How to Start a Forex Brokerage Firm

Key takeaways

- You can launch as an introducing broker (IB), go white-label, or build your own brokerage stack—the trade-off is speed vs. control vs. risk.

- In 2026, the hardest parts are usually licensing scope, compliance operations, payments, and execution/risk controls, not the trading UI.

- A realistic plan includes a timeline, a year-1 cost structure, a minimum tech stack, and the team roles regulators and operations will require.

Starting a forex brokerage can be profitable, but only if you treat it as a regulated financial operation, not a marketing project with a trading app attached. The early work is due diligence: pick a target market, map the licensing path, define how you will process trades (A-book, B-book, or hybrid), and make sure you can run compliance, payments, and risk controls day to day.

In this guide, we break down the three common launch paths, the typical timeline, and what your first-year build actually includes: business setup and staffing, major cost buckets, and the minimum software stack for trading, onboarding, risk management, and operations.

If your main question is how brokers earn revenue and manage exposure, see our e-book The ABCs of Price Risk Hedging – How FX Brokers Manage Their Price Risk.

Let’s dive into the topic.

When launching an FX business, you typically choose one of three approaches:

- Become an introducing broker (IB)

- Opt for a white-label solution

- Build a forex brokerage from scratch

Become an introducing broker (IB)

If you want to enter the market without building infrastructure or taking on full regulatory overhead on day one, you can start as an introducing broker (IB). In this model, you focus on marketing, sales, and client relationships, while a licensed primary broker provides the trading platform, liquidity/execution setup, and most operational tooling. You earn revenue through a pre-agreed commission or revenue share tied to the activity of the clients you introduce.

An IB setup can shorten time-to-market, but it also limits control. Your pricing, product scope, onboarding flow, and even how client issues are handled will depend on the primary broker’s policies and risk appetite. It’s a practical route if your advantage is distribution and client acquisition, not technology or dealing operations.

Pros

- Fast launch: you can start without building a full brokerage stack or standing up an operations team from scratch

- Lower technical load: the primary broker provides the platform, hosting, liquidity/execution, and core integrations

- Focus on growth: your main job is client acquisition and retention

Cons

- High dependency: your business relies on the primary broker’s commercial terms, platform roadmap, and operational decisions

- Limited control: you typically can’t fine-tune execution, risk settings, onboarding, or product coverage to the same extent as a licensed broker

- Economics can be volatile: revenue share structures vary, and your net income can swing based on client mix, trading behavior, and the broker’s payout rules

Opt for a white-label solution

If you want to launch quickly under your own brand, a white-label trading platform is a common middle ground between being an IB and building a brokerage from scratch. A white-label provider typically supplies the trading platform and hosting, and may also offer a packaged set of integrations such as liquidity/execution connectivity, market data, payments, and client onboarding tools.

This model can reduce upfront build work and shorten the timeline, but it does not remove the operational reality of running a brokerage. You still need to handle (or outsource) compliance, client support, payment operations, and day-to-day risk monitoring.

Commercially, white-label pricing is often a mix of monthly platform fees plus usage-based costs (accounts, volumes, symbols, add-on modules, support tiers), so the “cheap to start” plan can become expensive as you scale.

Pros

- Faster time-to-market: you launch on a proven platform without building core components from scratch

- Lower upfront cost: you pay a predictable platform fee instead of funding a full build and infrastructure program

- Vendor-managed operations: hosting, upgrades, and baseline maintenance are usually handled by the provider

Cons

- Rising costs at scale: fees often increase with active users, volumes, integrations, or support requirements

- Limited control: customization, execution/risk tooling, and infrastructure choices are constrained by the provider’s standard package and roadmap

- Vendor lock-in risk: migrating away later can be painful if key workflows, integrations, or data models are provider-specific

Build your own forex brokerage firm from scratch

If you want maximum control over pricing, execution, risk settings, product scope, and client experience, you can build your brokerage from scratch. This path takes more time and upfront investment because you’re building (or assembling) an operating model: licensing, compliance processes, banking and payments, execution setup, risk controls, reporting, and a support function that runs every day.

