Strengthening Real-Time Trade Controls with Modern Tech

Costly trading mistakes, like “fat finger” errors, continue to plague firms worldwide. From multi-million dollar losses to reputational damage, these incidents highlight the critical importance of effective real-time trade controls.

As trading volumes increase, legacy technology and traditional monitoring approaches often struggle to keep pace, leaving firms vulnerable.

The shortcomings of traditional trade monitoring systems

Legacy trade monitoring systems often rely on batch processing and end-of-day reconciliation. By the time an issue is identified, significant damage may have already occurred, resulting in financial losses, regulatory breaches, and reputational harm.

Another limitation of legacy systems is their inability to keep pace with the complexity of modern trading environments.

Traditional monitoring solutions frequently operate in silos, lacking integration with other critical systems and processes. This hinders visibility and makes it challenging to understand potential risks and their impact across the organization.

Without real-time monitoring capabilities, firms are left exposed to a range of risks, including:

- Fat finger errors: Inadvertent mistakes caused by human error, such as incorrect order entry or mistyped values.

- Rogue trading: Unauthorized or malicious trading activities by individuals within the firm.

- Regulatory breaches: Violations of trading rules, position limits, or other compliance requirements.

- Market manipulation: Illegal practices like spoofing, layering, or front-running.

Addressing these shortcomings requires a fundamental shift towards modern, real-time trade monitoring solutions.

The case for updating your trading software UX and risk management

Traditional approaches often treat user experience (UX) and risk management as separate concerns, leading to disjointed and ineffective solutions.

On one hand, a positive user experience is vital for ensuring trader productivity and minimizing errors. On the other hand, strong risk management controls are indispensable for protecting the firm from human-error incidents, regulatory violations, and reputational damage.

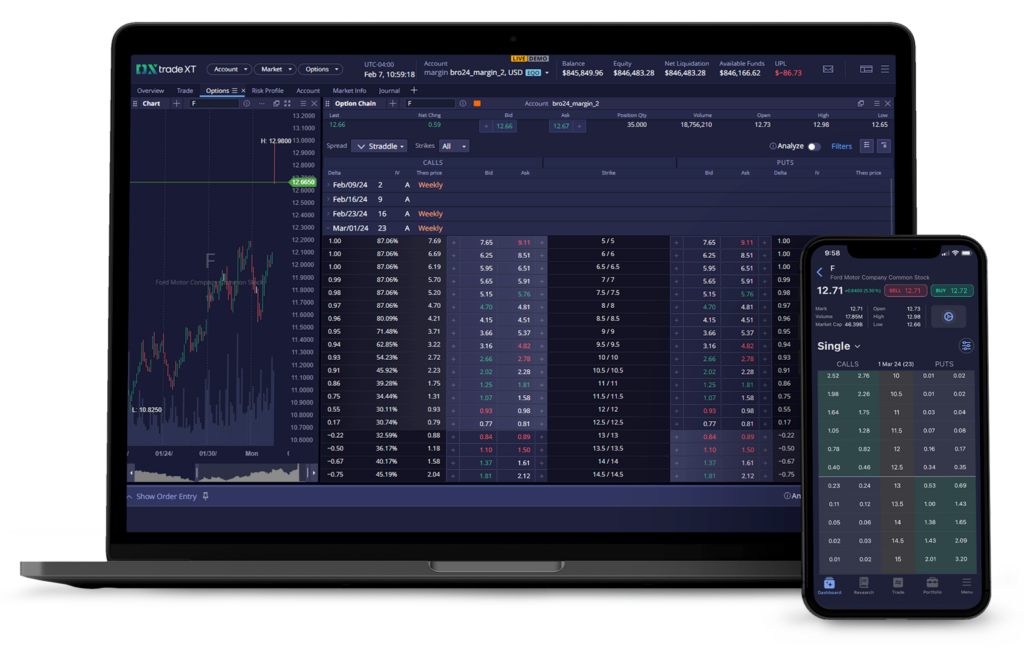

Custom software solutions offer the flexibility to tailor the trading platform to the specific needs of each organization, ensuring a seamless user experience while incorporating advanced risk management features.

Integrating UX and risk management allows firms to:

- Streamline workflows and reduce manual interventions, minimizing the potential for human error.

- Provide real-time risk visualizations and alerts, enabling traders to make informed decisions.

- Automate pre-trade checks and risk controls, preventing unauthorized or non-compliant trades.

- Continuously monitor trading activities and positions, detecting real-time anomalies and potential risks.

By upgrading these aspects, organizations can create an intuitive trading environment while ensuring the right risk controls are in place. For example, automated pre-trade checks and risk controls can be fully woven into the UX ensuring trades are vetted against predefined risk parameters.

Technological safeguards for real-time trade controls

Upgrading to modern technology allows firms to establish real-time trade controls and safeguards against various risks. These safeguards include:

Continuous monitoring

Real-time monitoring systems can track trading activities across multiple asset classes and markets, including equities, fixed income, derivatives, and currencies—as well as across different markets and exchanges.

Real-time risk calculations

Up-to-the-second risk calculations and exposure assessments based on real-time data enables firms to make informed decisions based on the most current information, minimizing the risk of based information on stale or incomplete data.

Automated pre-trade checks

Modern trade monitoring systems can perform automated pre-trade checks and risk limit enforcement, preventing unauthorized or non-compliant trades. The system will automatically reject or flag non-compliant trades, preventing unauthorized or non-compliant trades from being executed.

Rapid detection of anomalies

Advanced algorithms can detect anomalies, potential market abuse, and rogue trading activities. The system will generate alerts and notifications, enabling organizations to take immediate action and mitigate risks.

Seamless integration

Real-time trade monitoring systems can be seamlessly integrated with other systems to enable a holistic view of risk exposures and coordinated responses across different teams and departments.

These technological safeguards ensure firms stay ahead of emerging risks and protect their reputation in an increasingly complex and fast-paced trading environment.

Achieving real-time trade controls through custom software development

In some cases, the only way to update real-time trade controls is through custom software development. However, in-house software development teams are frequently constrained by limited resources, competing priorities, and a lack of specialized expertise in trading systems and risk management. This can result in suboptimal solutions that fail to address the specific needs of the firm adequately.

Partnering with financial software developers, such as Devexperts, is often the best way to improve real-time trade controls.

Devexperts’ deep domain knowledge, proven expertise in developing mission-critical trading systems, and a keen understanding of the industry’s evolving regulatory landscape will assemble the perfect team to meet your needs.

Custom software development allows financial institutions to:

- Incorporate proprietary trading strategies, risk models, and business logic into their systems.

- Seamlessly integrate real-time trade controls with existing infrastructure, minimizing disruptions and ensuring data consistency.

- Rapidly adapt to changing market conditions and regulatory requirements.

By partnering with specialized providers, financial institutions can overcome resource constraints, access deep industry expertise, and develop tailored solutions that address their unique needs.

The imperative of real-time trade monitoring

As we’ve seen, maintaining effective real-time trade controls is critical for managing risks and preventing costly errors. The solution then relies on adopting modern technological solutions.

By unifying user experience and risk management considerations, firms can streamline workflows, minimize manual interventions, and equip traders with real-time controls and alerts.

The problem is, in-house teams often face resource constraints and lack specialized expertise. That’s why many firms choose to partner with financial software developers, like Devexperts.

Custom software development allows firms to incorporate proprietary trading strategies, risk management, and business logic into their system, while seamlessly integrating UX and real-time trade controls with existing infrastructure. If this is something you are interested in, you can find out more about Devexperts’ custom software development here.