Understanding the Forex Brokerage Business Models – A-Book, B-Book, and Hybrid

Forex brokers employ various business models to manage risk, generate revenue, and cater to the diverse needs of their clients. Their primary approaches to handling client orders are A-book, B-book, and hybrid models (or C-book). In this article, we’ll explore these models and their pros and cons for brokers.

A-book model

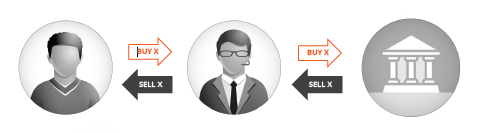

A-book model is also called risk transfer. And as the name suggests, price risk transfer describes the situation where a broker finds another party to assume the price risk and to run any potential losses. Usually, this is another broker, a bank, or a non-bank market-maker.

A-book is also known as the agency model, because the broker acts as an agent for client trades, forwarding orders on to “the market.” In this way, the broker assumes no risk because they’re not exposed to client trades; they simply provide traders with access to their liquidity provider(s) and act as an intermediary.

This strategy entails that the moment the broker receives a trade from their client, the broker will enter into another trade with a counterparty in the same direction as their client.

Regardless of whether the market rises or falls after the trade is made, the broker is not exposed and earns revenues irrespective of the outcome, as we shall see below.

Making money in A-book

Commission is one of the broker’s sources of income in the A-book model. In situations where the broker does not apply a markup to the spread (see below), the prices of entry and exit are the same for the broker and their client, with the client paying commission to the broker for the execution. Usually, this calculation is volume-based (e.g., $X per $1M or per lot). This commission constitutes the broker’s profit for the trade.

Another way to make money in A-book is through a markup to the spread, which is the difference between the current buy and sell prices of the instrument being traded. The broker makes money by applying a markup to the rates at which they trade with the client as compared to the rates at which the broker trades with their liquidity provider(s). This difference between the price provided to the client and the broker’s price taken from the LP constitutes the broker’s profit.

Risks associated with A-book

A-book brokers often advertise their businesses as having no conflicts of interest with their clients. This is because they earn revenues for facilitating the positions of their traders, rather than from their losses.

However, A-book as a model is not without its own risks. Trading with LPs in this manner, rather than managing client risk internally, can result in situations where the broker is exposed to market shocks without the ability to close positions or make appropriate risk management decisions.

A scenario such as this occurred in 2015, when the Swiss National Bank removed its currency’s peg to the euro. Since 2011, the SNB has maintained an artificial “floor” in the EURCHF exchange rate at 1.20, meaning that 1 euro would be worth at least 1.20 Swiss francs.

This was done to preserve the competitiveness of Swiss exports, achieved through currency market interventions where the bank sold Swiss francs for euros at a high cost to the national economy. When the SNB suddenly announced that it would no longer be maintaining the floor (shortly after assuring markets that it would), the franc appreciated by 30% against the euro in a matter of hours, leading to chaos on global currency markets and causing liquidity to disappear.

Why was this so relevant to A-book brokers? Because all of their business was conducted by forwarding client positions onto liquidity providers. At the time, many A-book brokers found themselves in losing trades with their liquidity providers that they were unable to close.

Currency traders had regarded the artificial floor as a safe bet because the SNB routinely stepped in to ensure that the exchange rate would not drop below 1.20. These brokers were now left holding large amounts of losing trades that internal risk management practices would have automatically stopped out in a B-book model (see below).

As a result, A-book brokers incurred hundreds of millions in losses, forcing several of the largest players in the industry to close.

Pros

| No conflict of interest | Access to deep liquidity and tighter spreads | Enhanced transparency |

| Brokers do not profit from clients’ losses. | Clients benefit from the competitive pricing offered by multiple liquidity providers. | Brokers provide a more transparent trading environment. |

Cons

| Commission-based revenue | Slippage and requotes |

| Brokers generate revenue through commissions, which may result in higher trading costs for clients. | Clients may experience slippage and requotes during periods of high volatility or low liquidity. |

Pro tip: Having a well-crafted marketing plan will help you easily navigate market complexities. Furthermore, it will help you connect with your target audience and drive exponential growth as a forex broker.

B-book model

B-book is actually an older business model in retail OTC trading than A-book. B-booking means that OTC brokers choose to accept the price risk from trading against their clients. In other words, the broker takes the opposite side of the client’s trade. If the trader is buying 1 lot of EURUSD, it necessarily means the broker is selling the client 1 lot of EURUSD. When the trader is long, the broker is short, and vice versa. This also means that when traders win, brokers lose, and when brokers win, traders lose.

When the broker accepts the price risk associated with a client position, it is called “B-book execution.” In this situation, trades are sometimes described as “B-booked”, “internalized,” or “warehoused.” This is because the trade stays on the broker’s books, rather than being forwarded on to their LPs.

B-book brokers act as market-makers. By taking the opposite side of their clients’ trades, they create an internal market and assume the risk associated with clients’ positions. One of the reasons that many brokers are comfortable assuming this risk is that it’s widely understood that only a minority of traders are profitable. Hence, the losses incurred from the trades of winning clients are more than offset by the losses of everyone else. Brokers that choose to internalize client orders have become extremely adept at managing this risk.

