What Are Working Orders? How and Why They’re Used?

Working orders, also known as pending orders, are a broad class of orders that allow traders to predefine certain conditions that must be met before a trade is executed. They’re known as either working or pending because the order is considered active until either the preconditions are met and it’s executed, or until it’s canceled by the trader.

An example of this would be an instruction to automatically buy a given asset in a certain quantity when the price drops to a lower level. This allows the trader to step away from their trading platform, knowing that the trade will be executed should the market move in their favor while they are away.

The difference between working orders and market orders

This is in contrast to market orders, which are executed at the moment a trader decides to either press “buy” or “sell,” and are filled from the liquidity currently available in the order book.

If the order in question is larger than the liquidity available at the top of the order book, the remaining volume is executed at the next best price. In this way market orders can be subject to slippage, meaning that they can be filled at a slightly worse price than the figure the trader saw on the screen before deciding to either buy or sell.

Pro tip: Learn more about order sweeping algorithms in our e-book explaining the mechanics of forex trading.

An easy way to understand the difference between market orders and working orders is that market orders are used when a trader is concerned with having their trade filled immediately, whereas working orders are used when a trader is concerned with executing at a specific price.

In other words, market orders prioritize the time of the trade, while working orders prioritize the price.

Liquidity makers vs liquidity takers

Another difference between these two types of orders is that when trading over an exchange working orders add liquidity to the venue or market being traded, whereas market orders remove liquidity. This is because to create a new working order a trader must lock up an amount of value to be traded at a later date should the market move in their desired direction.

The order book is essentially a list of these buy and sell instructions, with the best available prices for each being found at the top of the book.

Market orders, on the other hand, do not require any capital to be locked by the venue as they are executed immediately. They essentially “eat” through the available liquidity in the order book whenever a buy or sell market order is executed.

Traders who place working orders are defined as liquidity makers, because they add liquidity to the venue in question, while traders who initiate market orders are known as liquidity takers because their trades effectively remove liquidity from the market. This is also why when trading on certain venues market orders tend to be subject to higher trading fees than working orders.

The types of working orders explained

The easiest way to understand different working order types is to divide them into three groups.

The first group contains instructions to execute trades at a better price than the current market price (this would be a lower price for traders who are buying and a higher price for traders who are selling).

The second group contains instructions to execute trades at a price that’s less favorable than the current market price (we’ll see why below).

The third group contains instructions to close pre-existing trades either at a profit or at a loss.

