Trading Platforms: Your Key to Retaining Traders and Reducing Your Churn Rates

You’ve been focusing on offering competitive fees and spreads. Still, traders keep switching to a competitor broker! How can you reduce the churn rate and maintain trader loyalty? One way is through the trading platforms you offer.

To better understand FX/CFD traders’ views on trading platforms, we recently conducted an anonymous survey. We asked hundreds of traders what platforms they used, and what they liked in their trading platforms. Our questions also included what important features they looked for, what they lacked, and more. We found that traders want better trading interfaces. In fact, almost 60% of traders indicated they’re willing to switch brokers when offered a better platform.

That’s why it’s important you improve your trading platforms to prevent FX/CFD traders from turning to the competition for business.

In this article, we’ll discuss why a high-quality trading platform can help you maintain trader loyalty and offer insights from our survey. We’ll also list 3 features to include in your trading platforms to help you retain traders.

Let’s begin with 3 reasons why traders switch brokers.

3 Reasons Why Traders Switch Brokers

Though traders may choose to switch brokers for any reason, we’ve compiled 3 recurring issues that lead traders to switch to a new broker.

1. Better Fees and Spreads

You’d want to save money whenever you can and traders want that as well. That’s why they’ll keep searching for lower fees and spreads. This also leads brokers to focus on pricing to attract new traders. Still, our survey results show almost 38% of traders find fees and spreads are less important than the trading platforms on offer. In effect, if you offer better trading platforms and meet traders’ demands, you have better chances of reducing churn rates and retaining your clients.

2. Outdated Platforms

Based on the Devexperts survey, almost 47% of traders believe their platform is outdated. This means traders don’t have the tools and services they need to follow the booming FX and CFD trading industry. Instead, popular trading platforms settle for gaining popularity and fail to improve their service. They lack features like customizable layouts, a dashboard showing their performance, a trading journal, risk management, and advanced mobile trading. To this end, you can offer those trending features and attract traders to improve user retention.

3. Popular Trading Platforms

In the FX/CFD trading industry, more than 90% of brokers use one or a few popular trading platforms. These platforms make it easy for traders to switch to a new broker. As soon as a trader finds a better deal, they can switch and don’t even have to learn how to use a new platform! When you offer a unique trading platform, you gain better trader loyalty. Even with new clients, you can ease the transition with a few embedded onboarding videos to get them up to speed in no time. Then, they’re hooked on a modern, unique trading platform.

As you can see, traders prefer modern, unique platforms and this will help reduce the churn rate at your brokerage firm. Let’s check additional reasons why trading platforms are a decisive factor for traders.

Why Focus on Trading Platforms

Our survey showed multiple reasons why traders prefer unique trading platforms and why brokers should focus on offering them to reduce churn rate. Here are 3 main reasons.

1. Offer Modern Platforms to Meet Demand

As we’ve seen, traders prefer more modern platforms that cater to their fast-changing needs. Currently, though, the popular platforms haven’t improved their offering and instead, maintained their original features. They rely on their popularity to gain new clients.

A differentiating point for your brokerage would be to offer a modern, convenient, and constantly improving platform. In this case, you’ll deliver what traders need. You’ll also keep existing traders happy since they have all they need to execute FX and CFD deals fast and reduce losses.

2. Deliver Better Platforms to Attract Traders

Many traders value good trading platforms and are willing to switch to a new broker to access those platforms. In fact, the survey results show that 58% of traders are willing to switch to access a better platform.

