Lessons Learnt from 20 Years Developing Trading Software

Devexperts was founded twenty years ago and has quickly become one of the leading specialist technology and trading software vendors for financial markets. The firm will celebrate 20 years in the coming 2022 and is also a genuine technology pioneer in the online trading industry. E-Forex spoke with Vitaly Kudinov, Senior Vice President of Sales and Business Development at Devexperts, to learn more about the company’s trading technology, services, and plans for the future.

Vitaly, please tell us a little about your job and day to day responsibilities at Devexperts.

My official position is stated as Senior Vice President of Sales and Business Development. Put simply, my job is to help financial services firms and our own Devexperts engineering team to meet somewhere in the middle in order to establish fruitful relationships. Being able to convert business goals into technological requirements is crucial for understanding whether these potential relationships can be mutually beneficial. My role is to bridge the gap between these parties and translate requirements in a manner that everyone can understand.

Remind us of the range of Devexperts products and services and the types of financial trading firms you work with.

The Devexperts family, which includes dxFeed, our market data subsidiary, specialises in software and data solutions for capital markets. In the two decades that we have been in business, our company has worked in all areas of the technology chain that allows brokers and exchanges to offer trading services to their clients. From custom multi-asset trading platforms and trading platforms as a service, to matching engines, risk management and reporting tools, market data services and custom feed construction, even trading simulators and other innovative solutions such as financial smart chatbots and a VR interface for traders.

It’s very difficult for brokers to really stand out from their competitors nowadays. How do you think technology can assist them to do so?

If we look back to the history of online brokerage, barring the earliest days when the demand for trading services vastly outstripped the supply of available venues, it’s always been pretty challenging for newcomers to stand out. Brokers have traditionally competed on a number of fronts: trading platforms, client service, number of tradable assets, and fees. Only big brokers were (and still are) able to afford the development of their own custom trading platforms incorporating them with their vision. Smaller brokers have to play in certain other niches, either focusing on local markets or presenting themselves as boutiques, or doing both. But that doesn’t mean that the smaller brokers are without options. Today, technology is the differentiating factor because it touches on all of the above and allows smaller, more agile teams to gain advantages over larger, slower moving entities. The quiet revolution we’ve been seeing in brokers keeping their pre-existing MT4/MT5 back-ends and commissioning all-new front-ends that are more suitable for the demands of today’s traders is a perfect case in point.

At Devexperts, we started out on our own journey focusing mostly on big brokers with the budgets to commission custom developments and see them through. This is what has allowed us to gain the expertise required to also be able to bring more affordable solutions to market that are more suitable to mid-sized brokers and startups.

Devexperts has constructed numerous trading platforms from scratch over the past 20 years. What lessons have you learned about this very demanding development process that brokers should take note of?

The truth, which unfortunately many only learn the hard way, is that software development is very expensive. In online trading, we’re so focused on the competition between brokers for retail clients, we often forget that competition for developer talent across industries is even greater. To the point where today it’s an extremely finite resource that’s being pulled in so many different directions. The moral of the story is that complete, from scratch, custom development is not for the faint of heart.

Brokerages have completely different priorities and time horizons to software development companies. Expecting a brokerage to incubate its own permanent, on-call dev team is a big ask at the best of times, let alone when coding talent is so scarce. This is where companies like ours come in. We already employ experts in all of the areas a brokerage would have to find people for. We’re already in various stages of building and maintaining the kinds of trading infrastructure that brokers would ideally like to build for themselves.

The retail trading platform segment in particular has been somewhat stagnant for years, almost stuck in a rut. Is this a problem that needs solving, or are we unlikely to see any significant disruption to the existing status quo for the foreseeable future?

On the one hand we keep hearing how stagnant things are, but from our perspective it’s difficult to agree with a statement like that when Devexperts has been so immersed in platform innovation and development for so many years. Not only have we launched an all-new platform for the retail segment, we’ve also pioneered a SaaS model that’s accessible for newcomers to the space and highly scalable for brokerage businesses that start making waves.

I think that what might be being referred to in the question is the status quo regarding trading platforms in the online CFD segment, which is also gradually changing as brokers take those first tentative steps away from the incumbent front-ends, towards rethinking how they want the user experience of their brokerage to look and feel. I think it’s only a matter of time before the whole space undergoes a wholesale change, if only because of all the competition from other areas of the online trading landscape such as spot cryptocurrency and derivatives trading venues, zero-commission stock brokerage, wealth management and micro-investing apps. All of these businesses are in some way competing for that Millennial/Zoomer dollar and they’re all rethinking the user experience for this new generation.

Unlike many technology providers, Devexperts has been willing to act as an incubator of new ideas in the online trading space. What advantages has that given you in this highly competitive industry?