“From scratch” does not always mean writing every component yourself. In 2026, most brokers still start with proven building blocks (trading platform, liquidity connectivity, KYC/AML tooling, payments, reporting) and customize what sets them apart. The key difference from white-label is control: you decide how the stack is structured, how risk is managed, and how the business scales.

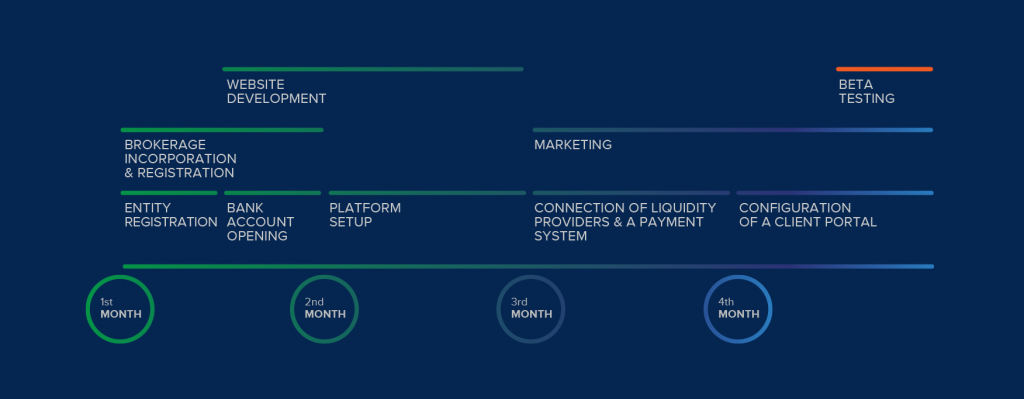

Below is an approximate timeline from project start to an official launch.

Pros

- Full operational control: you define execution and risk logic, pricing, onboarding, and the product roadmap

- Scales on your terms: infrastructure and integrations can be designed for growth and multi-asset expansion

- Clear differentiation: you can build a client experience that isn’t limited to a standard package

Cons

- Longer timeline and higher upfront cost: licensing, integration work, and operational setup take real time and budget

- Higher responsibility: failures in compliance, payments, execution, or risk controls directly impact business continuity

Requires experienced operators: you need strong ownership across compliance, dealing/risk, support, and technology from day one

Develop your business model

Before you incorporate your company, define the business model you can actually operate. Your target market, product scope, and execution setup will determine licensing, capital requirements, onboarding flows, payments, staffing, and the technology stack you’ll need from day one.

Define your target market

Decide where you will acquire clients and which rules you will be held to. Your target market affects:

- What license (or regulatory status) you need

- What you can advertise (hence, your forex marketing strategy) and how you can onboard clients