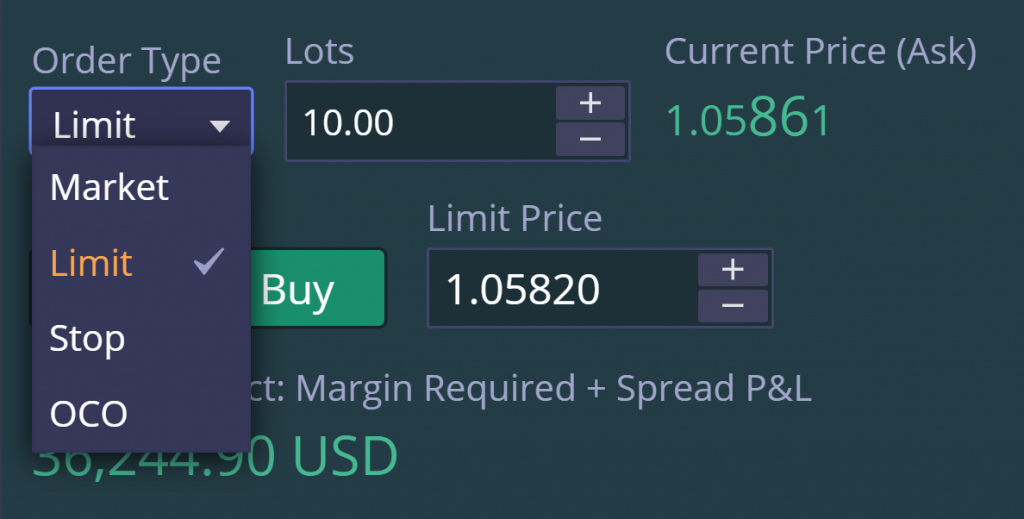

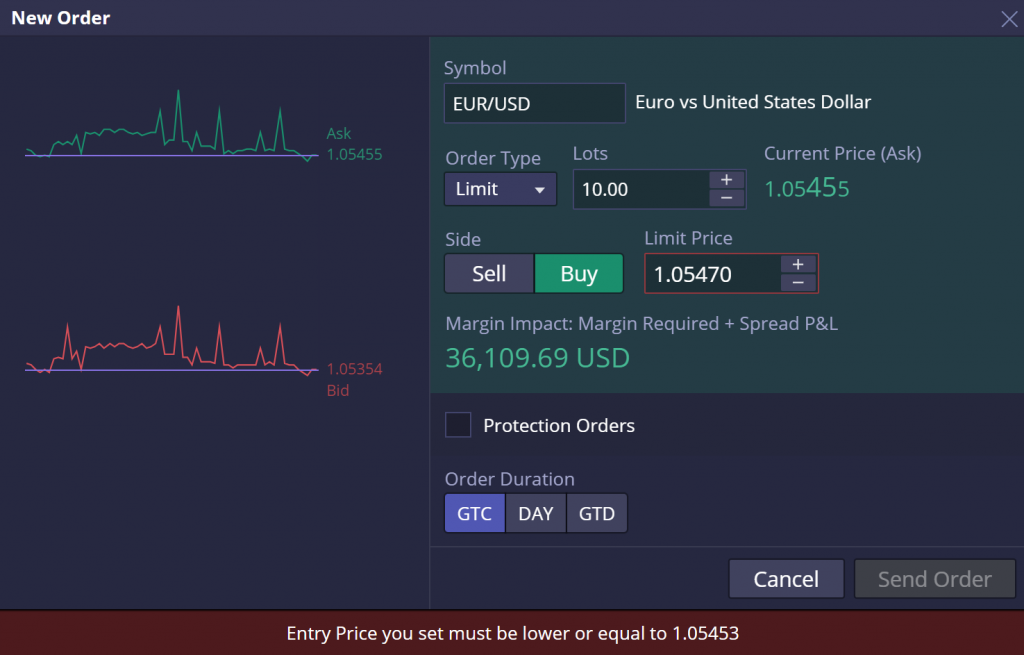

Limit orders

A limit order is an instruction to execute a trade at a more favorable price than the current price available on the market. Limit orders allow traders to have trades executed automatically on their behalf if and when the market they are trading reaches their desired price.

For traders attempting to buy, or go long, buy-limit orders allow them to potentially buy the asset at a better price than is currently available. Buyers want to buy low and sell high, so buy-limit orders are placed below the prevailing market price. For traders attempting to sell, or go short, sell-limit orders allow them to potentially sell the asset at a better price than is currently available. Sellers want to sell high and buy low, so sell-limit orders are placed above the prevailing market price.