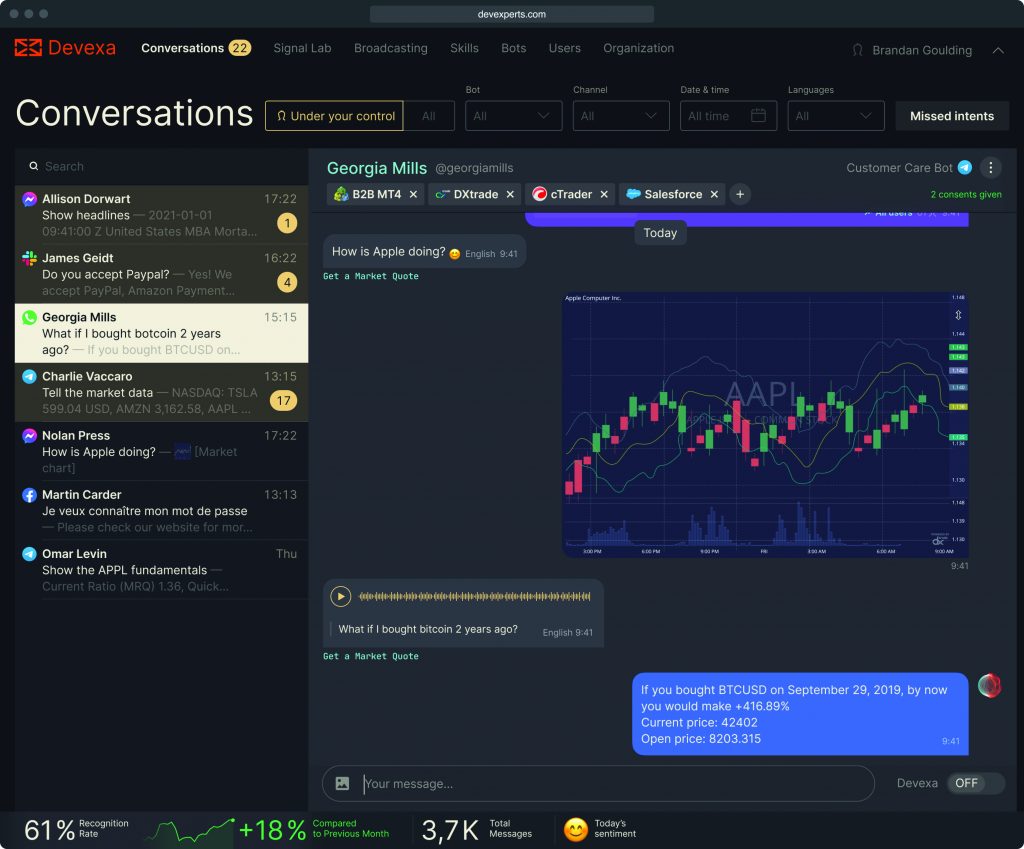

Innovation always involves risk, which is why in every industry you’ll notice that the overwhelming majority of firms prefer to play it safe, content to be guided by the risks taken by others as to the direction worth following. You need to be prepared that 9 of 10 of your innovations will never catch on, but no effort is truly wasted as our team learns more with every project it takes on. At Devexperts, we believe that the non-zero chance that every innovation has of catching on is more than worth the expense of green-lighting projects that may have no clear path to revenue generation at first. Some of our wildest outside-the-box projects ended up turning into viable products that are only becoming more relevant with time. Devexa, our smart assistant for brokerages is just one such innovation.

Why has data become such an important topic for retail brokers? How is Devexperts meeting their demand for market data and other associated products and analytical services?

Quality data is becoming a highly desirable resource, there’s no two ways about it. And in a world where the physical is increasingly migrating to the digital, this trend is only going to keep accelerating for the foreseeable future. When you factor in the trend towards tokenising everything, smart devices interconnected through IoT technology (internet of things), as well as ongoing experimentation with metaverses, it’s clear that the data requirements are on an exponential curve and, as a company, we have always been sensitive to this trend.

Unlike many technology providers, Devexperts does not outsource its market data needs. For the past 15 years, our market data branch dxFeed, has been building a vast market data network, connecting all major world exchanges and sources of historical price information with brokers, banks, fintech companies and other consumers of high quality data. Today dxFeed serves over 6 million end-users globally, delivering real-time and historical financial data across 2 million instruments. Our infrastructure also allows us to offer analytical and data services on the fly from the cloud environment, saving computing and network resources for brokers and other data consumers.

Increasing numbers of brokers are now looking to gain access to the cryptocurrency markets. What advice would you give them about deploying their trading and technology infrastructures to achieve this?