- What leverage, risk disclosures, and client protections may be mandatory

- Which payment providers and banks will work with you

Decide what asset classes you will offer

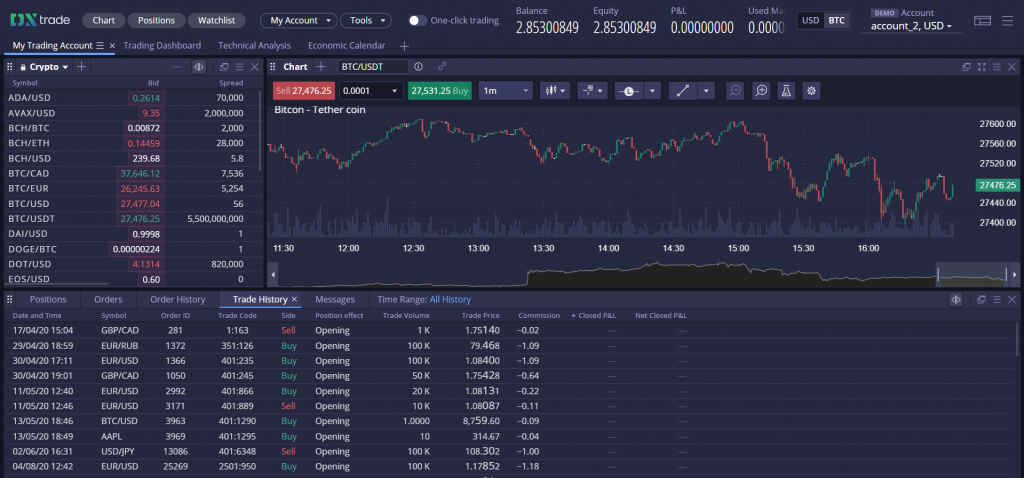

Multi-asset can increase retention and volumes, but it also expands your regulatory and operational scope. If you plan to add CFDs, crypto, or spread betting, validate early that your licensing path, banking setup, and compliance tooling support it.

If you offer crypto in the EU, factor in MiCA planning. MiCA’s CASP regime applies from 30 December 2024, with a transitional window for some existing providers that can run until July 1, 2026 (depending on the member state and authorisation status).

Example:

Choose your trade processing model

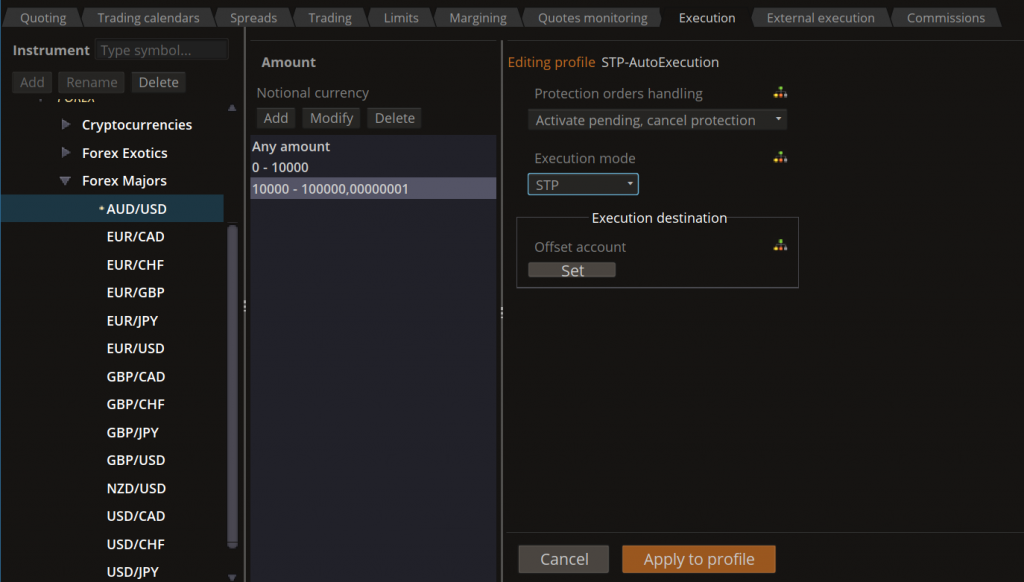

Your forex execution model drives both revenue mechanics and risk exposure. Most broker setups fall into one of three approaches:

- A-book (STP/agency): orders are passed through to the forex liquidity providers. Revenue is typically spread/commission; market risk is limited, but margins per trade are often lower.

- B-book (market maker): you internalize some flow. This can increase revenue, but it requires mature risk controls and disciplined dealing processes.

- Hybrid: a mix of A- and B-book by instrument, client segment, or other routing logic.

If you plan to internalize flow (B-book or hybrid), treat the dealing desk and risk layer as core infrastructure. At a minimum, you need real-time exposure monitoring, margin and liquidation logic, client/group risk limits, audit trails, and clear rules for execution and price adjustments.

Choose a jurisdiction for your company

Choosing a jurisdiction is not a “cheap vs expensive” decision. Start with where you will market, what you will offer (FX only vs CFDs/crypto), and whether you will hold client money. Then, validate these four points before you spend on incorporation:

- License scope and capital rules: minimum capital and ongoing prudential requirements depend on the services you provide and whether you internalize risk.

- Local substance: many regulators expect resident directors, local key roles (compliance/MLRO), an office, and evidence that the business is managed from the jurisdiction.