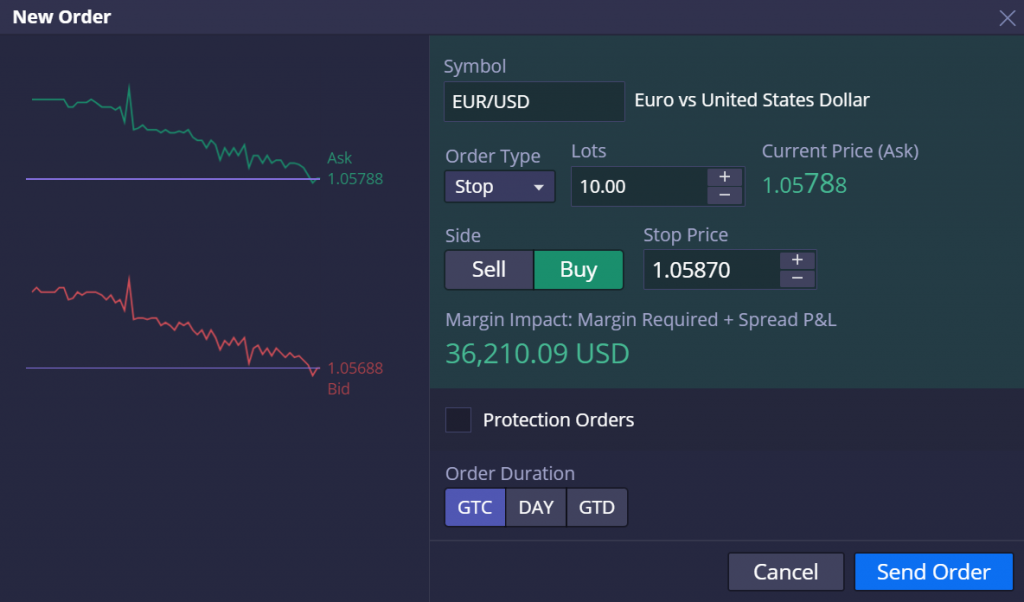

Stop orders

Limit orders are easy enough to understand. Most people can intuitively grasp the concept of buying low and selling high. But as we saw from our second group above, there’s a class of working order that allows traders to automatically execute trades at a price that’s worse than the current available price. Why on earth would anyone ever want to do that?

Stop orders are used by traders to prevent them from missing out when the market moves in the direction they’re expecting before they’ve managed to enter.

For example, a trader who wants to buy an asset they expect to rise, but wants to get in at a cheaper price, may wait, or use a buy-limit order as explained above. But what if the market never comes down to that lower level and moves higher? In this case, the trader will have missed out on the opportunity to enter the market.

A buy-stop order offers some protection against this scenario by allowing the trader to set a level higher than the current market price at which they’re willing to enter the market if they don’t manage to do so at a better price.

Similarly, a sell-stop order allows a trader who expects an asset to drop in value but hasn’t managed to sell at a more favorable (higher) price to define a lower level at which to sell should the market move down as expected.

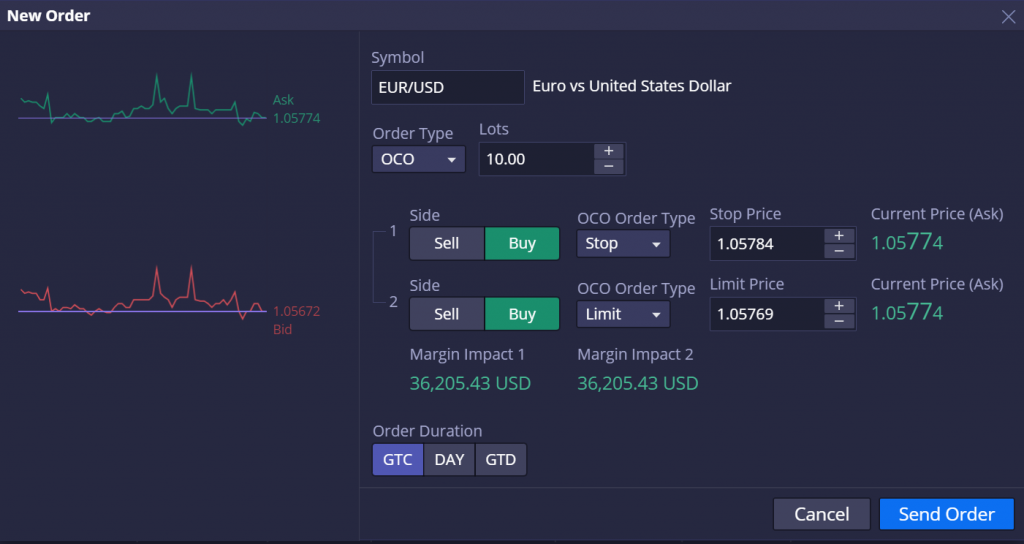

OCO (One-Cancels-the-Other) orders

OCO, or One-Cancels-the-Other, is a special kind of order that allows traders to use combinations of the order types described above. OCO orders are used when traders want to control for more than one market possibility, and thus to more effectively manage the risk of an unwanted outcome, or of missing an entry point. The reason they’re called One-Cancels-the-Other is that as soon as one of the two orders is triggered by the market, the other is automatically canceled.

