Understanding the Forex Brokerage Business Models – A-Book, B-Book, and Hybrid

Forex brokers employ various business models to manage risk, generate revenue, and cater to the diverse needs of their clients. Their primary approaches to handling client orders are A-book, B-book, and hybrid models. In this article, we’ll explore these models and their pros and cons for brokers.

A-book model

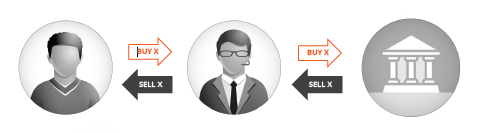

A-book is also called risk transfer. And as the name suggests, price risk transfer describes the situation where a broker finds another party to assume the price risk and to run any potential losses. Usually, this is another broker, a bank, or a non-bank market-maker.

This strategy suggests that the moment the broker receives a trade from their client, the broker will enter into another trade with a counterparty in the same direction as their client.

If the market rises, clients win, resulting in the broker suffering a corresponding loss. At the same time, the broker wins on their position against the counterparty, who in turn suffers a loss. And vice versa.

Making money in A-book.

Commission is one of the broker’s sources of income in the A-book model. Even though the prices of entry and exit were the same for the broker and their client, the client pays commissions to the broker for the execution. Usually, this is calculated as volume-based (e.g. $X per $1M or lot). This commission constitutes the broker’s P&L.

Another way to make money in A-book is through a markup (it’s when a broker adds an amount to the pricing for its clients): the broker makes money because the rates at which they trade with the client are worse than the rates at which the broker trades with the counterparty. The markup is the difference between the price provided to the client and the broker’s price taken from the counterparty. This difference also constitutes the broker’s P&L.

Pros

| No conflict of interest | Access to deep liquidity and tighter spreads | Enhanced transparency |

| Brokers do not profit from clients’ losses. | Clients benefit from the competitive pricing offered by multiple liquidity providers. | Brokers provide a more transparent trading environment. |

Cons

| Commission-based revenue | Slippage and requotes |

| Brokers generate revenue through commissions, which may result in higher trading costs for clients. | Clients may experience slippage and requotes during periods of high volatility or low liquidity. |

Pro tip: Having a well-crafted marketing plan will help you easily navigate market complexities. Furthermore, it will help you connect with your target audience and drive exponential growth as a forex broker.

B-book model

B-booking means that OTC brokers choose to accept the price risk from trading against their clients or they can transfer it to another market participant. Price risk acceptance means that the broker does nothing preventative. In the event that the market moves against the broker, the broker will run all of the losses, and vice versa.

When the broker accepts the price risk associated with a client position, it is called “B-book execution”. In this situation, trades are sometimes described as “B-booked”, “internalized” or “warehoused”.

B-book brokers act as market-makers, taking the opposite side of their clients’ trades. They create an internal market and assume the risk associated with clients’ positions.

Pros

| Enhanced profitability for brokers | Lower trading costs for clients | Faster trade execution |

| Brokers can profit from clients’ losses, ensuring a steady revenue stream. | Brokers may offer lower spreads and no commissions. | Since trades are executed internally, clients may experience faster trade execution. |

Cons

| Conflict of interest | Limited transparency |

| Brokers may have an incentive for clients to lose as they profit from clients’ losses. | The trading environment may be less transparent, as client orders don’t reach the open market. |

Hybrid model, or C-book

C-book is a term that is often used to refer to a risk management technique that differs from A or B-booking. The most common form of C-book risk management is the partial covering of a client order. Brokers can hedge the risk partially to mitigate the possible impact, but not eliminate it completely, choosing instead to manage the residual risk in the hope to profit from market movements.

If there’s a large client with B-book characteristics, but the potential P&L implications from sufficient market movements are outside of the broker’s risk appetite, by partially hedging trades, the broker can run a portion of the risk and not transfer all of the potential profits to their liquidity provider. However, such a strategy also opens the possibility for the broker to incur losses that they would have entirely avoided had they hedged the full trade amount.

Pros

| Flexibility for brokers | Catering to a diverse clientele | Balancing revenue streams |

| Brokers can manage risk more effectively by using a combination of approaches. | Hybrid brokers can offer a range of services to meet the varying needs of clients. | Brokers can generate revenue through both commissions and trading profits. |

Cons

| Potential conflict of interest | Complexity |

| Brokers may still have the incentive to profit from clients’ losses in certain situations. | Hybrid models are more complex to manage and may require additional regulatory scrutiny. |

Pro tip: If you are looking for a quick and cost-effective way to enter the trading market, read more about white-label forex trading platforms and how you can benefit from them.

Conclusion

In this article, we’ve explored the basic mechanics of risk management models that brokers choose for hedging purposes. While we’ve covered the most common methods used by brokers, it’s essential to realize that each broker is different and that many may adopt unique practices which suit their type of risk management and more importantly, their risk appetite.

It’s also important to note that similar to the forex market, risk management techniques will continue to evolve and there’s no fixed formula for how a broker will manage their price risk as all brokers will look for the optimal risk management performance to maximize revenue while reducing their risks.