- Banking and payments reality: account opening, PSP appetite, chargeback exposure, and settlement flows can make or break a brokerage, regardless of the license.

- Continuity risk: sanctions exposure, legal/regulatory volatility, and whether critical providers (banks, PSPs, liquidity, hosting) can keep supporting your setup.

Common jurisdiction routes (and what they usually imply)

Established onshore regimes (higher trust, higher bar)

Examples include the UK, EU jurisdictions (often via Cyprus for FX/CFD brokers), Switzerland, and Hong Kong. These markets tend to provide greater credibility with clients and counterparties, but they also entail more demanding expectations regarding capital, governance, reporting, and local staffing.

- In the EU investment-firm framework, initial capital can vary by permitted activities (for example, the €75,000, €150,000, and €750,000 tiers are typical under the IFD/IFR approach).

- In Switzerland, securities-firm licensing includes minimum capital expectations and a structured authorization process.

- In Hong Kong, licensing and financial resources requirements are explicit and tied to the regulated activity (including leveraged FX).

Offshore financial centers (faster setup, harder day-to-day operations)

Jurisdictions such as the Cayman Islands, BVI, and the Bahamas are widely used in financial services and may offer faster incorporation and lighter tax treatment. However, access to banking, payments, and marketing can be more difficult, and many serious counterparties expect stronger substance, governance, and documentation than founders anticipate. Offshore often means you need to prove controls more clearly to banks, PSPs, and liquidity providers.

“Fast-track” licensing destinations (often lower entry cost, rising substance requirements)

Some founders look at “fast-track” jurisdictions like Vanuatu because incorporation and licensing can appear quicker and cheaper than in major onshore markets. However, these regimes have been raising expectations lately: real local presence, clearer governance, stronger compliance documentation, and more evidence that the business is managed responsibly.

Be skeptical of any offer that quotes a single “all-in” number for getting licensed. The real budget is usually a mix of regulator fees, required capital, local substance costs (office, local directors/roles), compliance setup (policies, AML tooling, screening, reporting), and ongoing renewals and audits. Use official regulator guidance and up-to-date fee schedules as your baseline, then budget for the operational work that follows.

Choose a trading platform, software, and technology

A decision about a trading platform is a business decision. A “cheap” platform can become expensive once you add support tiers, upgrades, new modules, integrations, and vendor-managed infrastructure. It can also create vendor lock-in if core workflows, data models, or integrations are specific to one provider.

