Guide To Achieving Ultra-Low Latency When Modernizing a Crypto Exchange

When it comes to modernizing crypto exchanges, there are significant hurdles that come with legacy systems. Top of the list? Latency—the silent growth killer.

Modern matching engines have sparked a rebirth of the exchange industry, breaking down technical barriers, enabling ultra-low latency, and unlocking new levels of performance. These cutting-edge solutions are designed from the ground up to handle the intense workloads and high-frequency trading that characterize the crypto market.

To help you understand more, this guide shares a 6-step process on how to modernize a crypto exchange.

Achieving low latency: the core challenge for crypto exchanges

When it comes to digital currency trading, every millisecond counts. High latency can turn a competitive exchange into a market laggard, frustrating users and driving them towards faster competitors. But what exactly is latency, and why does it hold such power over the success of a crypto exchange?

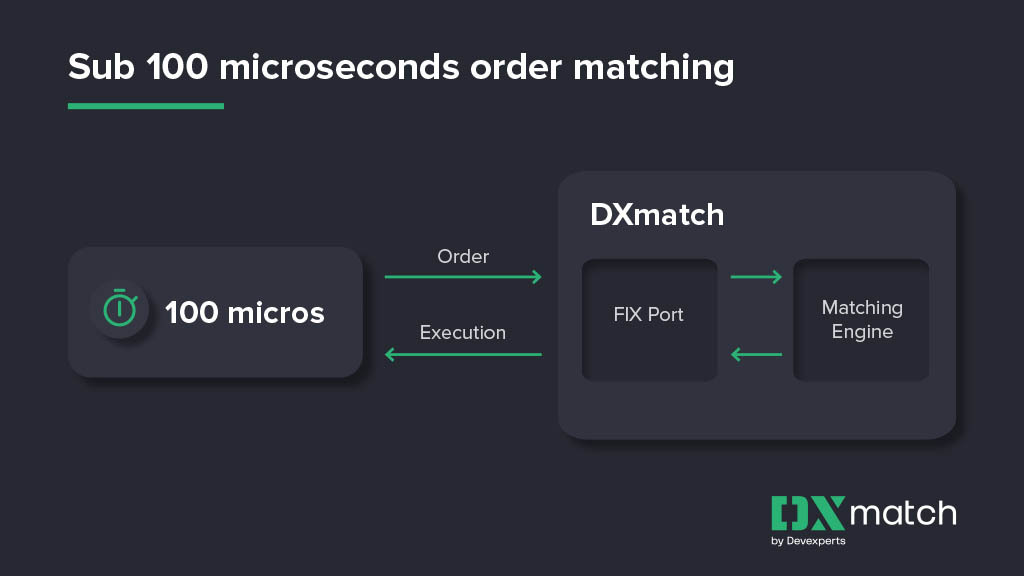

Simply put, latency refers to the delay before a transfer of data begins, following an instruction for its transfer. In trading terms, it’s the time it takes for your buy or sell order to be executed. Lower latency means faster execution, which is key for a responsive and reliable exchange.

The challenge, however, is finding effective ways to tackle it head-on.

For exchanges running on older legacy systems, the path to modernization can be more complex. That’s why updating legacy systems requires the right approach, one that is aimed at ensuring the exchange can not only meet but exceed the expectations of its users.

The technical debt dilemma

At the heart of many crypto exchanges’ struggles with latency is technical debt. Technical debt accumulates when adequate testing is neglected. Quick fixes and short-term solutions pile up, leading to a system that’s increasingly difficult to update.

Without a strong emphasis on quality assurance (QA) and testing, the cycle of quick fixes and patchwork solutions continues. This lack of rigorous QA practices not only hinders performance improvements but also poses risks to the reliability and security of the exchange.

Addressing technical debt is a strategic approach that prioritizes long-term solutions over temporary fixes. It involves shifting towards practices like continuous integration and delivery (CI/CD), which allow for more frequent updates and improvements with less disruption. This shift reduces latency and makes the system more adaptable and resilient to future challenges.

Achieving ultra-low latency: A strategic modernization approach

Achieving ultra-low latency requires the right approach. One that addresses both the surface-level symptoms and the underlying causes. To do this effectively, redesign and optimization of the system’s architecture is required—this ensures it has the resilient capacity to handle the demands of modern trading.

