Deep White-Labeling in Trading Platforms

Many brokers have made the decision to use a white-label trading platform, because it is an attractive one. It eliminates the need for developing and maintaining their own trading solution. This allows them to focus on their core business.

However, while the traditional white-label trading platforms offer cost and efficiency benefits, they may not provide the necessary differentiation from the competitors. That’s where deep white-labeling comes in.

The Limitations of Traditional White-Label Trading Platforms

There is one reason that brokers choose to develop their own trading platforms and solutions instead of using white-label offering. And it is to provide a unique set of beneficial features that help them stand out from the crowd. They want to offer something distinctive to traders that cannot be found in a standard white-label trading platform.

Regular white-label offerings are typically out-of-the-box platforms that come at an affordable price. However, they lack the level of customization needed for differentiation from competitors. When every trading platform looks identical, it becomes standardized. And the only way to gain an advantage is by competing on price. This prompts brokers to search for alternatives that allow them to distinguish themselves in the market while still maintaining affordability.

Balancing Customization and Cost: The Broker’s Dilemma

At this juncture, many are stuck between a rock and a hard place. On one hand, not many are willing to invest in the CAPEX-heavy side of platform development and then commit to the high OPEX involved in keeping it going. On the other hand, there is a pressing need to offer traders a tempting, unique platform that makes them more successful, and therefore encourages them to stay loyal.

Deep White-Labeling: A Comprehensive Solution

Deep white-labeling emerges as a comprehensive solution to the limitations of traditional white-label platforms. It goes beyond merely applying a brand label on top of an existing system that offers the same features to all users. And it delves further into the integration process, embedding itself within the broker’s own platform.

This deeper integration allows brokers to make unique customizations tailored to their company’s specific needs and offerings. As a result, they can distinguish themselves from competitors and create a more appealing and personalized trading experience for their clients.

And to maximize the potential, brokers should seek out trading platforms designed with deep white-label integration in mind. Because these platforms offer flexible and customizable features, allowing them to add or modify elements as needed to meet their clients’ evolving needs and expectations. By adopting a deep white-label solution, brokers can ultimately achieve a balance between cost-effectiveness and differentiation in the competitive trading market.

