White-Label Trading Platform – Complete Guide

Forex brokers looking to implement a new trading platform have two options. One is to develop their own custom solution. The other is to get turnkey software in the form of a cloud-based (SaaS) white-label trading platform.

Established brokerages might consider having a custom solution. However, startups and medium-sized brokers just don’t have the funds for custom development. Getting a white-label forex trading platform is the best choice they can make (and well-established brokers might find it a better option too!).

Let’s break down what exactly a white-label trading platform is, why it is beneficial for brokers, and what kind of challenges brokers can tackle using such a solution. Of course, we’ll mention the disadvantages of white labels, so you get to decide for yourself whether it’s worth implementing into your forex business.

Explaining white-label trading platforms

White-label forex trading platforms eliminate the need for brokers to spend preposterous amounts of time and money on custom development.

Essentially, a white-label trading platform is a solution ready for branding and with a short time to market. Good white-label software comes as a whole package: web and mobile apps, turnkey integrations, several hosting options, and sometimes even maintenance and support.

Read more about the forex brokerage software and infrastructure here.

Some providers of white-label trading platforms even offer customization (e.g. widgets tailored to your specific business flow) but they come at additional cost.

White-label FX solution benefits in a nutshell

- Can be branded with a broker’s logo

- Ready to be delivered in no time

- Feature-rich for a reasonable price

- Ongoing technical support and regular updates by a platform’s provider.

It’s also worth mentioning that providers of white-label platforms are always in fierce competition so they strive to equip their solutions with the most advanced trading tools and features. By enhancing the trading experience and broker tools, they win their customers.

What kind of FX brokers can benefit from white labels and how

- Forex startups

Forex brokerages at the start of their journeys are always in a crunch due to tight deadlines and budgets. They don’t have time or money for developing trading platforms from scratch, so a white-label trading platform is the best option for them. It allows brokers to offer their clients software under their own brand, launch quickly, and delegate all technical issues to a software vendor.

- Forex brokerages willing to expand their offering

A broker might have been around for some time and might want to expand their offering and audience. Their existing trading platform might not allow that, so getting an additional one is a great solution to this challenge. Actually, most FX brokers offer multiple platforms to their clients to diversify their offering of trading instruments and trading interfaces.

A white-label trading platform works wonders for such a case because, again, it’s affordable and quick in terms of delivery.

- Forex brokerages looking for a backup trading platform

Some brokers have custom solutions that are often down due to maintenance issues. They choose to get a white-label solution because it’s an affordable business continuity solution. Whenever their main trading platforms are down, they just reroute all their clients to a backup white-label trading platform hooked to the trading servers with all client data.

How to choose the right white-label trading platform provider

There’s an abundance of white-label trading platform providers on the market. Their offerings vary not only in pricing but also in platforms’ scope of supply.

What you should keep in mind is that a seemingly cheap white label might turn into a very expensive tool due to hidden costs. A software vendor might offer you only a web-based trading platform and all the rest might come at extra cost: a mobile app, maintenance, support, upgrades, additional features, etc.

It’s also advisable to investigate whether a software vendor has partnerships for turnkey integration with diverse third-party service providers, including liquidity hubs, market data providers, payment services, financial news feeds, etc.

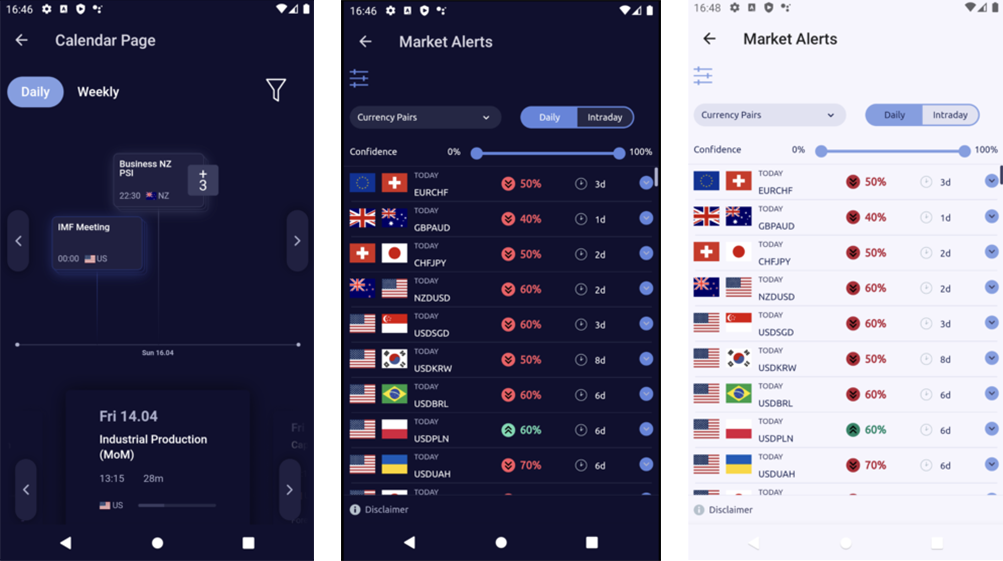

It’s not a must but some trading platforms, like our DXtrade, have nifty integrations with providers of market analytics and trading competitions.

So, if you’re on a tight budget, it’s better to find a software vendor that provides everything your business needs (depending on your situation, of course).

For startups, for example, the minimum technology package includes:

- Web and mobile white-label forex trading apps

- Integration with a market data provider

- Integration with a liquidity provider (for FX brokers utilizing the STP model)

- A CRM system

- A personal account room to onboard and retain clients.

What can go wrong with a white label?

With all being said, a white-label forex trading platform might seem like a perfect solution when a broker needs their technology demands covered. Of course, there are some downsides to white labels. Let’s sort them out.

- Limited customization.