To be honest, I was surprised to see how many cryptocurrency exchanges simply reinvented the technology pioneered by FX/CFD brokers many years earlier. I feel this was a huge missed opportunity on the part of online FX brokers, many of which found themselves behind the curve when it came to this new asset class. My advice to brokers trying to develop their own cryptocurrency strategies in 2021, is to bring crypto into what you already do best, rather than trying to pivot your business towards it due to its recent popularity.

What’s particularly interesting at the moment is the explosion in retail-facing crypto derivatives brokers coming to market completely independently from the retail FX/CFD market. For our part, we’ve been advising FX brokers to lead with their strengths and compete for market share in this precisely segment for years.

With Devexperts as a partner, they can leverage our technologies to offer crypto derivatives traders a vastly improved trading experience through DXTrade, as well as some highly innovative possibilities in synthetic assets and custom index creation thanks to the good people at dxFeed.

What areas of their business operations still present pain-points for many retail brokers?

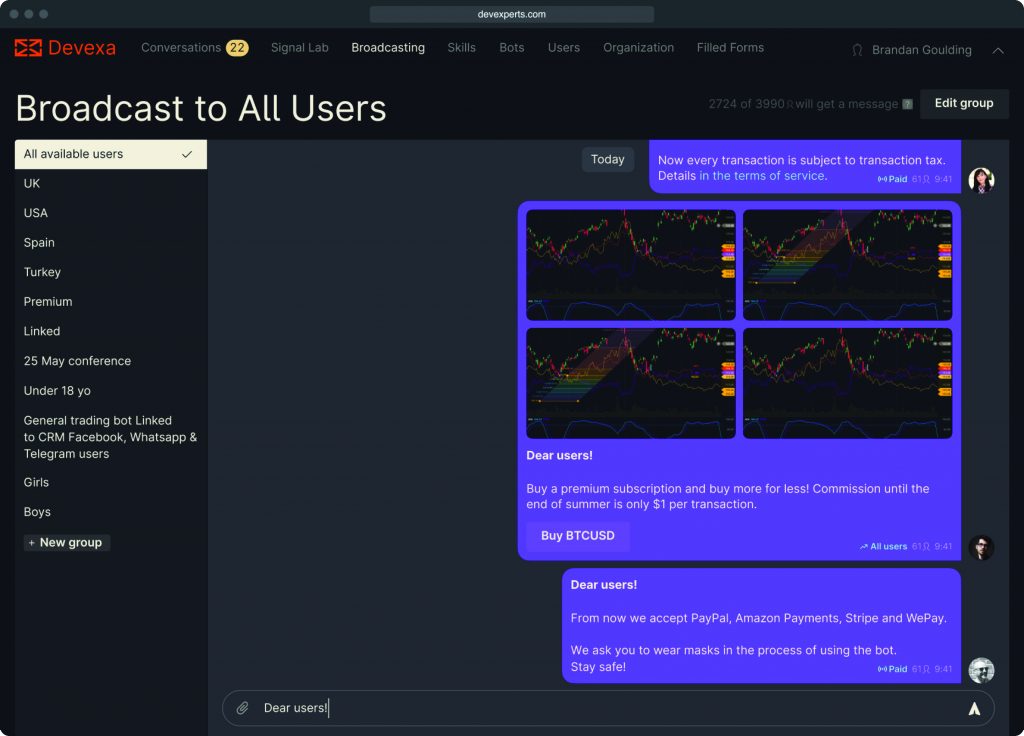

All the usual suspects still apply. Differentiation is an issue with so much overlap between the core services of each broker. The platform problem still looms large with so much of the industry unable to move beyond the incumbent platforms. Also, unifying the user experience not just across devices and operating systems, but also across the often fragmented on-ramps of each brokerage is becoming more of a priority in the industry.

Users now have one experience through a landing page, a different one through the homepage, yet another one through the trading platform and often a completely different one when it comes to the client area. I’d say that one of the most pressing current pain-points is to unify all of these different funnels and on-ramps into a single UX. Devexperts is bringing its own solution for this problem to market and we think brokers are going to be very happy with it.