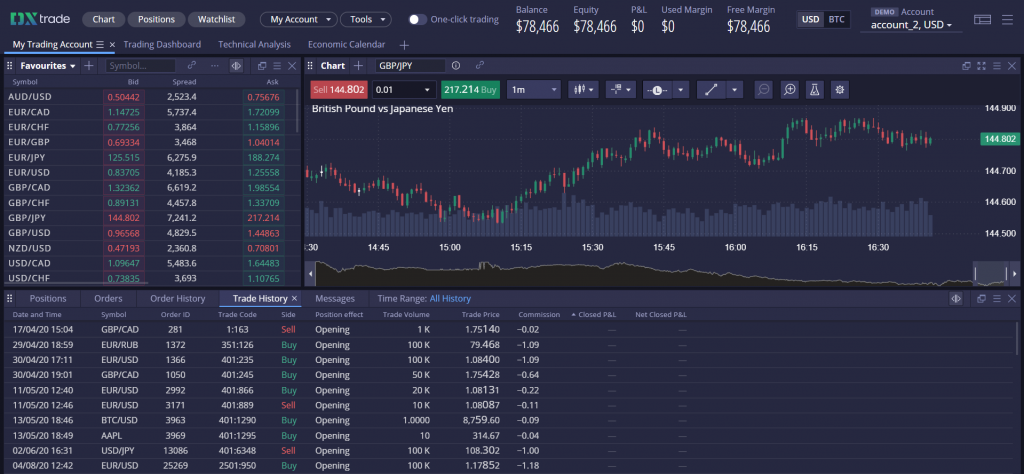

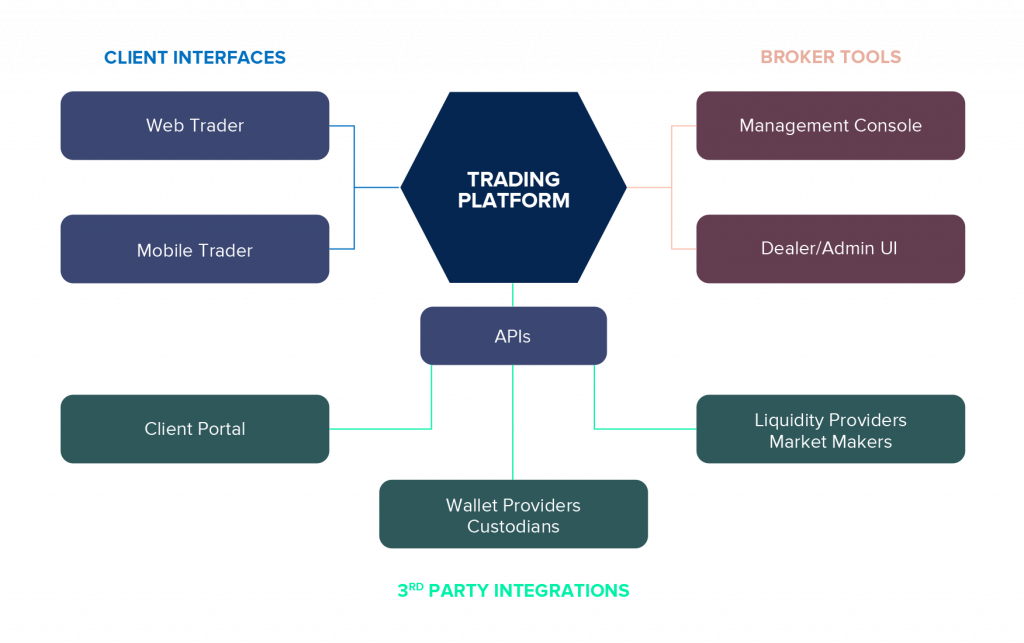

Modern platforms can reduce the number of add-ons you need at launch, but most brokers still integrate a few core components: liquidity/execution connectivity, market data, payments, KYC/AML tooling, and reporting. The goal is a stack you can operate without fragile glue code.

Some platforms also include optional modules that can reduce operational load, such as client communications tools, education, and copy trading.

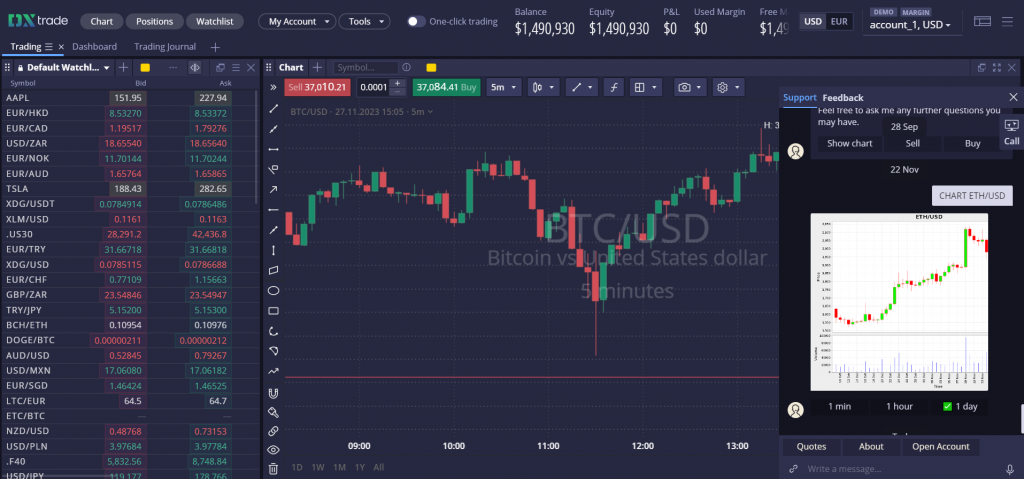

Example:

DXtrade can be integrated with Devexa, Devexperts’ virtual trading assistant and chatbot. In this setup, brokers can provide in-platform client support and engagement features such as news and updates, trading signals, and live operator interactions. Devexa supports audio and video calls and screen sharing, which can be useful for support and onboarding.