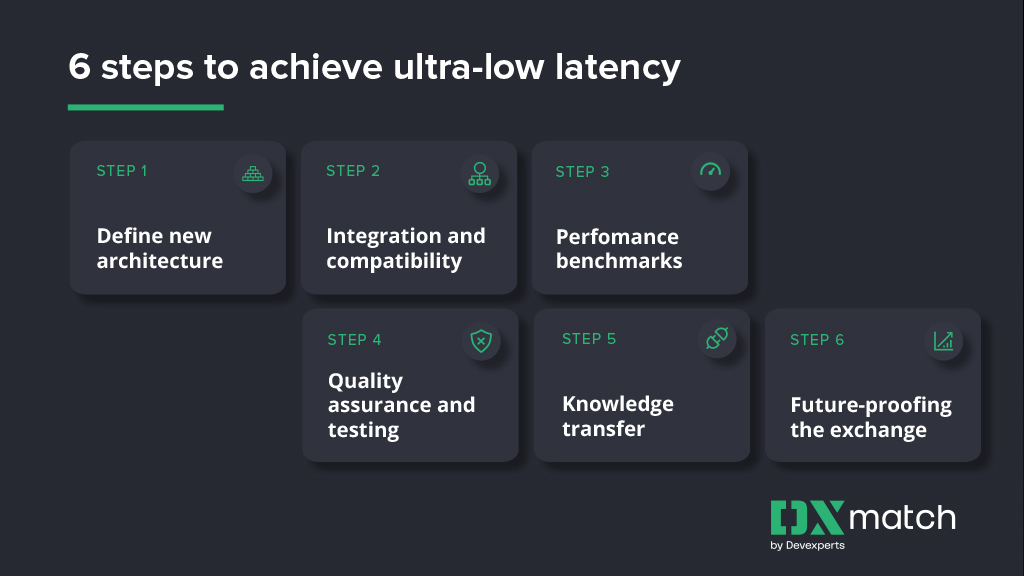

Let’s walk through this process:

Step 1: Define new architecture

The first step in modernizing a crypto exchange is through an event-driven architecture. This enhances the system’s responsiveness and efficiency by enabling real-time reactions to market events. This is a crucial element in the cryptocurrency trading environment where there can be millions of transactions in a queue per second.

To provide high-frequency traders with the rapid execution speeds necessary for competitive trading, direct access gateways are also essential. Similarly, developing a deterministic matching engine ensures trades are executed consistently, the engine upholds the integrity of trading activities. This guarantees that the execution of trades is predictable.

As a result, this foundation supports growth and adaptability, ensuring that the exchange can meet both today’s needs and tomorrow’s challenges. (If you’d like to see an example of what a modern matching exchange solution includes, you can read more about it here.)

Step 2: Integration and compatibility

A key step in designing a new architecture is to ensure all the pieces fit together seamlessly—the aim is to weave the new technologies into the existing framework—with minimal disruptions.

This means taking a close look at how different technologies, like Erlang and Aeron, can coexist and communicate effectively.

Ultimately, it’s important not to leave your legacy system behind. The key is to make sure the new architecture integrates smoothly with the existing framework, ensuring no disruption to your operations. For instance, careful planning and testing are required to confirm that the updated architecture doesn’t just coexist with the legacy system—but enhances it.

The end result should be a unified platform where the advanced capabilities of the new architecture bolster the reliability and efficiency of the legacy system, ensuring long-term stability and optimal performance.

Step 3: Performance benchmarks

For a modernized crypto exchange, establishing and achieving specific performance benchmarks is crucial. Setting precise goals like reaching sub-millisecond latency, and processing up to 100,000 orders per second is key to ensuring the exchange remains competitive and capable of handling high volumes of activity.

To achieve these targets, we recommend a multi-pronged approach: hardware optimization, software algorithm refinement, and embracing cloud technologies for scalability. These strategies ensure your exchange is agile and has the flexibility to adapt to volatile market demands without any downtime.

Step 4: Quality assurance and testing

With a high-performing system in place, you need to ensure it’s as reliable as it is fast. That’s where comprehensive quality assurance (QA) and testing comes in. This level of thorough testing is what guarantees the reliability traders expect and depend on.

For instance, continuous integration and delivery (CI/CD) practices allow you to introduce updates and improvements more frequently and with greater confidence. This ensures your exchange remains up-to-date and evolving with the market, while significantly reducing the likelihood of introducing errors or downtime.

Step 5: Knowledge transfer

A significant benefit of working with a highly experienced partner like Devexperts is the knowledge transfer between engineers and technical teams. Cultivating a deep pool of in-house expertise, enables your team to take the reins and drive future innovations.

Planning for this knowledge transfer and team development from the outset ensures that the exchange isn’t perpetually dependent on external vendors. Instead, it grows a core competency in cutting-edge technologies and methodologies, enabling you to adapt to future market demands and technological advances.

Importantly, this strategy addresses the ‘bus factor’—the risk associated with the loss of key team members. By broadening your team’s knowledge base, you significantly lower this risk, ensuring your projects remain on track even if key team members are unavailable.

Step 6: Future-proofing the exchange

The final step in your crypto exchange modernization journey is all about future-proofing. It’s crucial to design a system that’s not only built for today but also ready to scale and adapt to whatever tomorrow brings.

We’re talking about selecting technologies and architectural frameworks that can grow with your business, ensuring you’re never caught off guard when trading volumes increase or new market opportunities emerge.

By tackling latency and operational inefficiencies now, you can ensure your exchange remains competitive and relevant, even as the landscape of digital finance continues to evolve.

Securing your exchange’s future

Whether you’re just starting to explore the possibilities of modernization or are well into your journey, the imperative is clear: adapt and invest in the future of your exchange.

Standing still is not an option.

Modernization is the key to staying ahead of the curve, outpacing competitors, and delivering the exceptional trading experience that traders demand.

Don’t let latency issues and operational inefficiencies hold your exchange back any longer. Our team of experts will guide you through every step of the modernization process, from defining cutting-edge architecture to implementing robust quality assurance frameworks.

We’ll leverage the latest exchange matching technologies, refine your processes, and equip your team with the skills and knowledge to drive continuous innovation.

Reach out to us to learn more about how we can support your crypto exchange modernization.