How Brokers Assert Market Dominance with Stock Trading Apps

The boom of everything mobile

We’re in the boom of everything mobile. We have apps for everything — and trading is no exception.

For example, according to businessofapps.com, 130 million people used mobile apps to trade stocks in 2021. In 2020, even during the pandemic and its trading boom, the number of mobile traders was 50% lower.

But what exactly makes stock trading apps special, and why is the new generation of traders putting mobile first?

Reasons behind the rise of mobile

The core reason is obvious: mobile technology is convenient. Mobile trading apps ensure investors can manage their portfolios anytime, anywhere.

Markets are constantly shifting, and traders may not have time to get to a laptop. A tweet from Elon Musk could change everything in a second, so investors need to act fast, on the spot — mobile apps let them do this.

Trading has also become popular among retail investors who may lack access to a laptop within some exchanges’ trading hours. Mobile trading apps accommodate these circumstances and enable traders to invest in various scenarios.

In 2019, trading apps had 51.9 million users, according to businessofapps.com. As we mentioned, the number’s now surged almost three-fold. And that’s all hard data.

We’re tired of hearing it, but the pandemic did reshape the world. It gave the mobile craze an unseen push: 32% of millennials say they started trading or increased their trading activity thanks to COVID-19.

Millennials and Gen Z have forced companies to adapt to younger generations’ lifestyles. The new wave of investors values ease of access above everything else. And as we said, mobile apps allow people to trade anywhere, anytime.

What makes a good mobile trading app?

First of all, a good trading app needs a native mobile experience. Aim for vendors that provide native mobile apps for iOS and Android. Generic code just isn’t efficient, and the UIs typically aren’t as good as in native apps.

Mobile apps also provide a competitive edge because they cater to various traders’ needs. Apps have an intuitive experience that makes it easier for novice investors to start trading.

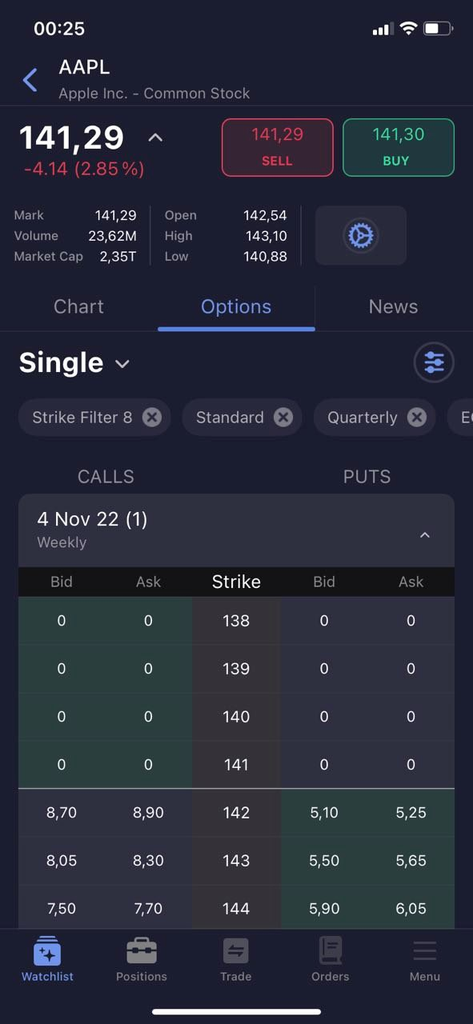

Well-thought-out screen layouts guide novice investors through trading tools, helping them to navigate the markets. Seasoned traders also benefit from mobile UIs when paired with comprehensive analysis tools such as charting with numerous studies and full option chains.

While we’ve covered the basics of how to build a good mobile app, here are some must-haves:

- Useful business tools: you’ll need a full-fledged mobile app that doesn’t rank below its web peer. It should feature real-time portfolio monitoring, market data streaming, risk management, news, quick order entry, watchlists, and charting.

- Quick sign-up process: traders need the ability to open a live trading account inside a mobile app without using a web platform.

- Modern UI/UX: you need to combine a modern look with functionality. Complex tools should be wisely designed for small mobile screens to preserve efficiency. Distribute data evenly to avoid clutter. Navigation and general app use should be simple for all traders. Check these examples of a mobile trading app with a clear UI below:

- Easy integration options: the app should have CRMs, payment providers, news and market data, KYC/AML providers, etc.

What the future holds

Trading with mobile devices is here to stay, and trends show the demand for mobile trading will only grow more.

Emerging markets have the greatest potential in the upcoming years in terms of trading and mobile user growth. Take advantage of this combo — get your brokerage a suitable mobile app.