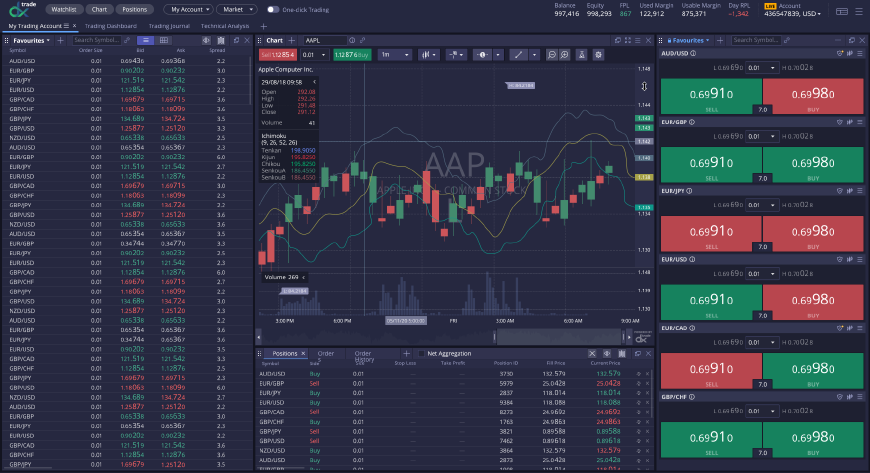

Why are traders willing to do this? We asked traders what they lacked in the platform dominating the FX trading space today. Unexpectedly, many traders indicated they needed comprehensive chart views. Some even indicated they needed indicators, drawing ability, or complete DOM view. When you offer these and other features, you’ll meet traders’ needs and gain new clients.

3. Integrate Analysis and Tools to Add Value

Lastly, 15% of traders use third-party analysis and trading tools and software on top of their trading platforms. This means the platform isn’t offering the tools they need to undergo analysis and/or track their trades.

This is another reason why offering better trading platforms with analysis and trading tools will encourage and improve trader loyalty. Traders won’t have to download or install any add-ons. This also means you won’t have to manage and oversee vendor relationships. In effect, you reduce your time and money spent on third-party tools and meet trader needs.

Top 3 Features to Include in Your Trading Platforms

Each trader has a different goal and strategy for FX and CFD trading. Traders with minimal experience may prefer simpler trading platforms. They’ll also look for platforms with basic analysis and charting tools. On the other hand, experienced traders may look for advanced risk management tools and technical indicators. If you cater to all traders, you’ll be able to retain beginners who outgrow the simple and basic trading platforms.

Here are the top 3 trading platform features to offer your traders.

1. Fully Customizable Layouts

Traders may have multiple screens and charting setups to accommodate the layouts they need. When you offer a fully customizable layout platform you help them have everything they need in front of them. They can detect trades and execute them instantly. This gives you an advantage over popular or other trading platforms which offer fixed layouts.

2. Built-In Trading Journal

Another thing traders have is their journals in third-party extensions or manually inputted into spreadsheets. Having to go back and forth to this journal to analyze strategies or track positions impacts potential profits. Instead, when you incorporate the journal into the trading platform entries become automatic, leaving room for analysis and repositioning. This attracts traders to your platform as it gives them versatility and convenience.

3. Full-Fledged Mobile Trading

Mobile trading isn’t a new offering. That said, it follows outdated platforms since mobile trading platforms haven’t adapted to traders’ needs. According to our survey results, more than 60% of traders use mobile trading apps. In this case, if the trading app isn’t good enough, profitability will suffer. When you offer an advanced and unique mobile trading platform you stand out in the field. You also present your clients with the best available tools to help them achieve their targets.

Pro Tips to reduce churn rate

- Offer trading platforms with additional features traders look for to improve the user experience, like indicators, signals, transaction volume analysis, stops, more Gann tools, complete DOM, etc.

- Use platforms with user interfaces that have complete API access to all parameters, robots, drawing ability, TP and SL hit notifications, the ability to move lines by point and hold, one-click transaction execution, one-click all position close, etc.

- Use trading platforms with a UI tailored for phones since more than 60% of traders trade from a mobile app.

The Bottom Line

You may be struggling to retain traders, but you can turn the tables in your advantage. Ensure you focus on the trading platforms you offer. Our survey highlighted that traders are willing to switch brokers with better platform offerings. In this case, traders would appreciate the added value of having better UX/UI and would, therefore, be more likely to remain loyal. In our experience, many brokers are shifting focus to trading platforms and choosing unique offerings. Check some case studies on our website for more information on trending requests.