Must Have Features and Components

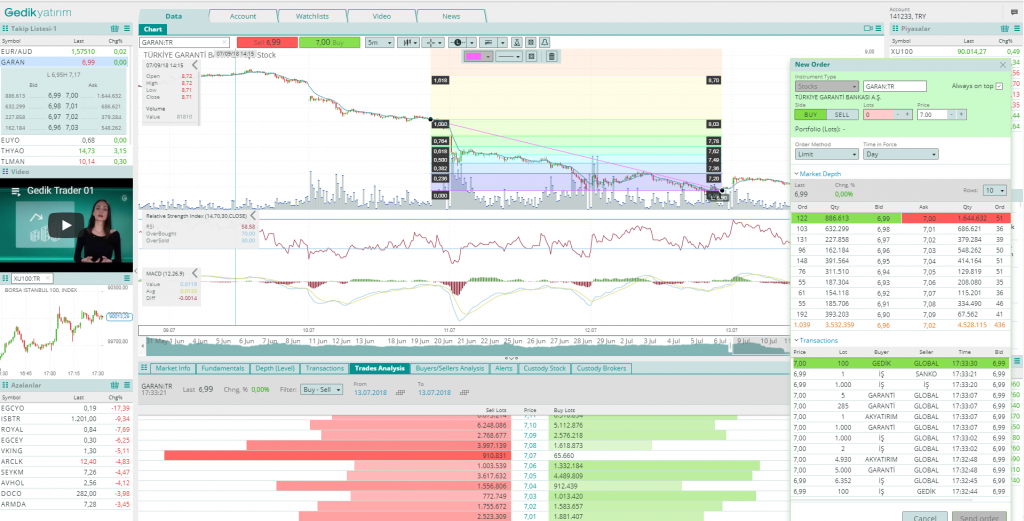

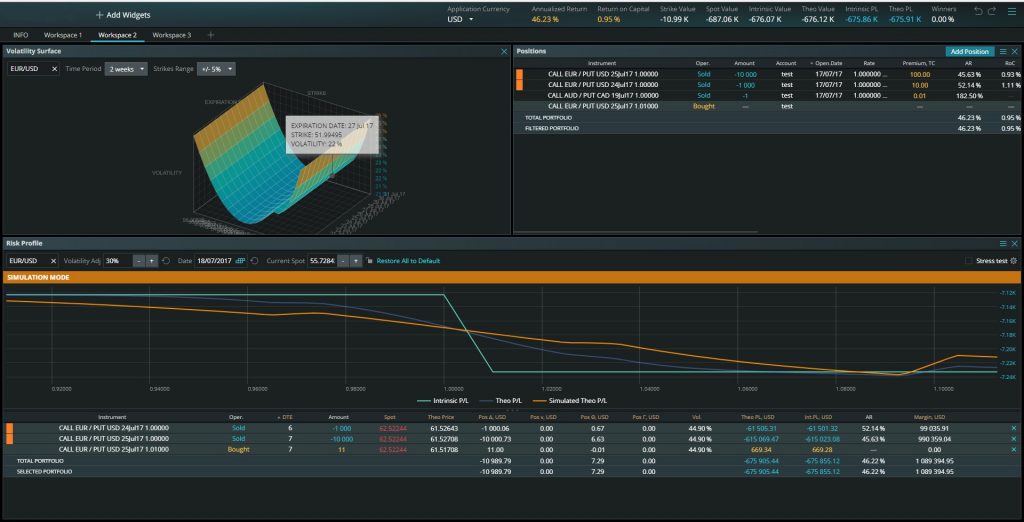

Deep white-labeling platforms must have a unique design from the beginning. While all trading platforms provide essential features, the true value lies in additional components.

These enhancements cover various areas. They include advanced analytics with dynamic watch lists, sophisticated charting tools, and in-depth studies. A streamlined user experience is also essential, offering single sign-on access to both the platform and the client’s cabinet.

Enabling traders to monitor their performance, identify improvement areas, and learn from mistakes is crucial. This empowers them to succeed in trading.

By integrating these innovations, deep white-labeling platforms create an attractive, user-friendly environment. This appeals to traders, simplifies their activities, and fosters long-term loyalty.

DXtrade: A Deep White-Label Trading Solution

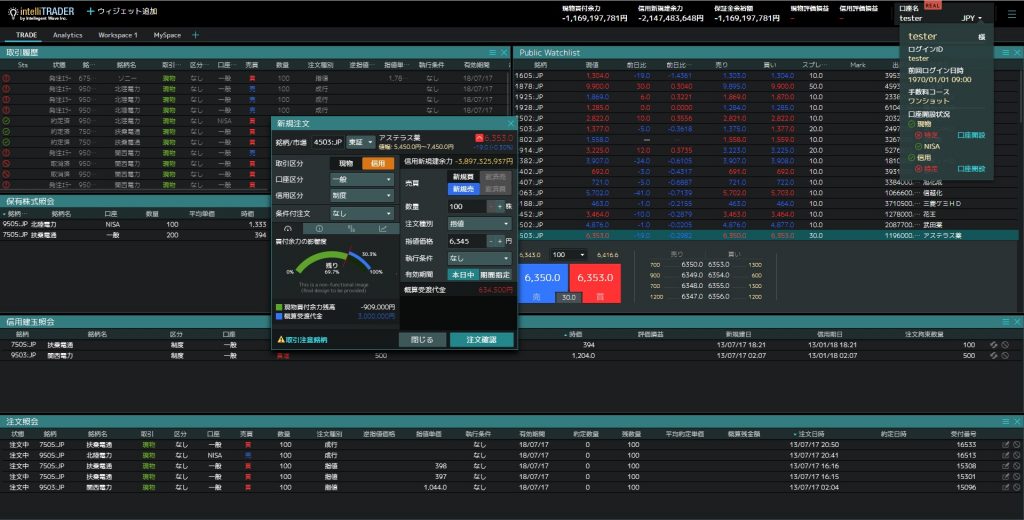

Devexperts’ DXtrade has been created to provide high levels of integration and flexibility with brokers’ systems. This enables them to customize features both on the back end and also on the client side of the platform, for a truly individual product offering.

Additionally, DXtrade, which is provided as a true technological partnership between the client and Devexperts, is flexibly designed to allow multi-asset and multi-market trading, so the same platform using the same interface can at the click of a button provide users with the ability to trade anything they wish, from e-FX to Stocks, Futures and Options.

Cost-Effective Differentiation

As a result of our hard work and innovation, brokers no longer have to contemplate spending vast amounts of money on developing and maintaining their own systems. It is now easy to stand out from the crowd while controlling costs.

Now we have discussed the basic concept behind deep white-labeling of a trading platform, here are some practical examples: