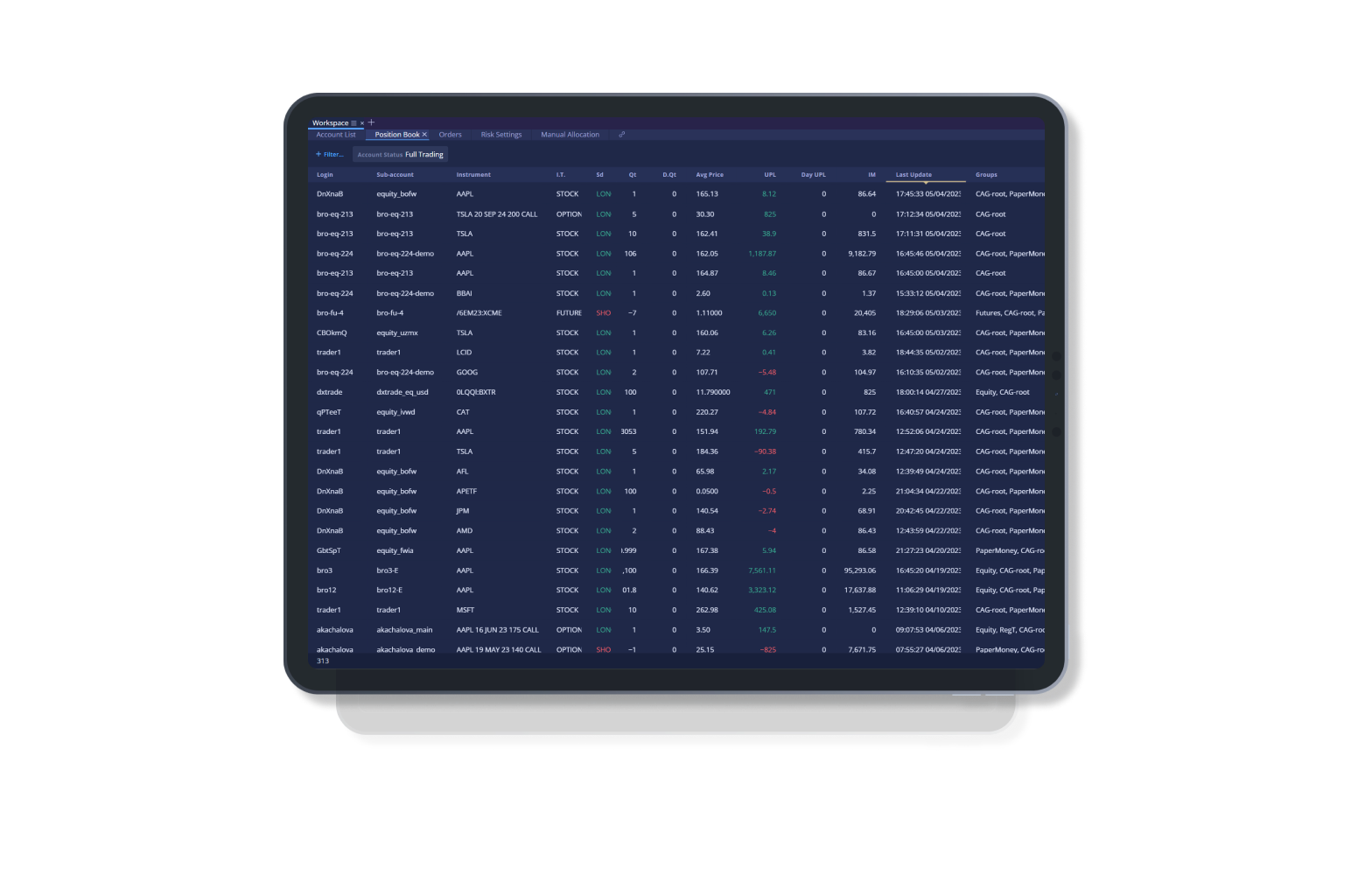

DXtrade OMS

Real-time management of orders, positions, and account balances

- Fractional OMS that supports pre-allocated block orders and

post-trade allocations - Good Til Order Management facilitates hosted daily resubmission

- Cash and margin account support with PDT monitoring for US trading

- Easy integration with any brokerage infrastructure

Out-of-the-box options trading platform

Trading widgets and tools:

DXtrade XT grows with

your brokerage

We offer flexible licensing options for DXtrade XT. Contact us so we can determine which

option is best suited to your particular needs and requirements.

DXtrade SaaS

- Launch your platform in as short as two weeks

- 24/7 maintenance and technical support

- Your own branded web and mobile apps

DXtrade Enterprise

- Endless possibilities for customization

- Run any business model

- Unlimited scaling

DXtrade source code

- Buy out the source code whenever you’re ready

- Take DXtrade XT in-house

- Avoid vendor lock-in

Need a custom solution?

DXtrade XT news

Stock Exchange Challenges: What Do Brokers Need to Know?

Stock exchange challenges: What do brokers need to know to protect themselves? Read how to build resilience for longevity.

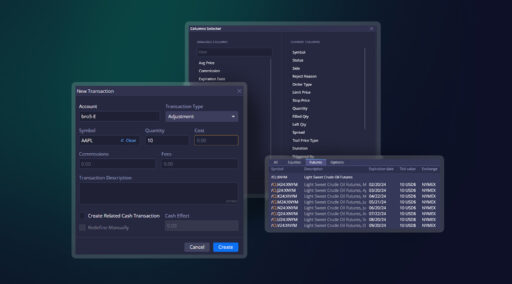

DXtrade XT Updates: More Integration With Futures, Transactions Widget, and Multiple UX Improvements

The new release of DXtrade XT is here featuring an updated instrument selector, updated Transactions widget, and multiple UX improvements.