You can think of an OCO order as covering you both when the market moves in your expected direction and when it moves the other way. For example, OCO orders allow you to combine a limit order with a stop order, the limit order allows you to enter the market at a better price than the current one, and the stop order allows you to still enter the market even if the price never reaches the level you defined in your limit order and moves in the opposite direction.

OCO orders also allow you to cover either side of the current market price when you don’t have a directional bias. So, for example, if the market you’re monitoring is trading in a narrow range and you have no opinion as to whether it will eventually break higher or lower, you can set a buy-stop order above the current price and a sell-stop order below the current price so that you can be covered regardless of the direction of the break.

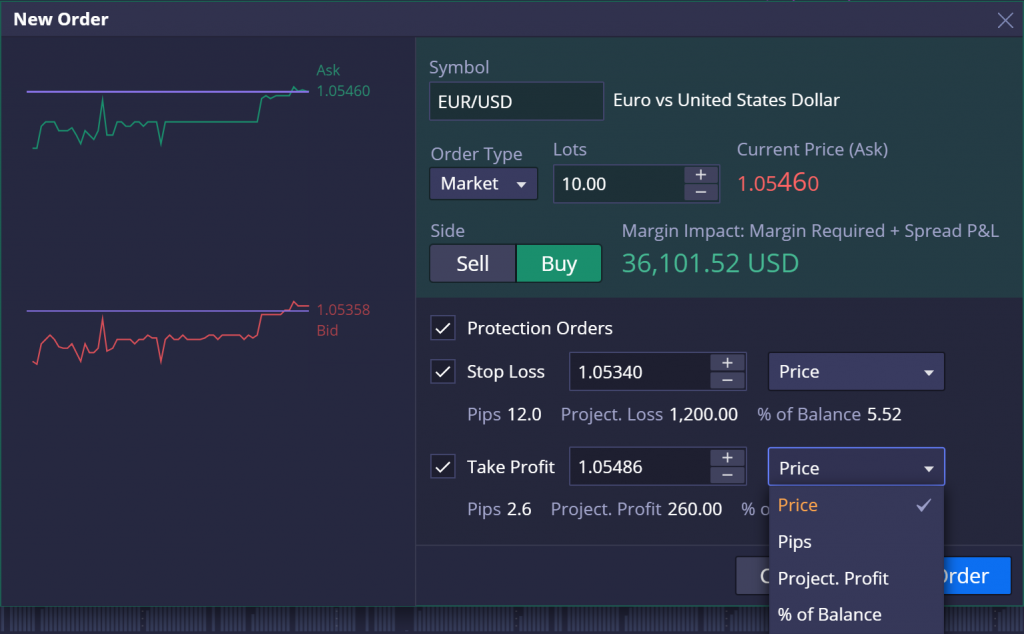

Take-Profit & Stop-Loss orders

Our third and final group of working orders focuses specifically on pre-existing positions in the market. Stop-loss and take-profit orders are simply instructions to automatically close existing trades either at a more favorable price (in the case of take-profit orders) in order to lock in gains, or at a less favorable price (in the case of stop-loss orders) in order to prevent further losses.

In the case of a long (buy) position, a take-profit order is an instruction to close an existing position at a price above the current market price. In the case of a short (sell) position, a take-profit order is an instruction to close an existing position at a price below the current market price.

In both scenarios, the take-profit order allows for a profitable position to automatically be closed while still in profit, protecting against the possibility that the market may move in the opposite direction before the trader is able to manage their trades accordingly.

Stop-loss orders work in much the same way except that their function is to automatically limit losses rather than to lock in profits. So, in the case of a long (buy) trade, a stop-loss is set below the current market price, allowing the trade to automatically be closed and thus limit losses if the market continues moving down. In the case of a short (sell) trade, a stop loss is placed above the current market price, allowing the trade to automatically be closed and thus limit losses if the market continues higher.

Recap

The three types of working orders described above (buy/sell-limit, buy/sell-stop, take-profit/stop-loss) provide traders with much more control over their trading activity while away from the screen. The orders allow them to automatically enter and exit at more favorable prices, avoid missing out on market moves, as well as lock in profits, and limit losses. All that while paying lower fees than when manually entering market orders to either “buy” or “sell” at the moment.