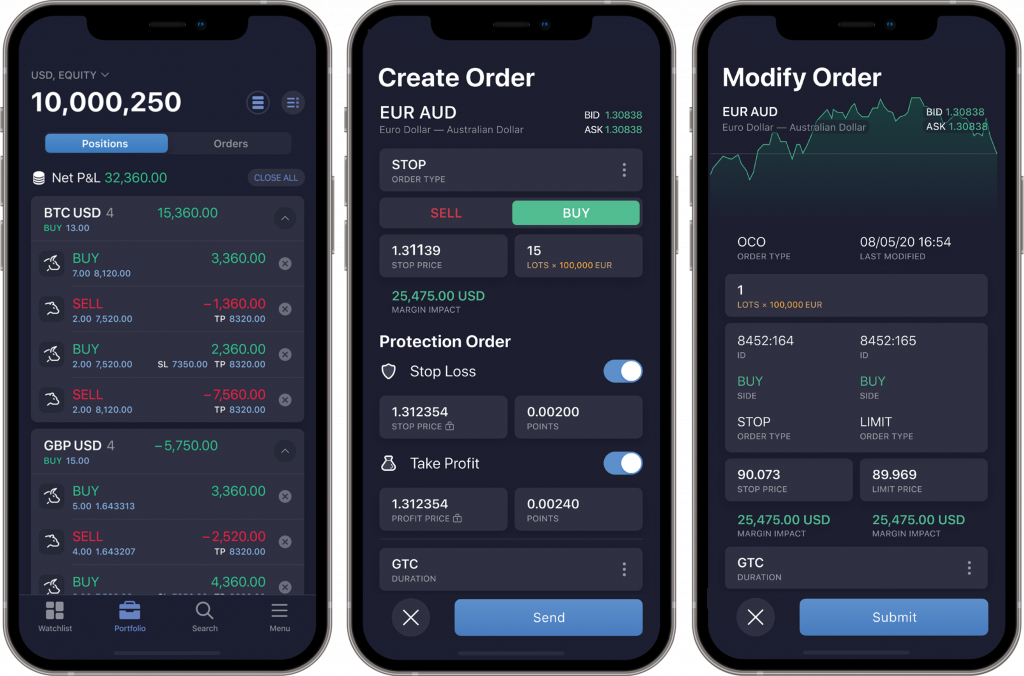

Last year you launched your all-new SaaS platform DXtrade. Please tell us a little about the most important features of DXtrade.

The most important feature is the platform’s modularity, which allows us to release a steady stream of updated widgets to enhance it. This can be an ever-expanding technical indicator set, new ways of visualising market data and even account management features that encourage traders to perform all relevant actions through the platform itself, which translates to more time spent on the platform. The market is perceiving DXtrade as a next-generation, multi-asset, 100% ready-to-use platform that comes out-of-the–box, hosted and maintained by Devexperts, and is suitable for all sorts of retail trading venues across the asset spectrum.

What new electronic trading products and services has your team recently been working on? For example, solutions that can help brokers to further automate their dealing and risk management processes or customer support and retention operations?

One of the efficiencies we’re able to achieve by providing solutions to so many different types of financial entities, is that as our institutional-grade solutions start to mature, we’re able to use key pieces in our more accessible SaaS products. For example, a powerful risk management module with fully automated A/B/C-book execution strategies, tiered markup and tiered margin mechanisms, is now built-into our DXtrade platform. This means that brokers don’t require any additional tools to set up a comprehensive, brokerage-wide risk management strategy as the platform itself can come with it out of the box.

As for customer retention, we believe our chatbot Devexa serves as a powerful customer retention and brokerage differentiation tool, either as a smart assistant inside the platform, or as a broker representative in messengers.

We’ve also developed a unique platform feature allowing users to track past trading activity in the form of a journal, completing it with tags, text notes and advanced search and filtering capabilities. So, now traders get back to the platform to not only issue new trades but also to analyse their past experience.

A new generation of retail traders are starting to make their presence felt. In what ways are they going to influence the technology powering the online trading business?

As I’ve already mentioned, one of the main points of consensus the industry is reaching involves making the entire process of registering, getting verified, funding, education, news, account management and trading into a single, unified user experience. One of the reasons for this consensus is an understanding that this new generation of retail traders have far higher standards than the previous one when it comes to user experience and UI design.

Fragmentation was a necessary evil in the earliest days of this industry. If it’s to move with the times it has to unify all the key areas a user interacts with into one simple-to-use interface, and since traders spend most of their time charting, this unifying interface should logically be the trading platform itself.

Looking ahead, how do you see Devexperts positioning itself to help the retail industry capitalise on the business growth opportunities that next generation technology will bring all around the world?

In the medium term, Devexperts will be helping brokers become true multi-asset and multi-market, mixing exchange-traded assets with CFDs, FX, and Cryptocurrencies in one platform offering.

In the long term, I hope one of our innovative products will become an industry standard, improving the way people trade financial markets, and thus making their lives better. You can expect to see both Devexperts and dxFeed breaking the fourth wall in our industry and going directly to the end trader with certain solutions and services. This is because we feel we’re now equipped to start building recognition amongst traders themselves as innovators in this space and we feel that eventually it will be the traders themselves who are asking brokers to offer our platforms.