Minimum technology you’ll need at launch

At a minimum, plan for:

- Trading platform (web + mobile access)

- Market data and/or liquidity (depending on whether you run STP, market making, or a hybrid model)

- CRM for client lifecycle management

- Client portal (member’s area) for onboarding, funding/withdrawals, KYC, and account management

- Compliance tooling (KYC/AML screening and monitoring, audit trails, reporting workflows)

Mobile matters operationally, not just for UX. If your platform offers both web and mobile interfaces, confirm what is synchronized across them (for example, DXtrade materials explicitly mention watchlist synchronization and “interfaces synced in real time” in some product contexts).

Example:

Fit to execution model and risk controls

Choose a platform that supports your order processing model. If you plan to run B-book or hybrid, you need risk controls that work in production: real-time exposure monitoring, margin and liquidation logic, permissions, and audit trails. Your platform provider should be able to support both A-book and B-book workflows where relevant.

Plan for scaling and future control

If your business model assumes growth into new instruments or a more customized operating model, validate how the platform scales and what ownership options exist. Devexperts states that the DXtrade source code can be purchased in some scenarios, which could support bringing development in-house later.

In 2026, “stand out” is less about slogans and more about what clients feel in the first week: onboarding speed, funding reliability, execution quality, and how you handle risk and support when something goes wrong. Pick a small set of differentiators you can deliver consistently and document them in your client-facing disclosures.

Here are practical levers that matter to traders and partners:

- Transparent costs and conditions: spreads/commissions, swaps, margin rules, and execution policy explained in plain language.

- Execution and stability: fast, predictable order handling, clear slippage rules, and uptime you can demonstrate.

- Onboarding and funding: KYC that doesn’t stall, deposits/withdrawals that work, and clear status updates.

- Product scope that fits your market: FX-only vs FX+CFDs vs crypto, with a roadmap you can support operationally.

- Risk controls that match your model: exposure monitoring, margin and liquidation logic, and audit trails—especially if you run B-book or hybrid.

If you want to incentivize higher volumes, do it with tools you can control and report on. Many broker platforms support rebates and commission plans that can be applied by account/group and configured by volume and schedule (for example, weekly or monthly rebates).

If you need practical guidance on broker operations and automation, Devexperts publishes e-books and guides for brokers on workflows such as operations automation and risk controls.

Hire a team

Your hiring plan should address two constraints simultaneously: what your regulator expects (local substance, named responsible persons) and what the business needs to run day to day. Even with a turnkey platform, you still need owners for compliance, payments, support, and risk.

A minimal functional structure often includes:

- Compliance / AML: KYC processes, AML screening and monitoring, reporting, recordkeeping (often including an MLRO role, depending on jurisdiction)

- Finance and operations: reconciliation, client money workflows (if applicable), PSP coordination, chargeback handling

- Customer support: ticket handling, onboarding support, complaints workflow

- Sales/retention: acquisition channels, partner management, CRM discipline

- IT/infrastructure: vendor coordination, incident handling, access control, change management

- Dealing / risk (if B-book or hybrid): exposure monitoring, risk limits, routing rules, post-trade reviews

Plan training as part of operations, not a one-time onboarding task. You want consistent handling of KYC edge cases, funding issues, execution questions, and risk events—and you want it documented.

Bottomline

To make planning easier, use a simple launch roadmap: jurisdiction and licensing scope, stack selection, onboarding and payments, risk controls, and the minimum team roles you need to operate. You can also use industry guides and broker-focused e-books to align stakeholders on how brokerage operations actually work.

Pro tip: To make it easier for you to plan and launch your forex brokerage business, we’ve created an infographic that highlights all the stages you need to go through.

If you’re a budding FX broker, you can trust us to handle the software part. After all, we’ve been delivering trading platforms to brokers since 2002! So you can be sure we’ll address all your business’s technology needs. Contact us.