Replacing a Charting Solution in a Trading Platform: A Comprehensive Guide

In the fast-paced world of trading, the accessibility, usability, and accuracy of charting tools can make or break investment decisions. Therefore, these tools’ underlying technology and functionality should be agile, robust, and efficient.

But what happens when your existing charting library fails to meet the standards or evolving requirements?

Arguments over charting library replacement

The most common reasons for replacement

- Usability issues

If users find it difficult to navigate or use the charting tools, their overall experience can be frustrating, leading to dissatisfaction and potential loss of clients. Although that may seem minor, the appearance and aesthetics of the charts might be unsatisfactory to some users.

- Performance lags

Slow load times and response can severely hamper the real-time analysis required in trading, causing delays and potential financial losses.

- Lack of functionality

Missing features that are considered standard or essential for modern trading may necessitate an upgrade or replacement.

There are other reasons, such as resolving a particular vendor dependency: being tied to a particular vendor’s proprietary technologies might pose risks in terms of pricing, support, and future updates.

Counter arguments

- Vendor risk

Switching to a new vendor might introduce unforeseen risks, such as compatibility issues or instability.

- User adaptation

Existing users may have become accustomed to the old chart’s look and feel, making a change potentially disruptive.

Planning the replacement

Stakeholders

- CTOs and CPOs

They will drive the strategic direction, ensuring that the new charting library aligns with the company’s goals and technology strategy.

- Software engineers

Responsible for the actual implementation, integration, and migration.

- Product managers

They will help translate business requirements into technical specifications and oversee the project’s alignment with customer needs.

- Business analysts

Engaged in understanding and defining user requirements and aligning them with system capabilities.

Milestones

- Requirement gathering and analysis

Understanding what is needed from the new charting library.

- Vendor selection

Identifying potential providers and evaluating them based on functionality, compatibility, support, and costs.

- Integration planning

Creating a system design that covers how the new chart will integrate with existing trading systems, including market data feeds.

- Implementation and testing

Developing the solution, followed by rigorous testing to ensure functionality, performance, and compatibility.

- User training and rollout

Educating users about the new tool, followed by a phased rollout.

Potential risks and caveats

- API compatibility

Differences in APIs between the old and new charting libraries might lead to integration challenges, requiring significant adjustments in the codebase.

- Market data feed integration

Ensuring that the new charting library is seamlessly integrated with existing market data feeds is crucial. This could involve understanding different data formats, protocols, and mapping strategies.

- Regulatory compliance

Ensuring that the new charting solution complies with all relevant regulations and standards is a must.

How DXcharts averts these risks

At Devexperts, we’ve developed DXcharts – our own charting package. As we’ve been in the business of developing trading platforms for over 20 years, and charting is an integral component of them, we’ve applied all our best practices in DXcharts.

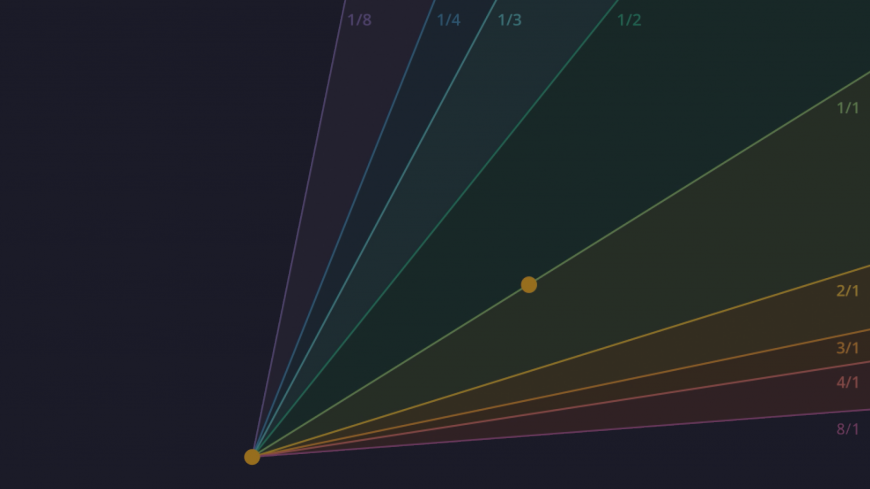

Besides basic historical and real-time market data visualization across multiple asset classes, DXcharts comes with over 100 technical indicators, a wide selection of drawings, and numerous chart types for in-depth technical analysis. We’ve also incorporated our proprietary language dxScript, so users can create their custom studies without any prior programming experience.

DXcharts accommodates different styles of trading with the trade-from-the-chart functionality, multiple charts layout, price scale configuration, and custom aggregation (timeframe) presets.

Going back to averting risks, DXcharts comes with a broad range of standard scalable APIs that ensure easy integration without any need to adjust the codebase.

The same goes for market data integration, DXcharts APIs allow plugging in any market data provider. We also equipped our solution with a special bundle that acts as an intermediary between charts, a trading terminal, and a market data provider because for some brokers it’s essential to display different quotes according to user groups due to varying markup settings.

As per regulations, DXcharts, as all our financial solutions, is compliant with major regulators (SEC, FCA, CySEC, CMB, JFSA, etc.) and conforms to the standards of global exchanges and market participants.

Conclusion

Replacing a charting library inside a trading platform is no trivial task. From understanding the reasons for switching to meticulously planning and executing the replacement, it involves various challenges, risks, and considerations. System design principles must be adhered to at every stage, and the need for seamless integration with other systems, especially market data feeds, must be addressed with expertise and caution.

For CTOs, CPOs, software engineers, product managers, and business analysts working in wealth management or brokerage firms, this guide serves as a roadmap to ensure the transition to a new charting solution is smooth, efficient, and aligned with business goals.

By understanding the potential pitfalls and carefully considering the options, you can make informed decisions that enhance your trading platform’s functionality and user experience.