Expanding Crypto Exchanges: Supporting Diverse Instruments and Strategies

In just the last few months, the crypto industry’s market cap has risen substantially according to Coinmarketcap. In 2013, there were only 7 cryptocurrencies. Today, the crypto society estimated that there are over 10,000 active cryptocurrencies. Collectively, cryptocurrencies hold over $1 trillion in value.

The world of cryptocurrencies is vast and, most importantly, still evolving. As a result, crypto exchanges must adapt to support various trading instruments—at scale. This requires robust, flexible, and scalable technology.

What’s more, to meet modern traders’ expectations, exchanges must offer advanced features like implied orders, risk control (kill switch, mass cancel, fat finger protection, etc.), Request for Quote (RFQ), and block trades. The ability to adapt and upgrade to meet these requirements is essential to compete.

So, what should a crypto exchange do?

In this blog, we’ll look at how technology plays a key role and the top features needed to support scalable crypto trading.

Expanding crypto trading capabilities

The range of trading instruments offered is evolving and the trends all point in one direction—people are growing more confident and interested in crypto.

That’s where expanding crypto exchange offerings come in. They enrich the trading ecosystem, catering to diverse investment strategies and risk appetites:

- Futures contracts: Agreements to buy or sell a particular cryptocurrency at a predetermined price at a specific time in the future.

- Options: Contracts that give traders the right, but not the obligation, to buy or sell a cryptocurrency at an agreed-upon price within a certain period.

- Tokenized assets: Offering assets that represent real-world assets on the blockchain, such as stocks, bonds, or commodities, allowing for fractional ownership and broader market access.

These instruments provide traders with more crypto exchange tools to hedge volatility risks and speculate on market movements, attracting a broader audience—from risk-averse investors seeking mitigation to aggressive traders aiming to leverage market fluctuations.

However, supporting a diverse instrument range presents challenges beyond inherent complexities. This calls for the underlying technical and operational infrastructure to be designed for agility and scalability, capable of processing intricate trades and high transaction volumes with ultra-low latency.

Cryptocurrency exchange technology, like Devexperts’ DXmatch, is designed to handle different and complex crypto exchange instruments while ensuring reliability and robust security. Technology providers, like us, continuously invest in system updates to meet the latest compliance rules and highest-level security measures.

Tackling scalability challenges: The role of crypto exchange tools

An exchange should be able to scale operations to accommodate a sudden increase in trades without compromising security or software responsiveness. To tackle these scalability hurdles, exchanges are turning to advanced technological solutions:

To sum up: Exchanges can build a robust foundation for scaling using a combination of three principles: distributed systems, cloud architecture, and dynamic resource allocation. This method supports competitive growth capable of adapting to users’ evolving needs.

Checklist: Advanced crypto exchange capabilities

Exchanges need advanced crypto exchange capabilities that enhance the trading experience and provide tools for executing complex strategies and managing risks—catering to both retail and institutional traders.

Here’s what you need:

Key advanced trading features

- Implied orders: Leverage implied liquidity across interconnected markets, enhancing order book depth and efficiency.

- Market-maker protection: Safeguard liquidity providers from rapid market movements, for a stable and liquid trading environment.

- Request for Quote (RFQ): Enable traders to request quotes for large trades, finding the best prices without adversely impacting the market.

- Block trades: Facilitate execution of large orders outside the public order book, minimizing market disruption.

- Margin trading: Allows traders to borrow funds to trade cryptocurrencies, potentially increasing their buying power and the potential for higher returns.

- Lending and staking: Provide users with the ability to lend their crypto or participate in staking, and earn interest or rewards on their holdings.

- Decentralized finance (DeFi) integrations: Integrate DeFi services directly into the exchange, offering users access to a wider range of financial products and services.

Supporting these advanced features requires a standard technological foundation:

- Ultra-low latency: Enables real-time order processing and execution in microseconds, minimizing slippage and maximizing potential returns.

- High throughput capacity: Handles massive transaction volumes without performance degradation, ensuring optimal user experience even during peak periods.

- Algorithmic trading: Essential for automating complex strategies and real-time decision-making.

- High-performance matching engine: Crucial for managing vast order volumes, and ensuring swift and efficient trade execution. (Note: This must handle advanced order types and strategies without compromising speed or reliability.)

- Flexible APIs: Seamless integration with traders’ systems and crypto exchange tools, supporting a wide range of strategies while ensuring data security and integrity.

This leads us to one key consideration: To partner with a matching exchange specialist, like Devexperts, or build in-house?

