How to Launch a Cryptocurrency Exchange

As of August 2024, the global crypto market value is $2.37 trillion.

The crypto world went through a lot in the past two years. Major crypto exchanges were either eliminated or went through a rude awakening that shattered investors’ trust. Authorities worldwide tighten regulations.

Still, over this year, Bitcoin and Ethereum have bounced back, and we can be sure that the crypto winter we’ve experienced is over. Cryptocurrencies are yet again solid and stable investments for people who are interested in digital assets.

Starting a crypto exchange business might be a good idea now. But before diving into details, let’s go through the basics.

What is a crypto exchange?

A crypto exchange is a marketplace where cryptocurrencies and their derivatives are traded. It serves as a platform that connects buyers and sellers, facilitating the fiat for crypto and crypto for crypto exchange.

Depending on the region of operation, an exchange might need to get licensed with a regulator.

What software do you need to create a crypto exchange?

You need to take care of multiple software components to launch and run a crypto exchange.

Matching engine

An exchange needs an order matching engine to match buy and sell orders from market participants to facilitate the execution of trades. When choosing matching software, it’s worth remembering that cryptocurrency exchanges favor throughput over latency. The main clientele of a crypto exchange is retail customers who don’t practice high-frequency trading, so there’s no point in chasing sub-minimal latency. However, retail clients may rush to enter positions during crypto market turbulence, thus the importance of throughput.

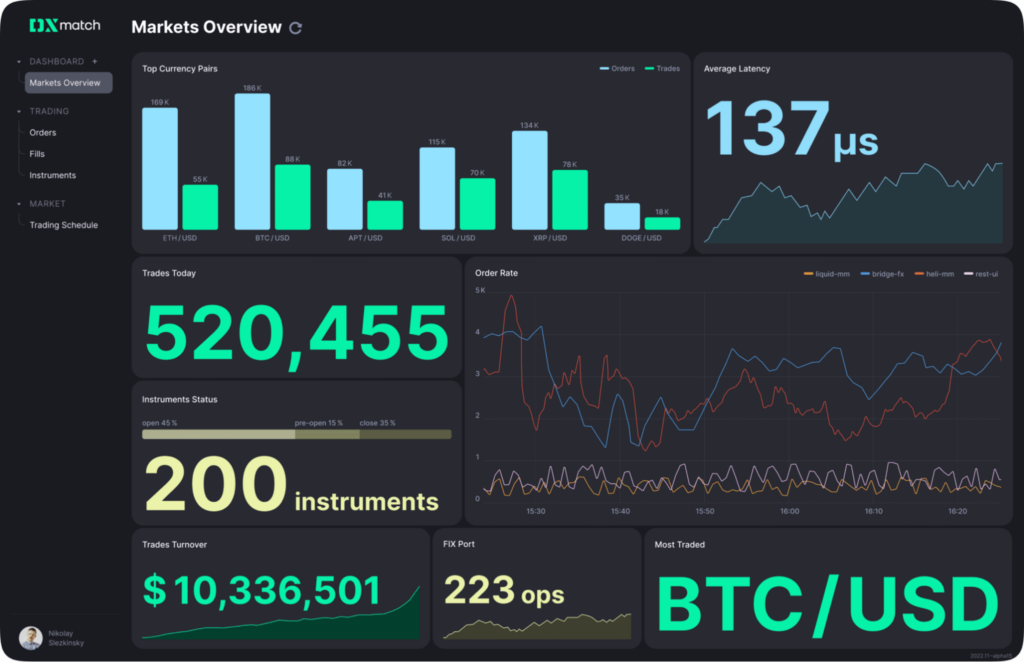

Take for example the Devexperts DXmatch proprietary matching engine. It has been successfully tested by a variety of recognized benchmarks to ensure great throughput, including a 1M order set. DXmatch has also proven very resilient during the maximum load times. All of that combined and with ultra-low latency to boot.

Pro tip: You can learn more about matching engines in general and, in particular, crypto matching needs in this article.

Admin panel

The trading and matching system must have an admin panel that enables operational officers to monitor the system’s performance and make necessary manual adjustments as and when required.

Continuing with our DXmatch example, it has a feature-rich admin panel that allows crypto platform personnel to make configurations, keep tabs on trading operations, and intervene when the need arises. A highlight of the DXmatch admin panel is the Markets Overview dashboard where operators can view the daily count of trades, top crypto pairs, and order rate graph.

Liquidity

There are four primary sources of crypto liquidity: centralized exchanges (CEXs), decentralized exchanges (DEXs), market makers and institutional trading firms, and over-the-counter (OTC) trading desks. As a crypto exchange owner, you’ll be able to accumulate your liquidity over time. Still, it’s worth integrating with other liquidity providers in times of low liquidity or demand for a wide range of assets.

