How to Start a Stock Brokerage Firm

Launching a stock brokerage firm from scratch might seem like a daunting challenge. But with proper guidance, it can be a straightforward process. This guide breaks down all the steps involved in launching a retail stock brokerage so it becomes easy to do in a few months.

All interested parties can use this guide to learn what it takes to open a stock or options brokerage. Our primary focus will be the trading platform — the core entity in this business.

When opening a retail stock brokerage, the first step is to choose your broker type:

- broker

- dealer

- broker-dealer

Becoming a broker

A broker acts as an intermediary between an investor and a securities exchange in an agency capacity. Brokers do not trade on their own account or hold securities in their inventory. They earn their income primarily through commissions or fees charged for their services, based on the size or value of the transactions they facilitate.

Becoming a dealer

A dealer acts as a principal, trading for their own account, meaning they trade for their own profit or loss. Dealers make money through the bid-ask spread, which is the difference between the price at which they buy a security (the bid) and the price at which they sell it (the ask). They play a crucial role in providing liquidity to the market, as they are willing to buy or sell securities when there is an imbalance in supply and demand.

Becoming broker-dealer

A broker-dealer combines the two above-mentioned functions. They can act as an intermediary between buyers and sellers (like a broker). They trade on their own account by holding securities in their inventory (like a dealer). Broker-dealers are subject to a broader range of regulations than brokers or dealers alone, as they must comply with rules governing both agency and principal transactions. In the United States, broker-dealers must be registered with the Securities and Exchange Commission (SEC) and be members of the Financial Industry Regulatory Authority (FINRA).

Once your decision becomes final, you can then make up your mind about which business to support, whether it be retail vs institutional. This decision will determine what license and technology need to be obtained later on.

Obtaining a license

The next step is to apply for and obtain the relevant license. This guide will focus specifically on broker-dealers.

In the United States, you can obtain a broker-dealer license from FINRA. The application process can take up to six months. All necessary documentation must be collected and submitted as soon as possible, to minimize the amount of time lost in this process.

Follow the 5 steps below to obtain a broker-dealer license successfully:

- Reserve a company name

- Sign up for system access

- Pay the application fees

- Meet FINRA’s standards of admission

- Submit form BD (a uniform application for Broker-Dealer Registration) online, hard-copy form BD, and all additional required forms and fingerprints

The application will be reviewed and processed within 180 calendar days. The next step is to decide what technology and software to use.

Obtaining operational technology

Once the application for a license has been submitted, it is time to focus on obtaining the necessary tools to run your brokerage. The biggest decision to make here is whether you will build or buy a trading platform.

Building a platform

The first option is to build everything from the ground up. However, this option has both advantages and disadvantages.

One big advantage is that building a platform will guarantee you a solution that meets your brokerage’s exact workflow and user interface needs.

The biggest disadvantage, however, is the sheer amount of resources required to build the trading platform, both in terms of time and money.

Buying a platform

The second option is to buy an existing platform provided by software vendors. Buying or licensing a platform can be a much cheaper and easier option to implement, and it could still allow you to deliver a unique offering to your clients.

One advantage of buying a platform is that it enables brokers to benefit from market-tested software. This, in turn, cuts down your solution’s development cycle and time-to-market.

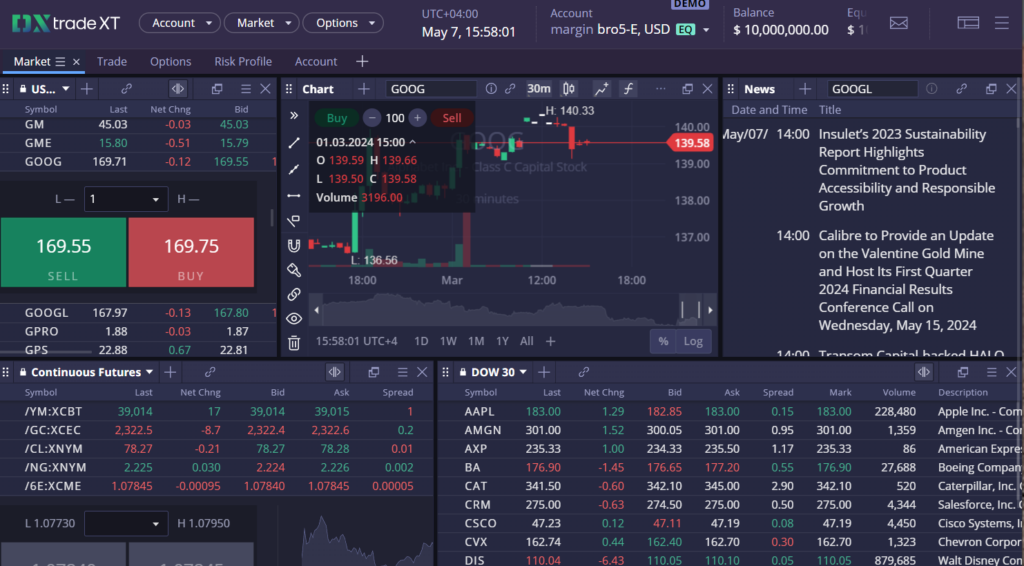

It may seem like licensing an off-the-shelf platform would limit the platform’s look and feel, however, this is not the case. For example, a solution like DXtrade XT offers a white-label trading platform with an extensive configuration engine to support even the most bespoke workflows.

DXtrade XT has been developed to allow brokers to tailor their platform according to their unique needs, to match the user’s color palette and preference for the overall look. New stock brokers can even have it ready to deploy within a month.

