Forex Broker Software and Infrastructure

Do you want to become a forex broker and run a successful brokerage business? Then you should know that it requires a lot of planning, resources, and knowledge. Choosing the right forex brokerage software is one of the critical aspects of this business. In this article, we’ll discuss the software and infrastructure that is required for a forex brokerage business.

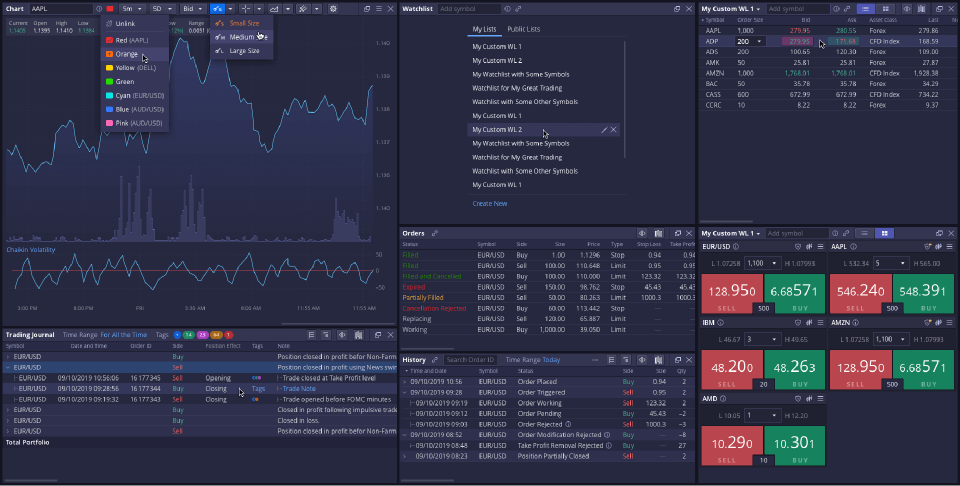

Trading platform – a critical part of the FX brokerage infrastructure

The trading platform is the primary tool that traders use to issue orders, monitor market data, and manage their accounts. As such, it must be well-designed, stable, and user-friendly, with a host of features that cater to the diverse needs of different traders.

FX brokers may use a third-party FX/CFD trading platform or develop their own custom trading platform. In either case, it should be stable and reliable and have robust back-end management capabilities.

Order types, real-time quotes, and technical indicators

A versatile trading platform should support various order types, including:

- limit orders

- stop-loss orders

- trailing stop orders

These order types give traders more control over their trades, enabling them to manage their risk effectively.

Real-time quotes are another crucial feature as they allow traders to see current market prices, which is vital for making instant trading decisions. Furthermore, various technical indicators should be available to assist traders in predicting future price movements based on past market data.

Integration with third-party software and systems

Trading platform integration with other forex broker software and systems is also vital. A brokerage can’t operate without risk management software, compliance software, and back-office systems. These integrations provide seamless communication between brokerage departments, reducing the risk of errors and improving efficiency.

Lastly, a trading platform should be secure to protect the broker and its users. Security measures should include login protocols, encryption of data, and regular updates to protect against new threats.

Risk management system – helping brokerages identify and mitigate risks

The next crucial component of a forex broker’s software infrastructure is the risk management system. Its purpose is to help brokerages identify and mitigate risks associated with trading activities, protect their financial positions, and ensure compliance with regulatory requirements.

The primary function of a risk management system is to monitor trading activities and detect any anomalies or irregularities that could pose a risk. This includes monitoring trades for potential price manipulation and other abusive trading practices.

Another key function of a risk management system is to manage the brokerage’s exposure to market risk. This involves monitoring the overall broker exposure to market movements and the exposure of individual traders and accounts. To manage market risk, the system should use various tools and techniques, including position limits, execution rules, and margin settings.

Execution rules allow risk management teams to manage A/B book settings on a per-client, instrument, and group basis. Margin settings allow your business to comply with regulatory margin requirements in different jurisdictions by setting margins on a per symbol, per group, and individual client basis.

The risk management system should also be able to generate reports and alerts to help the brokerage quickly identify and respond to potential risks. This includes alerts for large trades, suspicious activity, and other anomalies that could indicate a potential risk to the brokerage.

Finally, the risk management system should ensure compliance with regulatory requirements. This includes maintaining accurate records of trades and client activity and generating reports for the relevant regulatory authorities.

Back-office system

When it comes to forex trading, it’s not just about making trades on the trading platform. A lot of administrative tasks are involved behind the scenes, and this is where the back-office system comes into play. In simple terms, the back-office system is the software that manages the administrative tasks of a forex brokerage.

One of the primary functions of the back-office system is to handle account management. This includes opening and closing accounts, managing client information, and ensuring that clients meet regulatory requirements. The system should also allow back office staff to easily and efficiently verify clients’ identities and access their account activity.

Another crucial function of the back-office system is transaction processing. This includes managing the inflows and outflows of deposits and withdrawals, and ensuring that clients’ account transactions are not delayed.

Reporting is another essential feature of the back-office system. The system should also be able to generate client account reports that comply with regulatory requirements and guidelines.

Compliance is a crucial aspect of the forex brokerage industry, and the back-office system should have built-in compliance tools to ensure that the brokerage is following all the necessary regulations. These tools include anti-money laundering (AML) checks, know-your-customer (KYC) checks, and other compliance checks.

The back-office system should also integrate with the trading platform to provide real-time updates on trades and account balances. This integration ensures that clients can see their account balances and transaction history updated in real time.

Liquidity provider

A forex brokerage needs access to a liquidity provider (LP) to offer its clients competitive prices and fast trade execution. So, what exactly is this?

In simple terms, a liquidity provider is a financial institution that provides the trading platform with access to a wide range of financial instruments and executes trades at the best available prices.

One of the primary benefits of using an LP is that it allows FX/CFD brokerages to offer their clients the most competitive prices for trading instruments. This is because it has access to a vast network of financial markets and can offer prices close to the prevailing market rates.

Another benefit is that it ensures fast trade execution. The LP has access to a vast pool of liquidity, which means quick and efficient order execution. This is crucial in the fast-paced world of forex trading, where even a few seconds can make a significant difference in the outcome of a trade.

Using the services of a liquidity provider also ensures that forex brokerages can offer clients a wide range of currency pairs.

If you are interested in learning more about the forex and crypto LPs, take a look at our article “Exploring the World of Liquidity Providers“.

Compliance software

Operating a forex brokerage requires complying with various regulations and laws set by regulatory authorities. Compliance software plays a critical role in ensuring that forex brokerages follow these rules and regulations and can onboard as many new customers as possible while observing anti-money laundering (AML), and know-your-customer (KYC) rules.

Compliance software should be able to generate comprehensive reports. These reports are essential for regulatory reporting and audits. The software should generate reports that show the brokerage’s compliance with regulations and provide an audit trail of all activities. These reports should be easily accessible and customizable to meet specific regulatory requirements.

The use of compliance software is essential not only for regulatory compliance but also for the reputation of the forex brokerage. Clients are more likely to trust a brokerage that operates within the confines of the law and is transparent in its operations. Compliance software helps to ensure that the brokerage is operating transparently and can provide clients with the necessary assurance that their funds are safe and secure.

Conclusion

In conclusion, starting a forex brokerage business requires a significant investment in software and technology. Choosing the right one is critical to the success of the business. The trading platform, risk management system, back-office system, liquidity provider, and compliance software are essential systems that a forex brokerage needs to operate.