How to Start a Forex Brokerage Firm

Opening a forex brokerage firm could turn out to be a very profitable business. But as with any business, it is very important that you do your own research at the beginning. In this article, we’ll outline the basics of starting your forex business.

First, we’ll talk about the business models and the timeline. Then, we’ll review the business structure and staffing, estimate expenses, and go over the required software and technologies.

If you’re here because you’re curious about how forex brokers make money and how they manage the price risk, you can learn their inner workings in our e-book The ABCs of Price Risk Hedging – How FX Brokers Manage Their Price Risk.

Let’s dive into the topic.

When launching a FX business, you can go in one of three directions:

Become an introducing broker

If you’d like to avoid the tedious registration process and other starting hurdles, you can become an introducing broker (IB).

Many FX brokers offer the ability to create a dealing center using franchise licenses. That is how you become a broker without any technological and legal hassle. You will attract customers, and make a profit from their trades.

Your “big brother” will provide you with the entire infrastructure and a trading platform. They’ll also monitor and execute all your clients’ trades, take the better half of your profit, and claim all your traders in case of any issues. So, as an introducing broker, you’re not exposed to many risks, but you’ll receive a more slender income.

PROS

- You’ll use all technological aspects from a primary broker – the infrastructure, trading platform, and integrations with payment providers

- You’ll become a marketing pro – bringing in traders will be your only concern

CONS

- You’ll be fully dependent on your primary broker

- You’ll take 100% of the risk: if a successful trader joins via your affiliate link, the trader’s earnings will be fully attributed to your account, drastically reducing your profit

- You’ll have to accept whatever software your primary broker operates, and so will your traders – beggars can’t be choosers

Opt for a white-label solution

If you want to open a forex company fast and operate under your brand, you can opt for a white-label solution.

Many established companies can provide aspiring FX brokers with a trading platform and servers. They’ll also give you every technological aspect required to start.

In case you choose the white-label model, you can start your forex brokerage under your brand and with lower costs. You’ll only have to pay a monthly fee for the trading platform and a tolerable server setup fee.

PROs

- You don’t start from the ground up, so it takes less time and money

- You won’t worry about technical aspects – your white-label provider takes care of everything

CONs

- Your white-label service becomes more expensive when your client base grows

- You don’t have possibilities for fine-tuning your server and platform. You get a standard technology offering like any other broker

Build your own forex brokerage firm from scratch

If you want to be in control of your future and growth, build your own forex brokerage. Make the effort, invest more at the start, and have your very own traders. Let’s go over the details.

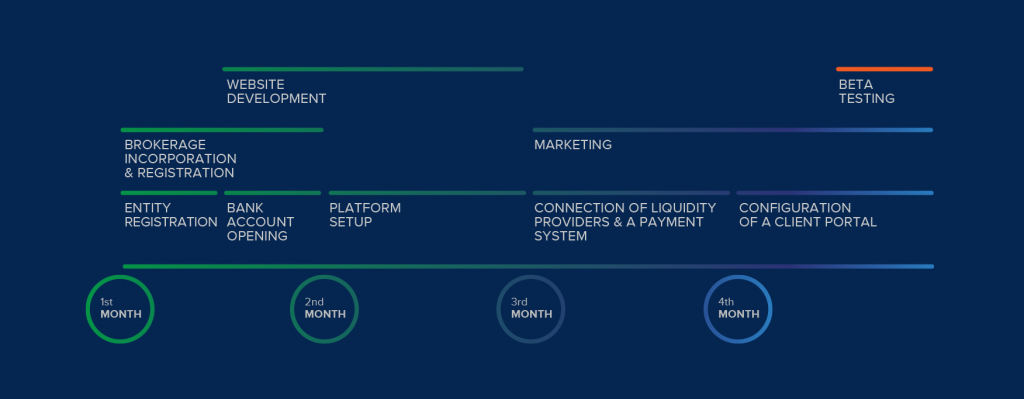

Here’s an approximate timeline from the start to an official launch.

PROS

- You need to dive deep into all FX business aspects

- You are in full control of all operations

CONS

- You start an FX brokerage from the ground up, so it takes more time and money

- Your mistakes will have a toll on business operations, and there’s nobody to fall back on.

Develop your business model

Before green-lighting incorporation, you need to develop your business model. Here are some of the most important things you need to do:

Define your target market

What is your target market? Is it South America, Europe, Africa, or Asia? Initial cash burn, marketing strategies, software requirements, registration and incorporation processes – everything depends on your choice of a target market.