User interface

Aspiring crypto exchange runners must know their target audience well. The fact with crypto traders is that they don’t fancy outdated and complex trading platforms. They need modern and easy-to-use interfaces that are suitable for use right away. This goes both for web and mobile crypto trading UIs.

Cryptocurrency wallets

A crypto wallet is necessary to enable trading on a crypto exchange. Investors use it to deposit and withdraw crypto and fiat currencies.

Legal framework

Crypto trading regulations vary depending on the market you want to target. We have a nifty infographic on regulating crypto exchanges worldwide in this article about order matching.

We strongly recommend adhering to AML and KYC procedures and studying your market’s local regulations. For example, the EU has introduced MiCA regulation in June 2023. There’s also a long-standing MiFID II framework. The US is on the path to regulate cryptocurrencies, too.

So, if you intend to lead a fair business, get ready to dig into legal hurdles.

Protection and security

The amounts of crypto stolen from exchanges and personal user wallets are massive. Ensuring maximum security will help you protect your business and indicate to your clients that you care about their funds.

Every crypto exchange should have multi-factor authentication and secure connections to custodians for crypto withdrawals and deposits.

How to start your own crypto business?

After dealing with all legal matters, each crypto startup needs to pick software to run the business. We went over this numerous times: there are turnkey options and a path of custom cryptocurrency exchange development. Currently, there’s no point in going for custom software for a crypto exchange. By the time it’s ready, you’ll find yourself in another crypto winter and totally out of money.

We’ve written an elaborate article comparing custom and out-of-the-box software so you can decide for yourself. But our advice is to go for a white-label crypto exchange.

What is a white-label crypto exchange?

A white-label crypto exchange is a ready-made solution with short-time-to-market delivery. Good white-label software comes with a whole package you need to launch: a matching engine, an admin panel, integration with liquidity providers, web and mobile apps, several hosting options, and sometimes even maintenance and support.

Some white-label providers of white-label labels can also introduce customizations (e.g., widgets tailored to your specific business flow), but they come at additional costs.

How long does it take to build a crypto exchange?

With a white-label crypto exchange solution, it takes only a week to launch if you’ve already sorted out all the legal hurdles and hired a team. By the way, you can learn how to assemble a team for your exchange by reading this article.

Devexperts offers the entire set of white-label software to launch a crypto exchange in mere days. Our DXmatch matching engine also comes with an admin panel for exchange staff. As a frontend, we offer DXtrade Crypto—a white-label crypto trading platform with a modern and intuitive interface.

DXtrade Crypto comes with turnkey integrations with crypto liquidity providers and crypto wallets, so you don’t have to worry about any technological aspect.

The DXmatch and DXtrade Crypto exchange ecosystem allows trading margin and spot cryptocurrencies and crypto CFDs. The ecosystem will fully support and facilitate your growth if you expand your asset offering with, for example, FX pairs or spread bets.

Our offering is secure, scalable, and has room for customizations. It’s also worth noting that both DXmatch and DXtrade Crypto are equipped with robust risk management, which provides a safety net to protect the exchange from accidents.

Summary: How to start an exchange for cryptocurrency?

To draw a bottom line, starting a cryptocurrency exchange can be a profitable business venture as of the end of 2023. However, it requires thorough preparation and attention to legal compliance.

Before you make any software purchase, define your target market and audience, exchange model, software and liquidity providers, and promotional strategy. Selecting the right liquidity providers and investing in marketing and promotion can quickly bring your marketplace to a solid industry level.

If you’re interested in starting a cryptocurrency exchange with an experienced software vendor that provides tried-and-tested white-label solutions, reach out to us.

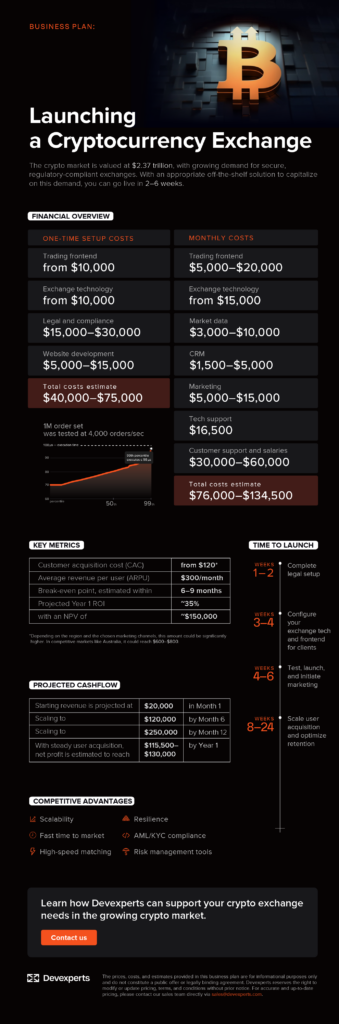

Pro tip: To make it easier for you to plan and launch your crypto exchange business, we’ve created an infographic that highlights some estimations and key metrics.