Issues with the B-book model

As we saw above, the B-book business model has its advantages in times of high volatility, where unforeseen events cause liquidity and price discovery to become unpredictable. By warehousing client trades, B-book brokers are better able to control what takes place on their books.

However, this control comes at the price of constantly having to trade against clients. This conflict of interest can lead B-book brokers to develop a bad reputation among traders. After all, it only takes one broker engaging in disreputable practices to tarnish the reputation of the industry (or in this case, business model) as a whole.

It was, in fact, this fundamental conflict between brokers and their traders that led many OTC brokers to explore the agency model in the first place. The opaque practices of some B-book brokers are also partly responsible for the increased scrutiny and stricter rules that have been imposed on brokers by regulators.

Pros

| Enhanced profitability for brokers | Lower trading costs for clients | Faster trade execution |

| Brokers can profit from clients’ losses, ensuring a steady revenue stream. | Brokers may offer lower spreads and no commissions. | Since trades are executed internally, clients may experience faster trade execution. |

Cons

| Conflict of interest | Limited transparency |

| Brokers may have an incentive for clients to lose as they profit from clients’ losses. | The trading environment may be less transparent, as client orders don’t reach the open market. |

Hybrid model, or C-book

C-book is a term that is often used to refer to a risk management technique that effectively combines A and B-book execution. In this model, brokers are selective about which client orders are forwarded on to the market and which are kept in-house.

In this model, brokers may also choose to internalize part of a client’s order while forwarding the rest of it to their LPs. Brokers can partially hedge the risk to mitigate its possible impact, but not eliminate it, instead choosing to manage the residual risk in the hope of profiting from market movements.

If there’s a large client with B-book characteristics, but the potential P&L implications from sufficient market movements are outside of the broker’s risk appetite, by partially hedging trades, the broker can run a portion of the risk and not transfer all of the potential profits to their liquidity provider. However, such a strategy also opens the possibility for the broker to incur losses that they would have entirely avoided had they hedged the full trade amount.

Thanks to the risk management technologies they have at their disposal, C-book brokers have become highly adept at segmenting their client base into different groups. In this way, they can internalize the trades that are most likely not to be profitable for the end trader, while forwarding on the trades from clients who are more likely to be profitable.

One of the consequences of the SNB event, described above, was that many of the A-book brokers that survived adopted a hybrid model in which they remained agents but also reserved the right to internalize trades at their discretion.

For A-book brokers, the hybrid model enables them to selectively forward client orders. For B-book brokers, the hybrid model confers a degree of legitimacy to their operations. They are regarded as more than a standalone market maker that plays the role of the “house” as in a casino.

Pros

| Flexibility for brokers | Catering to a diverse clientele | Balancing revenue streams |

| Brokers can manage risk more effectively by using a combination of approaches. | Hybrid brokers can offer a range of services to meet the varying needs of clients. | Brokers can generate revenue through both commissions and trading profits. |

Cons

| Potential conflict of interest | Complexity |

| Brokers may still have the incentive to profit from clients’ losses in certain situations. | Hybrid models are more complex to manage and may require additional regulatory scrutiny. |

Pro tip: If you are looking for a quick and cost-effective way to enter the trading market, read more about white-label forex trading platforms and how you can benefit from them.

Technological requirements

The technology that underlies these three business models is, in some ways, the untold story of how OTC business models have evolved over the years. Technologically speaking, B-book is the simplest model to run, as everything is conducted in-house. There are no LP relationships in place, nor is there a need to connect to external systems to trade with them. There’s also no need to consolidate the trading activity that takes place between the client and broker with what takes place between the broker and LP.

A-book models must deal with these technological overheads, which include low-latency connections to LPs for market data, as well as trade confirmation and management. Many A-book brokers choose to trade with multiple LPs, allowing them to secure better prices for their clients or even to split orders between liquidity providers. This requires bridging and liquidity aggregation technologies that B-book brokers do not have to worry about.

These liquidity relationships must also be built and maintained, which can be costly, particularly when dealing with prime brokers, which tend to avoid doing business with smaller trading businesses. For this reason, smaller brokers often have to source their liquidity from other intermediaries.

The hybrid, or C-book model, is technologically the most complex of the three. This is because it combines both A-book and B-book technologies, while also managing when it’s best to forward trades to LPs, when to do so partially, or which LPs to divide orders between, and when to internalize them.

Conclusion

In this article, we’ve explored the basic mechanics of risk management models that brokers choose for hedging purposes. While we’ve covered the most common methods used by brokers, it’s essential to realize that each broker is different and that many may adopt unique practices which suit their type of risk management and, more importantly, their risk appetite.

It’s also important to note that, similar to the forex market, risk management techniques will continue to evolve, and there’s no fixed formula for how a broker will manage their price risk, as all brokers will look for the optimal risk management performance to maximize revenue while reducing their risks.