Decide what asset classes you will offer

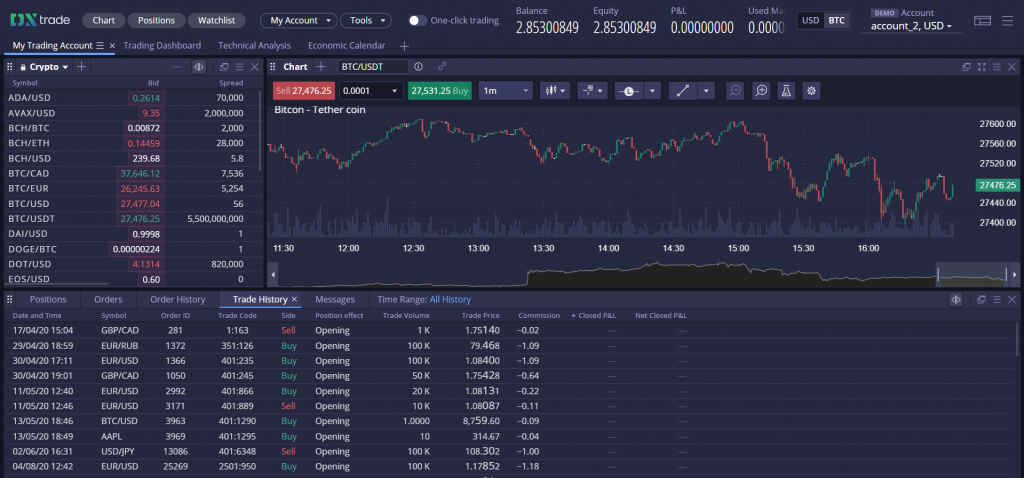

The more asset classes you provide, the more attractive your offering will look – it’s a no-brainer. Making your brokerage multi-asset by throwing in CFDs, cryptocurrencies, and spread bets into your roster will increase overall trading volume and your profit.

When choosing a trading platform, make sure you can seamlessly add more asset classes on the go. This mostly depends on your trading platform provider. When choosing one, let them know you intend to expand your offering in the future.

Don’t forget to decide if you will provide your traders with leverage, and if yes, how high this leverage will be.

Example:

Choose your trade processing model

- A-Book

- B-Book

- Hybrid

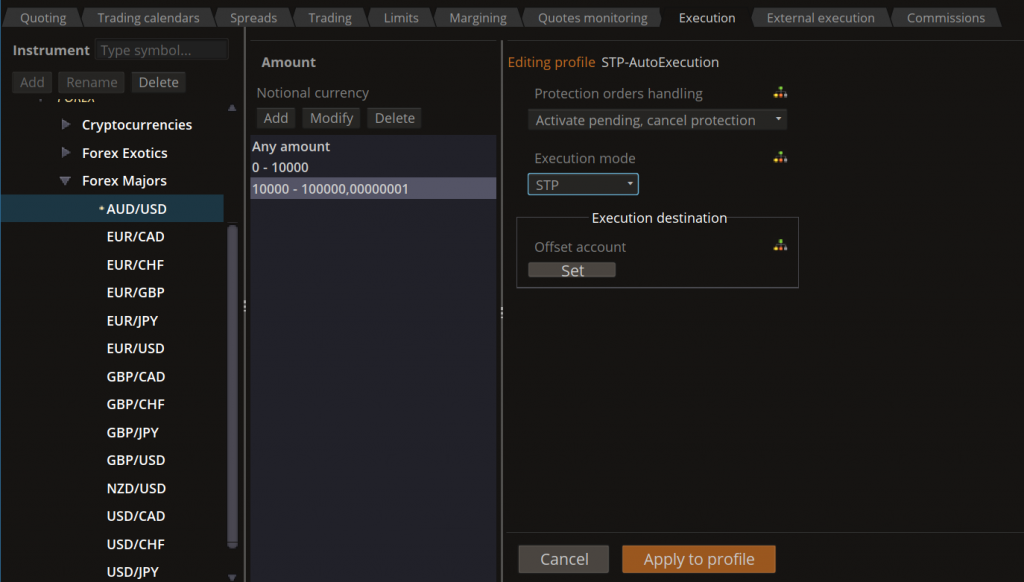

The way you process trades plays a crucial role in the amount of profit you’ll make. Brokers employing only STP (A-book) don’t risk much, but they also don’t earn much. Simply sending trades to liquidity providers will gain you a commission and spread – that’s all.

If you introduce a hybrid model and start working some orders within your dealing desk, you may be able to secure more profit, because you don’t pay anything to a liquidity provider. You can make your customers trade against each other if they have matching orders.

