How to Build a Prediction Market

Prediction markets, event derivatives, idea futures, or binary bets, as they’re also known, are growing in popularity. In the past, they’ve tended to gain public attention during important election cycles, only to fade from view thereafter.

Now, though, looser regulation in the US, and a number of innovative offerings that have made event-based trading easy and affordable, are creating a surge of interest among individual traders.

Could event-based trading be the next big thing? And are we witnessing competition to create a “killer app” for prediction markets in the way that companies like Robinhood and Revolut have attempted to offer killer apps in their own respective domains?

A brief history of prediction markets

Prediction markets have been around for hundreds of years. Whether it be bets on government officials and papal successors in 16th-century Italy, parliamentary elections in 18th-century Britain, or US presidential and congressional contests in the 19th century, these markets have always catalyzed a great deal of interest and speculative activity.

Prediction markets actually predate “traditional” securities exchanges by more than a century. The Amsterdam Stock Exchange was founded in the early 1600s, whereas the political betting on government officials and papal candidates in the Italian city-states goes back as far as the early 1500s. Even then, these types of event-based bets were regarded as an old practice.

Despite this, many authorities have been hostile to betting on political outcomes from their earliest days. In 1591, Pope Gregory XIV banned political betting, threatening violators with excommunication and driving the practice underground. In the United States, where political betting was considered by many as a way to buy votes, the practice has experienced numerous phases of tolerance and prohibition.

In contrast, the UK has been much more accepting of the practice. Political spread-betting became popular in the early 20th century, and today spread bets (where predictions involve not just the results of a binary outcome but the size of the margin) are available on political, sporting, and financial outcomes.

Internet-based prediction markets

The advent of the information age has allowed prediction markets to operate at scale. The ease of access and affordability of Internet-based prediction markets make it possible to gauge the sentiment of far larger groups of people than was previously possible.

The first of these markets was Iowa Electronic Markets, which was introduced by the University of Iowa in 1988 for research purposes. This market still exists and has been able to avoid falling foul of the Commodity Futures Trading Commission by keeping wagers to below $500.

In 2018, Augur became the world’s first decentralized prediction market, allowing users to create and bet on event-based outcomes on the Ethereum blockchain. This led to a flurry of innovation in decentralized prediction markets. According to Defi Lama, the largest market of this kind is currently Polymarket, which runs on the Polygon blockchain and uses the USDC stablecoin as a funding and payout currency.

Decentralized prediction markets have previously been targeted by regulators due to the manner in which they enable borderless, pseudonymous access to users that can circumvent local gambling and sports betting rules.

Kalshi, currently the largest centralized US prediction market, won a legal battle with the CFTC in 2024, allowing the company to continue running prediction markets on election outcomes. The ruling is being regarded as a landmark that could lead to a more lenient view of these markets by regulatory authorities. The current administration’s friendlier stance toward innovation in financial products is being viewed by many as a tacit green light for the industry as a whole.

How prediction markets work

The relative simplicity of prediction markets is one of the main reasons that there’s so much excitement surrounding them at present among financial services and fintech firms. The ease with which odds can be understood and predictions made makes them accessible to a far wider demographic than options and futures markets, or even the trading of equities.

Essentially, what you have with these markets is a binary bet in which a correctly predicted outcome earns the investor $1 for each contract bought. The price of a contract depends on how many contracts have been purchased on either side of the yes or no outcome. Since the outcome is valued at $1, what you effectively get with the price of the yes or no is a percentage possibility for either outcome.

For example, both Polymarket and Kalshi are currently running markets on whether Federal Reserve chair Jerome Powell will be replaced by the end of the year. The odds on both markets are more or less in line, with a yes prediction costing around 20 cents and a no prediction costing around 80 cents.

This means that the market only gives a 20% chance of Powell being ousted before the year’s end. These odds have moved around depending on how aggressive Trump’s anti-Powell rhetoric has been and could change closer to the date depending on how serious the market believes Trump is about replacing him with someone who’s more amenable to lowering interest rates.

