Order Matching – Driving Force Behind Exchanges and Dark Pools

All kinds of marketplaces, be it an exchange or a dark pool, equip some kind of order matching solution (also called matching engine) to meet the sole objective of efficient exchange of assets between their clients.

In this article, we’ll delve into the concept of order matching and explore how it functions and its significance in financial markets. We’ll also cover the basics of order matching in exchanges and dark pools, shedding light on their respective operations and benefits. Understanding this crucial mechanism is essential for investors, traders, and anyone seeking insights into the inner workings of modern financial markets.

What is an exchange?

First, let’s briefly define an exchange.

In the financial world, an exchange refers to a marketplace where various financial instruments, such as stocks, bonds, commodities, derivatives, and currencies, are traded. It serves as a centralized platform that brings together buyers and sellers, facilitating the exchange of these financial assets. Depending on the assets it offers and its region of operation, an exchange might need to get licensed with a regulator. Actually, most exchanges are regulated except some of those offering crypto assets.

Here’s an infographic that sheds light on the crypto exchange regulation worldwide.

Looking at this infographic and taking into account that all other kinds of exchanges are heavily regulated, we can confidently state that exchanges provide a transparent and regulated environment for trading, price discovery, and risk management, thus playing a crucial role in the global economy.

Regulators’ rules govern areas such as listing requirements, trading procedures, disclosure obligations, and investor protection measures. By adhering to these regulations, exchanges foster investor confidence and maintain the integrity of the marketplace.

Apart from facilitating trading, exchanges also provide additional services. These may include listing and delisting securities, market data dissemination, trade settlement, custody services, and regulatory oversight. Exchanges often collaborate with intermediaries such as brokers, market makers, and clearing houses to ensure smooth operations and the efficient functioning of the marketplace.

Different countries and regions have their own prominent exchanges, such as the New York Stock Exchange (NYSE) and NASDAQ in the United States, the London Stock Exchange (LSE) in the United Kingdom, and the Tokyo Stock Exchange (TSE) in Japan. These exchanges attract both domestic and international investors, enabling them to trade a wide range of financial instruments.

Order matching in exchanges

So, again, the primary function of an exchange is to efficiently match buy and sell orders.

When an investor submits an order to buy or sell a security, the exchange’s matching engine searches for compatible orders from other market participants. The matching engine evaluates multiple factors, including price, quantity, and order type, to determine the most favorable matches.

Exchange order matching typically follows one of two methods: price-time priority or pro-rata allocation. Under the price-time priority method, orders are matched based on the best available price and the time of order submission. The first order at a particular price takes priority over subsequent orders at the same price. On the other hand, the pro-rata allocation method divides trades proportionally among market participants based on the size of their orders.

The order-matching process plays a crucial role in maintaining a fair and transparent marketplace. It ensures that buyers and sellers can find counterparties and execute trades efficiently. Efficient order matching promotes liquidity, price discovery, and market integrity, enabling investors to transact securities with minimal delays and at fair prices.

If you’d like more detailed info on how exchanges are created, you can read our case study about the project where we’ve built and launched an exchange from scratch.

What is a dark pool?

A dark pool, also known as an Alternative Trading System (ATS), is a private trading venue or platform that allows investors to trade financial instruments, primarily stocks, and other securities, away from public exchanges. Unlike traditional exchanges, dark pools offer limited pre-trade transparency, meaning that order details are not publicly disclosed before execution.

In a dark pool, participants can anonymously submit buy or sell orders without revealing their intentions to the broader market. These orders are hidden from public view and are only visible within the dark pool itself.

The purpose of the dark pools

The primary purpose of dark pools is to facilitate the trading of large blocks of securities without causing significant price impacts in the broader market. By keeping orders confidential, dark pools aim to minimize information leakage and avoid the potential adverse effects of market participants reacting to large orders.

Dark pools are popular among institutional investors, such as mutual funds, pension funds, and hedge funds that often need to execute large trades that could potentially disrupt market prices if executed openly on public exchanges. By trading in dark pools, these investors can reduce market impact, avoid slippage, and maintain confidentiality regarding their trading activities.

Types of dark pools

There are two main types of dark pools: broker-operated and independent. Broker-operated dark pools are offered by brokerage firms as part of their services to clients, while independent dark pools operate as standalone platforms. Both types follow specific rules and regulations established by regulatory authorities to ensure fair trading practices and investor protection.