Future-proof trading infrastructure: Build vs buy

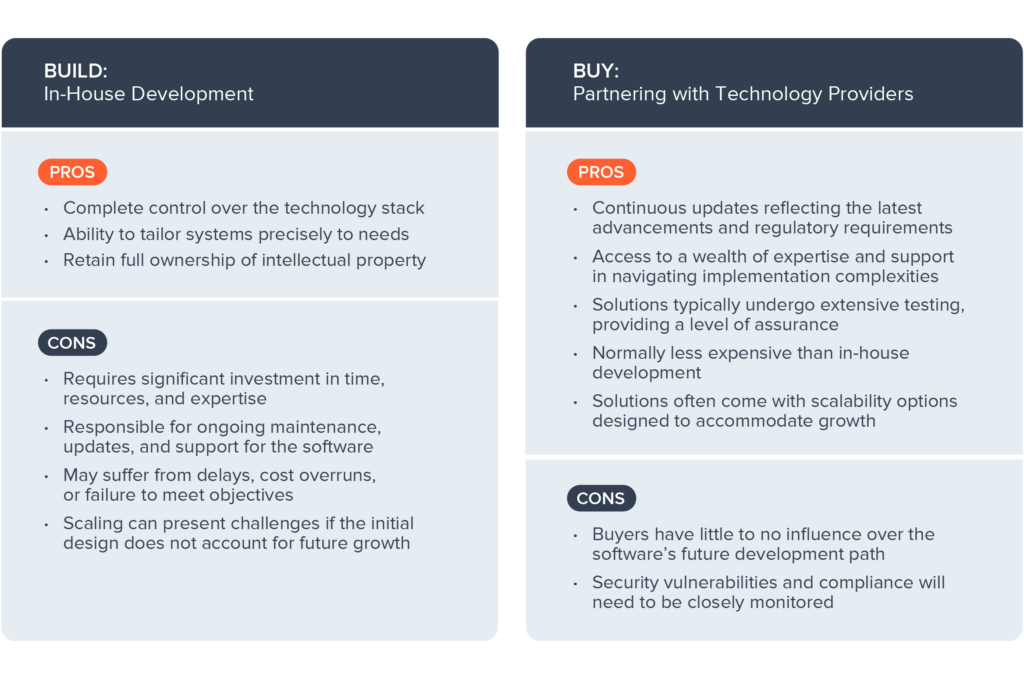

To help exchanges weigh up the choice, here’s a quick look at the pros and cons of each option:

Of course, the choice between in-house development and partnering should be guided by an exchange’s specific needs, strategic objectives, and resource availability.

But regardless of the path chosen, one thing remains the same: upgrading infrastructure to support advanced crypto exchange instruments and strategies is essential. It provides the agility and adaptability to stay ahead of the curve.

Building a scalable future for crypto trading

Advanced features such as implied orders, risk controls, and block trades are now standard expectations for modern traders. Exchanges must therefore equip themselves with technology that supports these complex strategies while managing large volumes of transactions with minimal latency.

Competitiveness hinges on the ability to scale, adapt, and upgrade. Through distributed systems, cloud architectures, and dynamic resource allocation, exchanges can manage growing demands without sacrificing performance.

Key takeaways:

- Scalability enables growth: Scaling for a larger volume of trades across diverse crypto exchange instruments is key. Distributed systems and cloud architecture address scalability.

- Advanced features attract traders: Sophisticated features like implied orders, RFQ, and block trades support complex strategies and effective risk management.

- Robust infrastructure fuels growth: Ultra-low latency, high throughput systems support real-time advanced trading.

- Build vs buy: Partnering with technology providers is a more cost-effective solution–one backed by continuous development and a wealth of expertise.

- Continuous evolution is crucial: Exchanges must evolve to meet advanced needs and stay competitive.

As crypto exchanges continue to evolve, the integration of comprehensive, scalable technologies will be pivotal in sustaining growth and enhancing user engagement. Whether opting to build bespoke solutions or partner with established tech providers, exchanges must prioritize agility and technological adeptness to thrive in the dynamic crypto market.

Keen to learn more?

- Download our ebook: Building Resilient and Scalable Trading Systems for Crypto Exchanges

- Read our blog: Overcoming Low Latency Issue When Modernizing a Crypto Exchange

Looking for a solution that can handle growth?

Here are just a few reasons why crypto exchanges choose Devexperts:

- Limitless customization: with our versatile plugin system tailored for specific business requirements.

- Seamless integration: made simple with industry-standard protocols, ensuring smooth collaboration for external market participants and custom services.

- Continuous evolution: with regular updates three times a year, bringing new features, performance boosts, bug resolutions, and enhanced security, all while staying current with the latest OS and hardware.

- We carefully design each feature: drawing on extensive analysis of competitor exchanges’ APIs and functionalities to deliver unparalleled, best-in-class solutions.

If you’d like to find out more, we invite you to get in touch with us.