Although white-label platforms allow branding with a broker’s logo and sometimes colors, there are barely any options to customize overall design and functionality. When looking for a white-label solution, brokers should carefully assess it according to their expectations and ensure it aligns with their specific requirements.

- Vendor lock-in.

When getting a turnkey white label, brokers rely on their technology provider for ongoing support and updates. It’s crucial to choose a reliable partner with a proven track record to avoid disruptions. However, this might not be a major issue if a broker diversifies platform offering and software vendors.

Example of a white-label FX trading platform

As we’ve already said, there’s a glut of white-label solutions on the market. All of them provide different levels of functionality and UI/UX design. Brokers are free to do their research and find the right platform that fits their budget and standards.

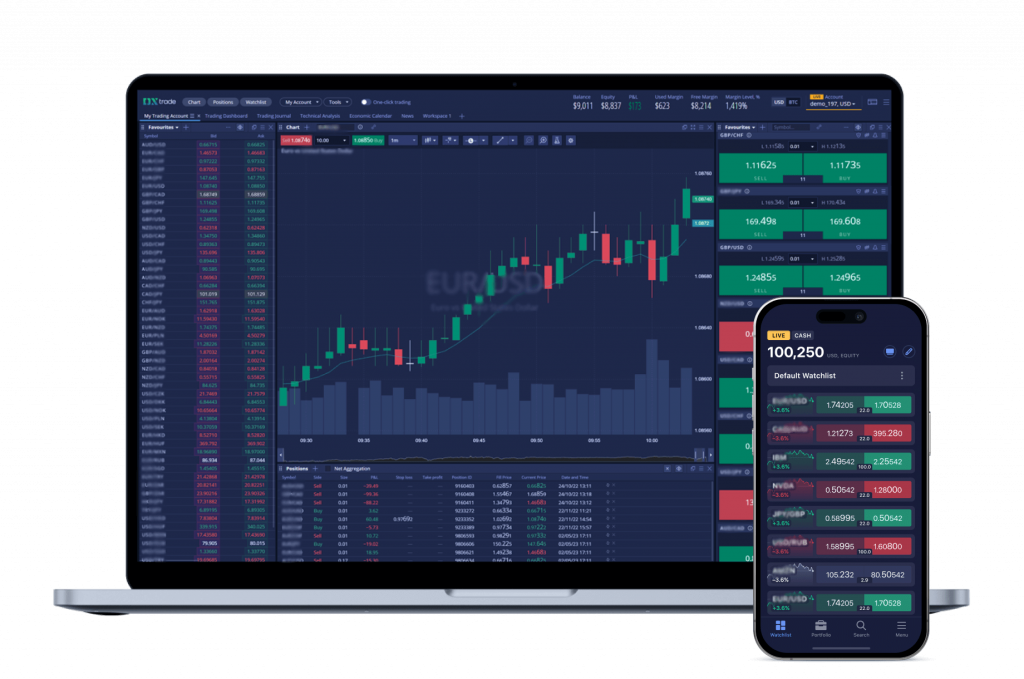

At Devexperts, we offer DXtrade CFD, a white-label trading platform for forex, CFD, crypto, and spread-betting brokers.

What’s great about DXtrade is that it’s always deployed on servers occupied by a single broker. And that’s what brokers should always check with their software providers – whether the platform has a single-tenant deployment. It’s essential both for web and mobile trading platforms as a risk management measure.

Explaining single-tenant deployment

In terms of web trading platforms, some software vendors choose to provide brokers with a shared server. An FX broker getting such a white-label trading solution can’t possibly control their server neighbor. If one of them does something wrong and a server goes down, others suffer. Also, some trading platforms don’t allow re-configuring trading settings without server reload, so how brokers should tune to these circumstances is a trick question.

In terms of mobile trading apps, single-tenant deployment means having dedicated pages in app stores. This way, brokers truly control their apps and are not exposed to the risk of being banned from app stores if somebody else does wrong.

Customization and personalization

Besides a barebones trading platform, it’s always nice to have additional customization capabilities to help make the platform truly your own. With DXtrade CFD, you can tailor your brokerage exactly to your clients’ unique needs especially if they are tired of outdated legacy platforms. You can fine-tune your DXtrade CFD interface from basic buy/sell screens suitable for novice traders to a multi-screen chart-rich layout for more tech-minded traders.

Another nifty bonus of DXtrade CFD is advanced risk management. The platform offers a balance between automation and manual control, providing brokers with a robust yet flexible risk management approach.

Weighing pros and cons of FX white-label trading solutions

| Pros | Cons |

| ● Brokers operate a trading platform under their own brand ● Short time to market ● Budget-friendly ● Plenty of platforms to choose from and match a broker’s expectations ● Turnkey integrations allowing brokers to launch without worrying about any technical issues Possible advantages: ● Further customization when a broker is ready to develop their offering ● Technical maintenance and support ● Additional nifty integrations with providers of marketing analytics and trading contests ● Layout customization without additional cost | ● Limited customization ● Vendor lock-in Possible disadvantages: ● Everything except a web trading platform comes at an extra cost ● Multi-tenant deployment |

Conclusion

As we see, the benefits of white-label FX trading platforms clearly outweigh their shortcomings. White-label trading platforms are a superior solution for forex brokers, offering cost and time efficiency, enhanced trading experiences, and sometimes even technical support. These platforms provide brokers with a turnkey solution, eliminating the complexities and expenses of custom development.

By opting for a white-label platform, brokers can establish their own brands, streamline operations, and deliver a comprehensive trading experience to clients. Choosing a white-label platform allows brokers to focus on their core competencies while harnessing the power of a proven and feature-rich trading solution. With white-label platforms, brokers can enter the market swiftly, save costs, and provide a cutting-edge trading experience under their own brand.