iFX EXPO: A Thematic Yearly Review and Look Forward to 2025

As we gear up for another action-packed calendar year of iFX expos, we at Devexperts thought it would be a good idea to review some of the most prominent themes that emerged during this year’s busy iFX EXPO schedule, as well as looking forward to what visitors are likely to encounter in 2025.

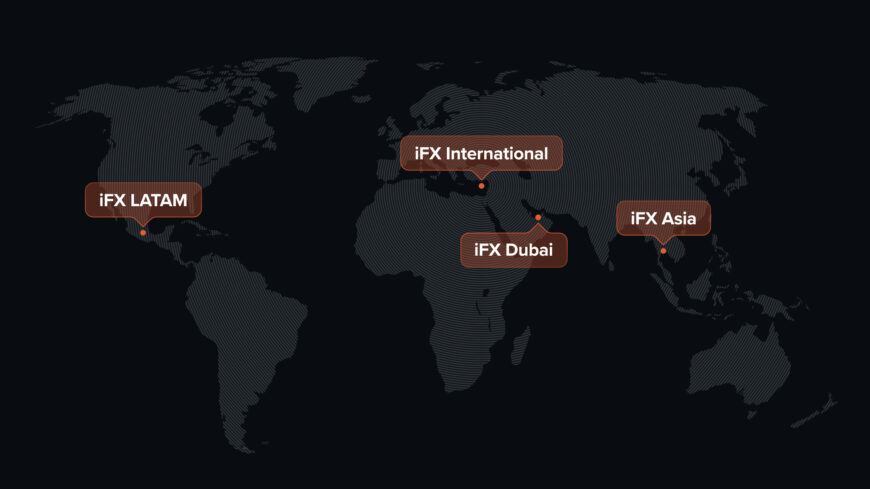

Aimed at bringing the best and the brightest in fintech together in an environment of networking, discussion, and collaboration, the iFX EXPO has grown to become the industry’s premier event, hosting a far broader array of business interests today than in years gone by.

So, as we look forward to another year of scintillating discussions, salubrious events, and positively overflowing swag bags, let’s take a moment to review the current state of play, so as to be able to properly situate ourselves in the evolving fintech conversation going forward.

Worlds apart coming together

Participants in recent expos will have observed a growing presence from areas of the financial landscape that were largely absent from these events in years gone by. The participation of representatives from the banking sector, both traditional and neobanking is a case in point.

As a new wave of challenger banks has emerged in the last decade or so, many have gradually made inroads into the trading sphere, viewing their growing millennial and Gen-Z user bases as the perfect audience for a host of novel financial products that can be delivered through their own unique interfaces.

This has brought incumbents to the table as the dividing lines between bricks and mortar institutions and e-money services have become increasingly blurred, which has led to development firms diversifying to pursue a far more multifaceted agenda, rather than just focusing on trading platforms and back-end integrations.

Revolut’s recent acquisition of an FCA license testifies to this general trend, as does the move that traditional banks have been making to revamp their online offerings, particularly their smartphone interfaces and services.

An evolving payments landscape

This naturally leads to payment providers also taking a far more prominent and diverse role in these events. As the industry moves on from brokerage payment provision as a service being a primary concern, these crucial businesses have come to dominate the proceedings. This was particularly apparent in 2024, with many representatives from the payments industry, as well as a great deal of stage time devoted to the topic of payments.

The integration between payment providers and both FX and crypto market participants is opening up a host of new possibilities where previously the main concern and pain point for financial services firms was just establishing and maintaining payment relationships in a shifting regulatory climate.

As trading continues to grow into a global lifestyle product beyond the niche it once occupied, and as regulation becomes ever more stringent and harmonized across jurisdictions, what were once regarded as risky businesses from the perspective of payment providers now represent unique opportunities for growth and expansion into new territories.

The establishment of trusted relationships between payment providers and regulated trading firms is leading to mutual opportunities for both types of business, as emerging markets such as Africa and Latin America become increasingly important. The presence of firms based in these regions at recent expos, as well as the tangible interest among European providers to increase their own emerging market presence further confirms this trend.

Crypto as more than just an asset class

Another prominent trend to observe is the coming of age of digital assets. Where previously crypto evangelists had to work overtime to convince financial services firms, regulators, and even traders of the asset class’s viability, today crypto is being increasingly explored as a technology that can yield competitive advantages in a variety of domains.

One can observe the conversation shifting from crypto as a speculative asset, to crypto as a crucial technology in the realm of payments, but also as a frictionless vehicle for cross-border and cross-broker transfers.

The fluid, cost-effective, and rapid manner that consumers can deposit and withdraw via digital assets is an ongoing discussion with a host of regulatory concerns, but also business opportunities for financial services firms that are now taking the technology more seriously than merely another addition to their respective multi-asset offerings.

Back to earth after the AI honeymoon

As the euphoria surrounding AI leveled out and the low-hanging fruit was picked off the machine learning tree (AI as a marketing buzzword, copycat LLM implementations, etc.) there has been a definite sense in recent iFX expos that the industry is really knuckling down to explore what this incredibly fertile technology can offer the financial services industry.

This includes how AI can be used to reduce frictions in the payments industry, whether it be through intelligent payment gateways or by ensuring that transactions are regulatorily compliant, more secure, and fraud free in a far quicker, more flexible, and less human-resource-intensive manner.

The technology is also tremendously relevant to the manner in which trading businesses interact with their various liquidity providers as well as other trading venues that may be subject to different rules and regulations. The general idea is that AI can be leveraged in order to offer far more sophisticated order routing possibilities and improved execution for the end trader.

Looking forward to an exciting new year of iFX EXPO events

With the inaugural iFX EXPO event of 2025 in Dubai now less than a month away, we have some indication of what the prominent themes split between the Speakers Hall, Idea Hub, and Traders Arena will be.

Crypto continues to be a perennial topic of interest, both as an evolving asset class and as a technology. We anticipate that this interest will only continue to grow in the expo events to be held in the latter half of 2025, as the post-halving year has historically been one in which bitcoin, and crypto in general, tend to generate a lot of headlines.

AI continues to remain front and center. As mentioned above, we have discerned a gradual shift away from the more obvious uses of the tech and appear to be moving in the general direction of more thoughtful applications. We look forward to hearing from the experts with their “boots on the ground,” so to speak.

The interest in and around the payments landscape also shows no signs of abating, with many specialists in the field set to descend on January’s expo to lend their expertise to financial services businesses both new and established.

Finally, the prop trading phenomenon, which has taken the industry by storm in recent years appears to be coming of age. In what is being dubbed as prop trading’s “next phase,” long term viability over short term gains appears to be the priority, with many interesting talks from prominent guests planned on this topic.

Our head of OTC products had the following to say about iFX EXPO:

Jon LightDevexperts Head of OTC ProductsThe growth of the iFX EXPO has been truly staggering. Watching it evolve from a niche FX-centered event, to one that encompasses all areas of the fintech landscape in a truly global manner has been a sight to behold. It’s also always something of a homecoming, no-matter where in the world it’s being hosted, because it affords us an opportunity to reconnect with old colleagues, touch base, and get a sense of how the financial landscape as a whole is changing from a range of different vantage points. I’m really looking forward to attending again in 2025.

As you might be able to tell, at Devexperts we can’t wait for the New Year, and are gearing up to hit the iFX EXPO circuit hard! We look forward to seeing all of you there. Be sure to stop by our representatives for an interesting chat wherever you see us!

Happy New Year and see you soon!