This model will require well-trained dealing staff and good software, such as a dealing desk and risk management software for running a B-book model. This also needs more investment. The good news is you can switch to this model after you launch the business and start feeling more comfortable.

Read more about the processing models here.

Incorporate your company

You need to be extra cautious when choosing a country to incorporate your forex company in. Some obvious reasons for this include capital requirements, the size of the guarantee fund, taxes, reporting, government fees, your professional qualification, background checks on you and your partners, minimum required personnel, and so on.

You should also take into account less trivial aspects. A country may seem very appealing, but it may pose a serious threat to your business continuity due to political reasons. We don’t want you to lose your business over politicians’ power plays.

Fun fact: Several years ago, Belarus started gaining traction as a viable country for incorporation. Its terms looked very favorable, and the capital requirements were significantly lower than anywhere else. FATF and EAG even assessed the country’s AML/CFT measures and deemed them satisfactory. Then, the chaos with the government began, followed by the country’s complete isolation due to the war in Ukraine. But these issues were foreseeable – the country’s president has been in office since 1994, and was well overdue for change. So, this country isn’t the best environment for business continuity.

So what are the safe options for incorporation (for now)?

Established forex centers

These are countries like the UK, Switzerland, and Cyprus. These centers are very prestigious. But in the case of the UK and Switzerland, they’re very hard to approach. In fact, these countries have regulatory hurdles, requirements to have a banking license and unrealistically high capital expectations. Cyprus is easier to approach, and we’ll talk about it further.

Offshore financial centers

The Cayman Islands, the British Virgin Islands, and the Bahamas could be great choices because they’re experienced in financial services. Offshore financial centers offer low-cost entry and some tax benefits. It doesn’t mean officials don’t have high expectations for other aspects, but nobody said launching a brokerage would be a breeze.

Asia and the Pacific

The most popular options in the region are Hong Kong and Vanuatu. However, they’re in the process of tightening their regulations.

Register and regulate your forex business

Registering as a financial body with a regulator of choice depends on where you’d like to market your forex company. Registering your entity makes it legitimate and more trustworthy.

One of the most common regulations is CySEC (Cyprus Securities and Exchange Commission). If your target audience is the EU, it could be a great choice. Cyprus boasts the biggest number of forex brokers, so it has an established environment for launching a brokerage firm.

If your target traders reside in Asia, you have options for any budget. For example, launching a regulated brokerage in Hong Kong costs a minimum of $650,000. It does take some time but sets you up for success in the region. But don’t count mainland China in – they don’t allow margin trading there.

If you don’t have that much money, get licensed in Vanuatu (VFSC). It’s affordable and fast, but you must establish a physical presence in the country with an office and appoint a local manager and director.

Sidenote: Once you’re settled, you can diversify your regulatory portfolio by obtaining additional licenses. A good combination of licenses allows brokers to benefit from better trade leverage levels, marketing opportunities, and a wider range of trading instruments offered to customers. Your trading audience will also be way broader.

Another affordable option is the Seychelles forex license (FSA) with a $1,500 application fee and a $3,000 annual fee. You can also opt for the Mauritius forex license (FSC) with a $3,000 registration fee and a $9,000 annual fee, but the required minimum capital for this license is approximately $250,000.

Choose a trading platform, software, and technology

The best choice you can make as a forex broker is to get a turnkey trading platform from an established platform provider. The market has plenty of these, and their pricing varies. Also, keep in mind that a seemingly cheap trading platform can turn into a very expensive tool. You have to account for tailgating costs on maintenance, support, upgrades, additional features, etc. Such a seemingly affordable trading platform also might put you into vendor lock-in.

But nowadays, you won’t need extra plugins if you start with a modern and flexible trading platform. So don’t worry about add-ons such as bridges – save your money.