Those investing in a yes outcome today stand to make a greater profit than investors who purchase the same contract closer to the date (assuming that the odds of Powell’s removal rise). They can wait until the contract is resolved to earn this profit, or alternatively, they can sell their contracts to other yes buyers closer to the end of the year, should the price of a yes prediction rise.

Prediction market accuracy

Prediction markets are known for providing accurate forecasts of election outcomes, often more so than conventional polls or individual experts. The monetary incentive that these markets provide for picking the correct outcome is regarded as one of the reasons for their accuracy, in contrast to traditional polls, in which political leanings can influence predictions.

Having “skin in the game” is likely to be the key to the predictive power of prediction markets. A 2006 study showed that real-money prediction markets were significantly more effective than play-money prediction markets in correctly forecasting non-sporting outcomes.

Prediction markets correctly predicted the 2024 re-election of Donald Trump and the recent New York mayoral primary victory for Zohran Mamdani. In the run-up to the 2024 US election, Polymarket correctly predicted that Joe Biden would withdraw from the race weeks in advance of the official announcement of his withdrawal.

However, event-based markets are not infallible. Like all betting markets, odds can be swayed by large wagers coming in on one side. This is one of the oldest criticisms of prediction markets, that outcomes can be “bought.”

Another weakness of relying on crowd wisdom is that it’s only as wise as its collective participants. The accuracy of political betting in the UK was shown to decline in the 1920s and 1930s. This was attributed to the privileged male patrons of the “parliamentary majorities” market on the British Stock Exchange falling out of touch with the issues driving British politics at the time.

The Fourth Reform Act, which introduced limited female suffrage for women over 30, followed by the Fifth Reform Act, which gave women equal voting rights to men, as well as the emergence of the Labour Party as a political force, represented a popular groundswell that these bettors overlooked.

Similarly, prediction markets failed to predict both the first presidential term of Donald Trump and the UK’s Brexit vote in 2016. This, however, was likely due to media bias influencing public opinion to view these outcomes as far more unlikely than they truly were.

Prediction market trends

A notable trend has been observed in prediction market activity that goes all the way back to the early 20th century. A great deal of interest was generated in these markets around important elections. This interest would then wane during periods of political apathy or during extended periods of one-party rule.

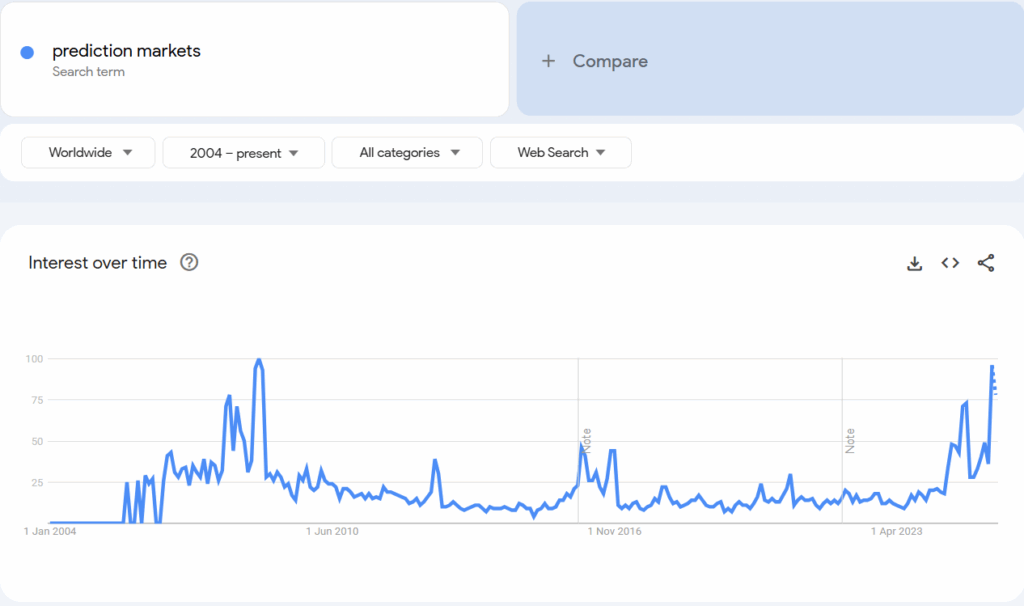

This still appears to hold true, with Google searches for “prediction markets” tending to peak in and around the 2008, 2012, 2016, 2020, and 2024 election cycles. The outsized peak in 2008 may be attributed to the perceived importance of that particular election (Obama being the first black president of the United States), as well as to the timing of the Great Financial Crisis.