It’s important to note that while dark pools provide advantages such as reduced market impact and increased execution flexibility, they also raise concerns about market transparency. The lack of pre-trade transparency in dark pools means that the broader market may not have complete visibility into trading activities, potentially impacting price discovery and overall market efficiency. Regulatory bodies closely monitor dark pools to ensure compliance with regulations and prevent any abusive or manipulative practices.

Order matching in dark pools

Order matching in dark pools operates differently from traditional exchanges due to the limited pre-trade transparency and the unique characteristics of these private trading venues. The specific mechanisms can vary among different dark pools, but here is a general overview of how matching of orders typically works:

- Order submission

Participants in a dark pool submit buy or sell orders for specific securities. These orders contain information such as the desired quantity, price, and order type (e.g., market order or limit order). The orders are usually anonymous, meaning the identities of the buyers and sellers are not disclosed.

- Order-matching algorithm

Dark pools employ proprietary algorithms to match buy and sell orders within the pool. These algorithms consider various factors, such as the order size, price, and participant preferences, while prioritizing efficient execution and minimizing price impact.

- Internal matching

The dark pool’s matching engine searches for compatible orders within its own pool. It identifies potential matches based on price and other relevant parameters. The goal is to find the best possible matches that fulfill the desired quantity and price requirements for both buy and sell orders.

- Liquidity provider matching

In some cases, if there are insufficient internal matches, dark pools can also match orders with selected liquidity providers. These liquidity providers may include market makers, high-frequency trading firms, or other participants who have agreed to provide liquidity to the dark pool.

- Order execution

Once a match is found, the buy and sell orders are executed within the dark pool. The trade occurs at a price that satisfies both parties involved in the match.

It’s important to note that the specific order-matching algorithms and protocols employed by dark pools can vary, as they are proprietary and closely guarded by the operators of each dark pool. The primary objective remains to facilitate the efficient execution of large block trades while minimizing market impact and information leakage.

Regulatory authorities closely monitor dark pools to ensure compliance with regulations, prevent manipulative practices, and maintain fair and orderly trading conditions.

At Devexperts, we also have experience launching a dark pool for a Canadian broker. You can learn more about this case study here.

Conclusion

Order matching is a vital mechanism in both exchanges and dark pools, ensuring efficient trade execution in financial markets. While exchanges facilitate transparent price discovery and open order books, dark pools provide an alternative venue for institutional investors to execute large block trades with minimal market impact.

Understanding the intricacies of order matching enables brokers and investors to navigate these marketplaces effectively, maximizing trade execution efficiency and achieving their investment objectives. Whether in traditional exchanges or dark pools, order matching remains a crucial element in maintaining liquidity, fostering fair market conditions, and facilitating seamless transactions.

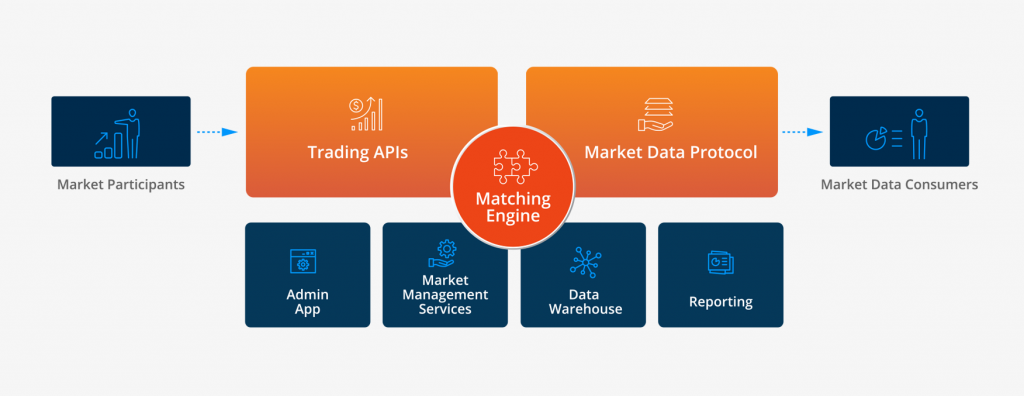

At Devexperts, we’ve built our proprietary order-matching solution that works both for exchanges and dark pools and is compatible with a broad range of trading instruments. It operates on the price-time priority algorithm and could be installed even on bare metal (actually, it’s the best deployment option for the most stable progressing latency). You can learn more here or just contact us for a demo and a consultation.