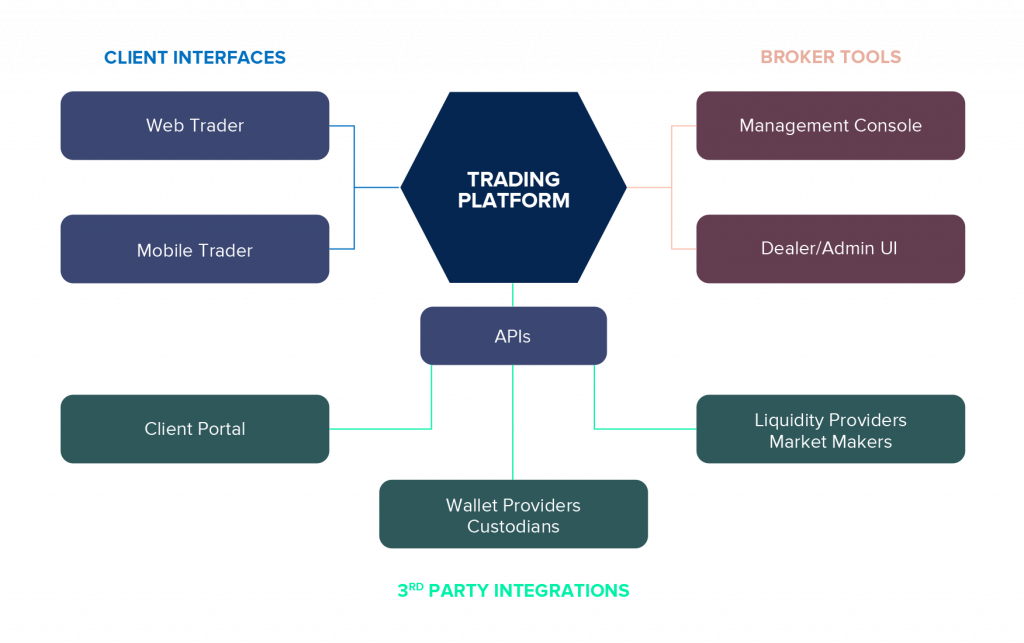

It’s also worth checking out whether a trading platform is already integrated or allows quick and easy integration with various third-party service providers – liquidity hubs, market data providers, payment services, financial news feeds, etc.

Some trading platforms also have nice perks like chatbots that take the burden off support teams, educational modules, and copy trading functionality.

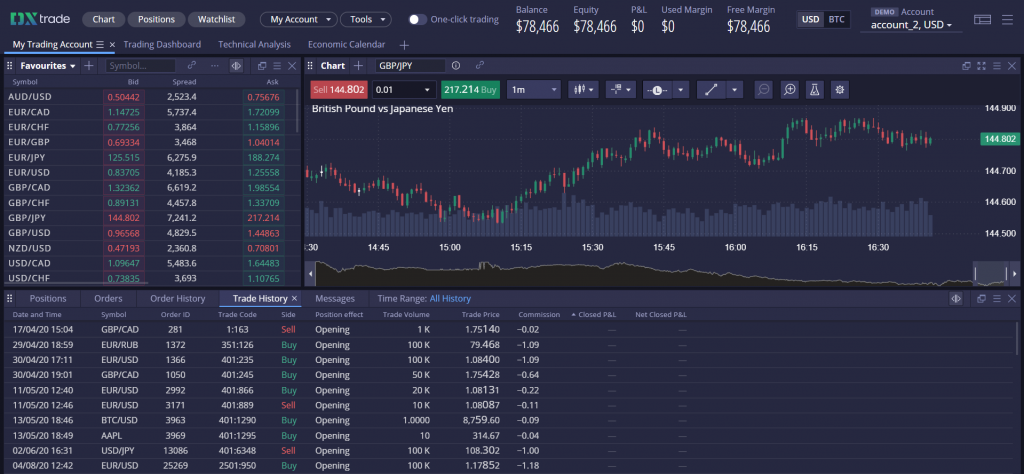

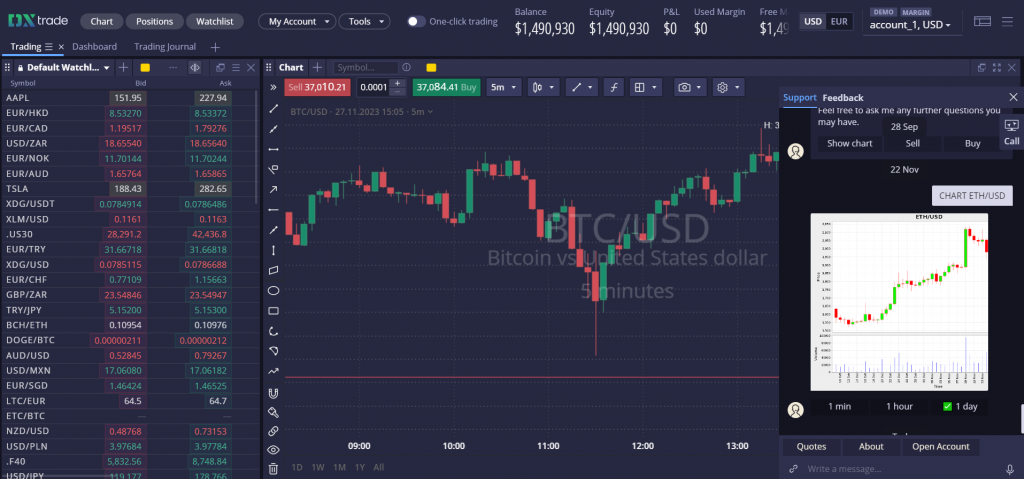

Example:

Like our own DXtrade CFD: it has been recently integrated with Devexa, a virtual assistant and a chatbot that provides support, news updates, and trading signals. As a broker using DXtrade CFD, you can now offer your traders round-the-clock AI-powered assistance switching to full-scale support, complete with audio, video, and screen sharing. An extra benefit: you can fine-tune your Devexa widget to match your own DXtrade CFD look.

