The Winning Hand: Institutional Crypto Trading Solutions

Zombies vs Goblins

The beginnings of the crypto market are unlike any other asset class: the first clients weren’t institutions but retail. The initial exchange solutions weren’t built upon financial grade technology, agreed standards, security, testing, and experience gained from other financial markets.

In fact, one of the most famous original exchanges started out as something completely different. At its peak, it was the world’s largest Bitcoin exchange in terms of market share, handling over 70% of the world’s BTC transactions. A year later, in 2014 the exchange was filling for bankruptcy.

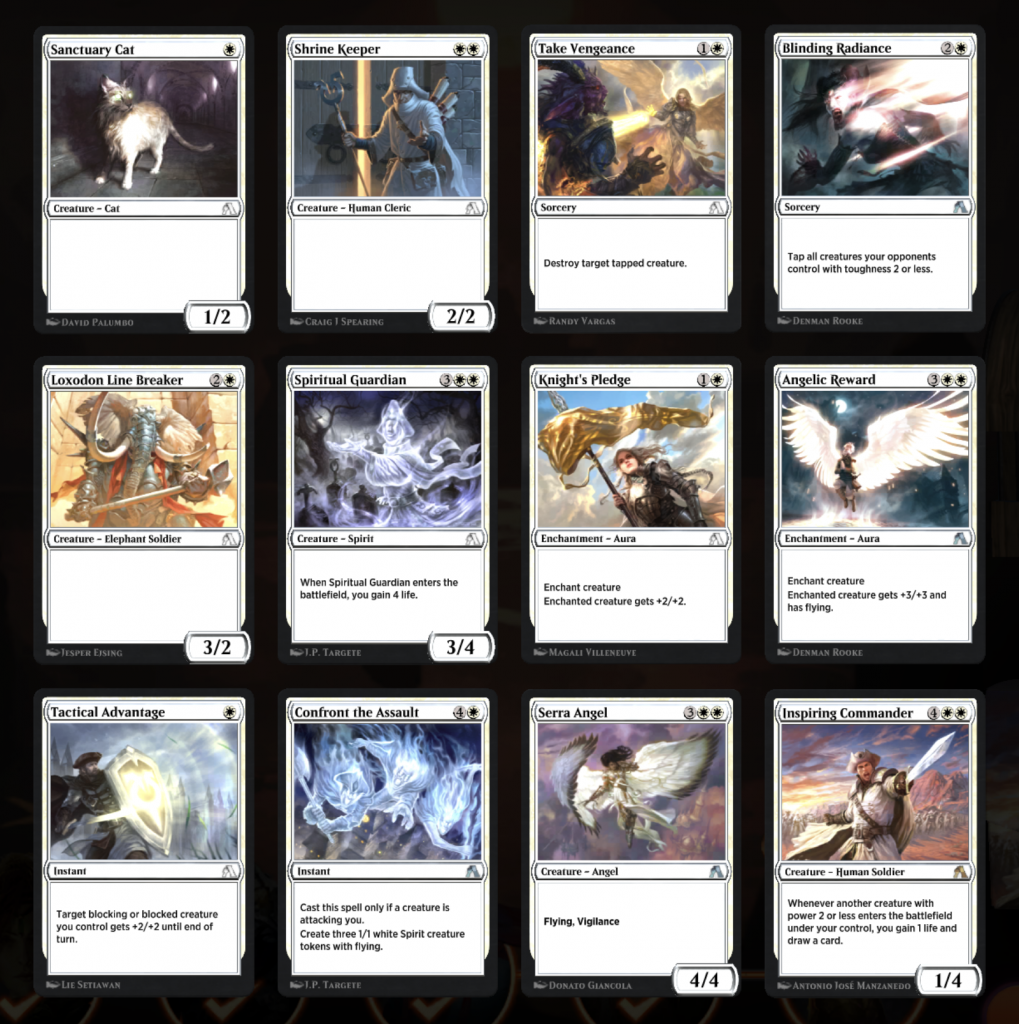

That exchange was Mt. Gox, but it didn’t start out as a crypto exchange. The name actually stands for “Magic: The Gathering Online eXchange’’. It was originally built by a programmer as an exchange platform for trading fantasy virtual playing cards, like these:

The fantasy card trading exchange didn’t really take off and was closed down, but the domain was kept. A few years later the developer came across Bitcoin and realised people needed a place where they could exchange the cryptocurrency. He repurposed the website, adapted the exchange software, and stuck with the same name and domain – Mt. Gox.

The Mt. Gox exchange became wildly popular, but it was too much for the creator to manage. Ultimately, the exchange was sold to someone who was better equipped to continue expanding its reach.