6 things to consider when choosing a trading platform

When choosing a platform and discussing it with the vendor’s solution architects, you need to consider several things.

Supported asset classes

Based on the broker-dealer license and prospective asset class offering, a platform needs to be flexible enough to support your current business needs and future growth potential. A few asset classes to consider for retail trading are:

- Equities

- Simple and complex options

- Futures

- Mutual funds

- Fixed income (bonds)

Of course, not all of them are necessary. You may, for instance, begin by offering just stocks, and once ready to move forward, enabling a new asset class can be as simple as making a few clicks.

Cash vs. margin trading

Another factor to consider is the type of trading you want to offer your clients. This will dictate which trading accounts the platforms will support.

For cash account trading, the money deposited to purchase securities is the only money investors can use. Simply put, investors can only trade with the cash available in their accounts.

Cash accounts

Using cash accounts is a straightforward and less risky way of doing business for brokers. Investors can’t go short, and can only trade simple options under predefined scenarios if offered by the broker.

Margin accounts

If the broker is ready to undertake more risk, they can use margin accounts to lend money to customers.

The customer will use borrowed money to invest, magnifying their profits and losses as they are using leverage. Margin account users pay interest on any money borrowed. They are able to open short positions and use additional option strategies.

However, margin trading often requires brokers to follow local market regulations set out by the applicable government. For example, brokers in the US need to monitor the number of trades executed per day and limit the margin rate for retail traders.

A platform like DXtrade XT supports cash and margin accounts out-of-the-box. For cash accounts, DXtrade XT offers full securities trading in all supported quantities with settled funds. For margin accounts, it includes Reg-T margining for equities and equity options, custom margin profiles, and margin override on the instrument level.

Order Management System

An Order Management System, or OMS for short, is an electronic system developed to execute securities orders.

An OMS allows brokers/dealers to track each order’s progress. As such, choosing the right system is vital.

When choosing an OMS, it is important to take into account the supported asset classes. Other things to consider include – the quantity increments supported, the number of counterparties or destinations, and the types of end users or traders being targeted. For example, the OMS module in DXtrade supports orders both in fractional quantities and notional amounts.

An important component of an OMS is the routing capabilities based on supported asset classes and executing destinations. For example, the DXtrade platform has a routing wheel that allows brokers to establish routing profiles on the asset class level. It features automatic reroute if orders are rejected and allows brokers to update route percentages and destinations in real-time.

For brokers that support Fractional trading, an OMS can route orders as received to destinations in fractional and notional quantities. It could also provide a facility for brokers to manage fractional inventory accounts in a Principal capacity. This can be achieved with a fractional rounding algorithm which takes orders in fractional and notional quantities, rounds to whole share quantities based on platform configuration, and route to the street in round lots.

Upon order execution, the algorithm allocates the original order quantity to the client’s account and allocates the remainder to a broker inventory account. The DXtrade OMS offers a configurable fractional algorithm, and it also provides an inventory management system to minimize the principal account position risk.

Risk Management and Monitoring

Risk management is a crucial component of any trading platform and most provide monitoring tools built into the solution itself. Based on the supported asset classes, it is important to identify what risk settings and monitoring capabilities your brokerage needs.

DXtrade XT can provide a customizable set of risk profiles for pre-trade offers.

A risk profile tool can also help determine traders’ reliability. It enables risk assessment for a portfolio of options. As a result, users can estimate potential P/L while simulating changes in key parameters. Said parameters might include volatility, time, and underlying price.

Additionally, real-time monitoring for account balances across clients is crucial. This will allow the broker/dealer to liquidate single or multiple accounts in bulk by closing all positions, trade on an account’s behalf, or export data from the grid.

Orders need to be monitored as well. In certain situations, the firm’s employees may need to replace or cancel simple orders. For instance, this may happen if a trading terminal experiences an unexpected load and crashes when the market is highly volatile. In this case, the client may need to make changes to their account by phone, such as exporting data or canceling orders in bulk.

Monitoring all clients’ open positions is also crucial. One needs to be able to order audit trails for all accounts, manually import positions, and export data.

The trading platform’s OMS section is responsible for performing risk management. But it also handles the following monitoring activities:

- Real-time exposure monitoring

- Risk management groups and profiles

- Price stream management

- Execution settings

Reporting

In smaller companies, clearing agents and back office systems are responsible for compliance reports. Larger companies, however, will handle this task themselves.

DXtrade XT can send account statements as a monthly report. Brokerage account statements generally include a summary of the broker or dealer’s holdings (which is the recent market value of one’s holdings), account numbers, and contact information for financial professionals and clearing firms.

Connectivity

One of the most important features of a platform is its connectivity options for external systems and venues.

Here are a few third-party integrations that should be taken into consideration:

- Client portal

- Executing Destinations

- Clearing Agents and Back Office

- Market data

- Financial news

Most OMSs leverage FIX protocol and APIs to support connectivity, from inbound order flow and client onboarding to outbound order routing, compliance reporting, and clearing.

The wrap-up

Building a brokerage is not a quick and easy task. You could, however, license a platform that is already available. This saves time and allows you to focus on marketing and launching your stock brokerage business. However, for a truly unique result — if time and money allow it — it may be best to request a custom solution from companies that specialize in this domain.

Whatever you choose, we at Devexperts are at your service. We can create a tailored solution for you, or you can license one of our out-of-the-box platforms.

In case you prefer to build a solution, you can always request a consultation, and we will be happy to guide you on your journey.