It’s preferable to get involved with a trading platform provider that offers (almost) everything you need to launch your business. The minimum set of technology includes:

- A trading platform (the core of any forex brokerage project)

- A market data and/or liquidity provider (depending on your FX business model)

- A CRM system (to store and manage your client base)

- A dedicated account profile space to onboard and retain your clients (aka client portal/member’s area, etc.) with an integrated payment provider and built-in KYC module

Make sure your platform provider equips you with a modern mobile trading app in addition to a standard web trading platform (some platform providers do this for an extra cost). That’s because most traders now use on-the-go trading, and many trade exclusively through mobile apps.

Example:

If you choose an established trading platform like DXtrade CFD, you also get a mobile app that syncs on-the-fly with the web trading UI. It gives your clients the ability to trade in one swipe anywhere they are (provided they have internet access). App branding with your corporate logo and color scheme is a nice perk to have.

In terms of features, choose a trading platform that supports your preferred mode of processing orders. If you choose a hybrid model, your platform provider should have tools for both A- and B-book. Risk management software is also vital for FX brokers running their trading book and with an in-house dealing desk.

Additionally, it’s important to choose a platform provider capable of scaling according to your business growth. When you get comfortable with your starting package, you can start expanding your offering with new trading instruments. This will help you attract more traders.

Some FX/CFD trading platforms can accommodate this ambition, like our own trading platform DXtrade. When you grow into an established broker, you can opt for a custom trading platform, buy out its source code, and make it your in-house solution for full control over your business processes. And by the way, this is what makes your DXtrade trading platform unique – it always provides FX brokers with a variety of options for scaling and evolving their FX brokerage business.

Make your forex brokerage stand out

You won’t get anywhere without a solid selling point. You need to let the world know that you exist and you’re the best – but you should back up your words, of course. What key benefits do you offer? Can you provide your traders with anything special that differentiates you from the competitors?

Throughout this article, we talked about attracting traders by all means. And this will push traders to choose your FX brokerage. For instance, some traders are attracted by the fact that you’re a registered FX business, and others would like to trade forex and cryptocurrencies on one platform. But the most appealing aspect is profit.

Customers want tight spreads, quick execution, and maybe some reward for how much they trade. You can set up some kind of reward system and foster larger trading volumes (way better than charging inactivity fees). The right forex trading platform will help you with this: it has a system of rebates and commissions. First-class performance is when a trading platform allows brokers to configure rewards for traders according to a sophisticated segmentation – the way DXtrade does.

As a seasoned trading platform provider, at Devexperts, we provide FX brokers with a marketing package. They can use it to develop an efficient website and highlight all the DXtrade trading platform benefits for traders.

Hire a team

When hiring a team, you need to consider your needs, but also the regulator’s requirements. The latter might oblige you to hire local employees and even a local director.

Throwing these regulations aside, let’s talk about your needs as an FX business. The following departments must cover your basics: compliance, accounting, sales, support, IT, and dealing.

You might consider conducting an educational program for your staff to ensure everyone’s on the same page and your employees understand an FX brokerage business’s principles. It’s also helpful to ensure everyone is aligned with the industry’s regulatory standards. By the way, we’ve already created educational resources for FX brokers’ employees – check them out here.

Pro tip: To make it easier for you to plan and launch your forex brokerage business, we’ve created an infographic that highlights all the stages you need to go through.

How to become a forex broker?

You have to remember many details, and this can be overwhelming. But we’ve created a checklist to make your life easier when launching your FX brokerage business. You can download it here.

If you do your homework and approach opening a forex brokerage firm gradually, soon you’ll be running a profitable business and serving thousands of traders.

At Devexperts, we take care of all trading software solutions and integrations required for such initiatives, so you can focus on other business matters like marketing, customer relations, and dealing.

If you’re a budding FX broker, you can trust us to handle the software part. After all, we’ve been delivering trading platforms to brokers since 2002! So you can be sure we’ll address all your business’s technology needs. Contact us.

Disclaimer: Please, note that this text was written in October 2022. It may be possible that some information is outdated.