The technical and security requirements needed to build an exchange for transacting wizards, zombies, and goblins are much less sophisticated than those needed for trading financial instruments. These discrepancies led to constant issues for Mt. Gox, including database leaks, security breaches, theft, fraud, and transaction delays – more or less the exact things in which mainstream financial exchanges invest a lot of resources to avoid.

Despite all these challenges, however, Mt. Gox continued to grow and was processing over 70% of the world’s bitcoin transactions at its peak. That was until 2014 when it was hacked again and “lost” 850,000 Bitcoins, which was 7% of all Bitcoins that existed then. That many Bitcoins would be worth over 50 billion USD at the highs we’ve seen so far in 2021. The full story of Mt. Gox is very complex and the bankruptcy case along with the investigations are still ongoing.

This history of the original technology behind crypto exchanges is similar across some of the other early exchanges. They were built by techies who had successfully created crypto exchanges but didn’t necessarily have experience building robust platforms for financial markets. Key considerations like execution methods, standards, and APIs had been reinvented or in some cases skipped.

Enter the Wizards

The crypto market needed major reform before institutions would be able to take up trading. Even with enormous interest in this new asset class, no sane risk department, at any respectable financial institution, would ever let their trading desks touch crypto without having at least some basic familiarities to the traditional financial markets model.

When we talk about institutional firms, we broadly cover:

- Investment banks, brokers & FCMs

- Market makers and LPs

- Mutual, pension and hedge funds

- Insurance firms, endowments and other asset managers

- Proprietary trading firms, High-frequency trading firms (HFT), algorithmic trading firms, and professional traders

Technology is just one of the areas that differentiates the market for institutional clients. The lines among the different cryptocurrency industry providers are increasingly blurred between retail and institutional.

The Winning Hand

Let’s take a look at the important items for institutions to keep in mind when getting into the crypto space.

Protocols

Most crypto exchanges started out with just a UI and added APIs later on. These were their own protocols built from scratch. Protocols need to be straightforward for an institution to integrate into an exchange or OTC market maker. They have to be nimble and quick to offer seamless integration, given changes in liquidity. Ideally, the protocol is something institutions are well versed in, such as FIX.

Hedging

Institutions will never allow their trading desks to go into an asset unhedged. This changed after CME launched Bitcoin futures in 2017 and options in 2020. This also allowed firms to have exposure without some of the issues that come with spot crypto. There are also OTC forwards and options coming to the market, though, they do have some issues that are still being worked out as it’s difficult to have an agreed market price.

Custody and Settlement

Given the risks of holding crypto in wallets or directly on a hard drive, the recent increase in firms offering insured and secured crypto custody has helped institutional firms get more comfortable in this area. Alongside these custodial solutions, the rise of non-custodial crypto wallets is empowering users to take full control of their assets while maintaining security. Additionally, these firms have become trusted third parties for settlement assistance, further solidifying their role in the crypto ecosystem.

Liquidity

Institutions want to know that they can easily enter the market and close their positions when needed without causing the price to change. Exchange volumes are still comparatively small to traditional markets. That said, the rise of OTC market makers and brokers makes it cheaper to trade and liquidity continues to grow. Liquidity creates more liquidity.

Regulation

Institutional firms need to stay in line with the rules set out by the regulator. In a market that is in its infancy and evolving rapidly, so too is the regulation. While many regulators have allowed crypto trading, rules continue to change and terms are not yet in line with other asset classes.

Enhanced Security

Security weaknesses at some of the original exchanges have spooked institutions. Firms need to trust that assets are secure on the platforms on which trades are executed. This covers a vast area from network security through to multi factor authentication.

KYC

Institutional firms need to rest assured the counterparties they’re executing against have gone through the proper level of KYC procedures, ensuring they fall in line with regulation and settlement risks are minimized.

Technology

Institutional firms want to trade on technology they’re used to and that offers high availability, disaster recovery, low latency and high throughput. They require technology that’s been used in other markets and has been thoroughly tested. Firms also need seamless APIs and intuitive UIs that work.

Reliable Data Feeds

The crypto market is highly volatile and fast-paced, which often leads to off market pricing. It’s important to have protection against spikes and stale quotes.

Conclusion

This hand of cards is by no means a full house for institutions right now. Much reform and development is needed to help onboard financial institutions. We’ll likely see a lot more ongoing improvements in the space, turning what was originally a retail-dominated pastime into a full-fledged institutional market. That may not be what Bitcoin’s creator had envisaged, but it certainly seems to be the way things are headed.

To learn more about Devexperts’ crypto trading solutions for financial institutions, please get in touch. Our platform solutions support exchange and OTC trading across multiple instrument types.