As can be seen above, interest is currently peaking outside of a US presidential race. This may have something to do with last year’s ruling in favor of Kalshi, which generated a great deal of interest in its own right and opened the door to further prediction market growth in the United States. Kalshi is currently valued at $2 billion following its last funding round. The company’s CEO has referred to it as the fastest-growing company in America.

A technological overview

The overlap between event-based trading and gaming, as well as the relative simplicity of these markets, may lead some to believe that the technology underpinning them is also simple. Allow us to dispel this myth right off the bat. Prediction markets have far more in common with futures and options exchanges than they do with online gambling sites.

Predictions are exchange-traded, meaning that these markets are created between participants with a view of the order book, rather than by a single party acting as principal. This means they require all the technological components behind the scenes that you’d expect from a financial exchange, such as order management systems (OMS), matching engines, and backend administrative interfaces.

Event-based trading is truly a market that never sleeps. The probabilities of different outcomes are so sensitive to incoming news that they have to operate around the clock. This means that, from the get-go, prediction markets have even stricter uptime requirements than other venues that don’t trade 24/7. This requirement introduces some technical considerations, such as how to maintain uptime when upgrading systems, managing market parameters, or dealing with technical challenges, such as components failing or falling victim to an attack.

In the interests of reliability, much like other venues that place a premium on high availability (e.g., crypto exchanges), some degree of replication of core system components is required. This enables back-up versions of critical systems, such as the matching engine or database, to take over in the event that main systems go down.

Consensus algorithms that ensure all duplicates agree with the exchange’s canonical sequence of events are also important. They allow for a seamless switch between system copies and no interruption of service for the end trader.

On the administrative end, it’s advisable that market management, such as the creation, resolution, and removal of contracts, be conducted on the fly. It’s also preferable that this management is possible through administrative interfaces connected via APIs in high-level business logic, rather than requiring changes to configuration files and the intervention of technical staff.

The same also holds for system updates, which should also be practicable on the fly. A modular architecture and individual components that allow for rolling restarts allow event exchanges to update their systems without interrupting service to clients.

Additionally, as we’ve repeatedly seen in numerous crypto bull markets, businesses consistently underestimate the peak load their systems are likely to be exposed to. In order to avoid becoming victims of their own success, prediction market providers with foresight will ensure that their systems are able to handle considerably more traffic than even their most optimistic growth forecasts might suggest.

This, again, can be achieved by replication, albeit of a horizontal variety. The ability to split available markets off into different instances of the matching engine offers more headroom when certain events capture the imagination of the public and generate a massive amount of trading activity.

As far as specific requirements go, prediction markets require more flexibility in their resolution than futures or options markets. The market on Powell’s removal discussed above may resolve on any date before December 31st. Protections against front-running are also required for certain event markets, such as live sporting events, where those present may have an advantage over those watching from a distance. In these cases, the ability to introduce latency in the execution of trades is also required.

Final thoughts

Over the past few years, we’ve seen an increased focus on bringing innovative financial instruments to the US market that are better suited to individual investors. 0DTE options and perpetual futures are two examples of this trend. Event-based trading has the potential to be a far greater success than either of the above instruments due to its simplicity, affordability, and the fact that it transcends finance.

As the regulatory landscape shifts in favor of prediction markets, we expect this to be an area of growth, with many firms attempting to enter the space. Healthy competition between exchanges and the technology providers that support them will lead to best practices emerging as systems are stress tested in live conditions.

Devexperts is currently engaged as a technology provider in the prediction markets segment. We bring our expertise in developing and deploying resilient financial infrastructures to this exciting new market and are looking forward to being a part of its ongoing evolution.